With Slowly Rising Rates, Look to Laddered SMA Portfolios

When the Fed raised interest rates last December for the first time since 2008, many corporate cash investors who had lived through previous tightening cycles expected a series of increases through 2016. But worldwide turbulence in equity markets in the first quarter, additional easing by central banks overseas, and ongoing uncertainty about the U.S. economy led to a Federal Open Market Committee (FOMC) decision not to raise rates at its April meeting. Now, expectations that the Fed might increase interest rates three or four times this year have been tempered.

After so many years living in a zero-interest-rate world, the slow pace of increases has been a disappointment for cash investors hoping for a return to the good old days of decent returns from fixed income investments. Their search for yield has also been complicated by money market fund reforms diverting much institutional cash into government-only funds with low yields, and from Basel III liquidity coverage requirements prompting banks to turn away non-operating deposits in interest-bearing accounts.

However, even a slower and shallower path to further tightening can provide returns for those who make direct investments in fixed income securities through separately managed accounts (SMAs). In our May 2016 white paper, we explained why the Fed has not yet followed up the December rate hike with additional tightening. We also pointed to a silver lining for corporate cash investors: by paying attention to the weighted average maturities (WAM) of securities in a separate account portfolio, investors may obtain greater yield potential while meeting liquidity needs. Why?

- First, unlike money market funds, SMAs allow for direct ownership of securities. Separate account portfolios can be customized to each institutional investor’s unique risk tolerance and liquidity needs.

- Second, later-maturing securities in a laddered portfolio may allow for greater yield potential, while earlier-maturing securities can help to maintain a baseline level of liquidity

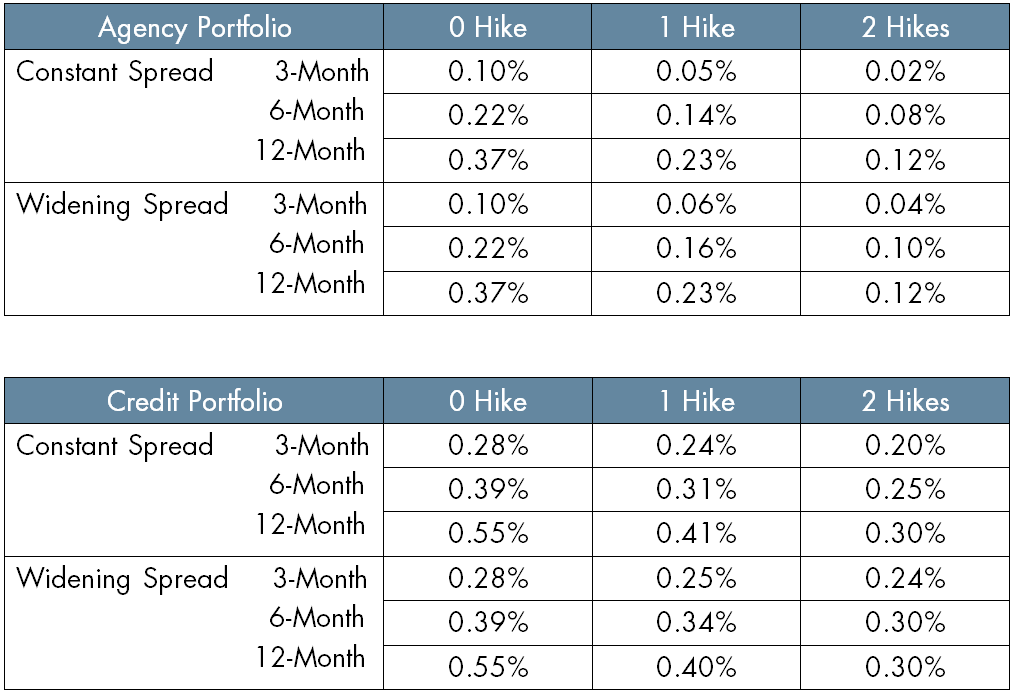

To understand what returns might be possible, we modeled three scenarios—depicting one, two or three interest rate hikes in 2016—to compare potential portfolios of government-backed agency securities (Agency Portfolio) with SMA portfolios that include corporate debt rated mid-A and higher (Credit Portfolio). We used the reverse repo rate (RRP) as a proxy for yields one might expect to see from government money market funds. Our scenarios demonstrate that a laddered SMA portfolio that includes commercial paper may be able to outperform government funds and agency portfolios (Table 1).

Table 1: Yield Outperformance over RRP

*Source: See our [May 2016 and March 2016 white papers] for model portfolios and source details.

In an SMA, unrealized losses from securities that trade at lower prices when interest rates rise must be accounted for. However, with adequate intervals between rate hikes and a moderate lengthening of maturities, our example shows negligible unrealized losses. In any case, losses are not booked if assets are held to maturity.

In our current uncertain interest rate environment, the flexibility and control provided by separate accounts have rendered SMAs an ever-more attractive investment vehicle. By investing in longer-duration securities, investors can lock in greater return potential, while shorter-term securities can help provide liquidity.* SMAs can be customized to match the individual investor’s unique liquidity and risk-return profile.

At Capital Advisors Group, we have been in the business of managing separate account solutions for corporate treasurers for 25 years. In addition to our May white paper, we direct you to our March whitepaper on Optimizing SMAs in a Rising Rate Environment as well as last month’s research on Maintaining Liquidity in Corporate Cash Accounts to learn more about separate accounts and how they could work for you.

*There is no guarantee that SMAs will achieve these goals.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.