What Would a Second Trump Term Mean for the Fed?

In April, The Wall Street Journal reported that former President Donald Trump’s advisory team has been drafting proposals that could potentially alter the structure of the Federal Reserve, in the event he is elected for a second term. The former President’s team has yet to publicly confirm the existence of such plans, but the reporting begs the question of what a second Trump term could mean for the Fed. The former President was very vocal in his criticism of Chair Jerome Powell in his first term, but was restrained from taking any concrete action. The Wall Street Journal, and similar reporting from The New York Times, suggest that a second term could see a more systematic undermining of Fed independence.

Removal of Jerome Powell as Chair

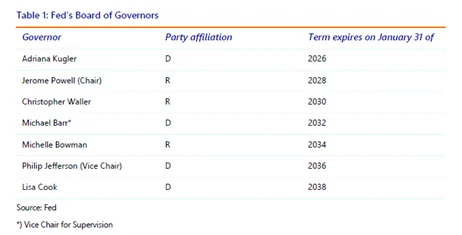

The crux of The Journal’s reporting suggests that Trump wants to have a say in the Fed’s interest rate decisions. Seemingly, the most straightforward way to do this would be to replace the current Chair with someone sympathetic to Trump’s cause. This would be easiest to do after May 2026 – when current Chair Powell’s term as Chair ends. At that point, Trump could nominate someone of his choice to the Board of Governors and subsequently to the Chairmanship. The nominee would require confirmation by the Senate through a majority vote, a process with major implications that will be discussed further in this blog.

If he wanted to expedite the process, Trump would need to not only get rid of Powell as Chair, but also fire a member of the Board of Governors. This is due to the fact that the Chair can only be nominated from amongst the Board members, and currently there are no open seats on the Board. The next one to open won’t be until January 2026, when Governor Adriana Krugler’s term expires.

Figure 1: Federal Reserve, Rabobank

It is also unclear if the firing of a Chair and member of the Board is legal. The Federal Reserve Act allows for the removal of a Governor by the President “for cause,” but it is far from certain that a political disagreement over the inclusion of the President in interest rate decisions would constitute being “for cause.” Similarly, there is no precedent for a President short-circuiting a Fed Chair’s term. These circumstances are completely uncharted waters.

Increasing Executive Control Over the Fed

If Trump were able to remove Powell from the Board, he could effectively nominate anyone he wanted to replace Powell. The requirements to serve on the Board of Governors are minimal; essentially the person must not work or serve on the board of a financial institution and must be a resident of their district at nomination for at least two years. The Federal Reserve Act states that the Chair should be a person of “tested banking experience”, which the Fed’s own guidance interprets as “requiring familiarity with banking or financial services.”

The real hurdle is the Senate confirmation process. In contrast to many other issues, the Fed is still somewhat of a sacred cow in Congressional politics. Officials may be willing to scapegoat the Fed for political expediency, but they are generally aware of the importance of its independence. Trump discovered this during his first term, when he unsuccessfully attempted to nominate several individuals to the Board who were viewed as partisan appointees. The most notable of these was Judy Shelton, a Trump advisor who vocally criticized the Fed’s 0% interest rate policies for years until Trump assumed office (at which point she switched positions to argue for low interest rate policy). Despite the Republicans having a majority in the Senate at the time, there was enough push back that her nomination failed to even make it to the floor for a vote.

Macro Implications of a Partisan Fed

Despite these guardrails, it is plausible that Trump could fill the Chair and multiple Board positions with partisan officials. In this case, there would be no concrete rules to prevent them from consulting with the President on policy decisions. Such an action would mark a severe undermining of the Fed’s independence, which could, in turn, have a variety of implications:

1.Partisan Policy Decisions

The most obvious of these is that policy decisions could shift from being based on the state of the economy, to at least partially based on partisan politics. Given his well-expressed affinity for lower rates, as well as his prior criticisms of the Fed, it seems likely that Trump could attempt to steer the Fed towards pursuing an easier monetary policy than it otherwise would on its own. This would serve a dual purpose:

- Supporting employment and growth in the near-term

- Buoying financial market valuations (particularly stocks)

The latter is of particular importance, both as a signal and a check to the President. It is often stated that the “stock market is not the economy”, however politicians are inclined to look at it as a real-time gauge of the health of the economy. Public sentiment is often linked to the stock market, as everyday citizens see it reflected in the news and in the health of their 401Ks. Thus politically, it might make sense to keep interest rates low to curry public favor. However, this can have negative macro implications if it results in excess inflation or asset bubbles. This in turn could undermine stock valuations, thereby defeating the purpose of low interest rates in the first place.

2.Higher Inflation

There are two considerations when it comes to the impact of politically-motivated Fed decisions on inflation. In the short term, an excessively low interest rate policy could result in marginally higher inflation. Depending on the context of the situation, this may or may not prove to be problematic, as the economy can support various levels of inflation and there may be instances where pressure on the Fed to keep rates lower results in better macroeconomic outcomes.

The bigger issue stems from the loss of Fed independence in the long run. A much-cited paper by Lawrence Summers and Alberto Alesina[1] provided the bedrock for the wave of central bank independence in the 1990s/2000s by showing that independent central banks tend to perform better than their counterparts. That is, they promoted a more stable inflationary environment without any negative impact to labor market or growth outcomes.

The Fed’s own push towards greater independence came after the much-maligned tenure of Arthur Burns, who lost the battle against inflation in the 1970s amidst pressure from then President Richard Nixon to provide expansionary monetary policy in the run up to the 1972 election. A similar loss of confidence could see a de-anchoring of inflation expectations that feeds into wage and spending patterns. This wage-price spiral would likely be bad for the economy and could undermine the Fed ‘s credibility, making the prospect of bringing inflation back down much more difficult and costly.

Conclusion

It should be noted that the probability that former President Trump would be able to politicize the Fed Board seems relatively low. There are a number of guardrails in place which would prevent wholesale changes overnight, and enough political will to keep the Fed independent. Beyond this, there could be potential negative feedback loops via geopolitics and financial markets, which would argue for maintaining the Fed’s independence. It’s perhaps for this reason that the names being bandied about as potential replacements for Chair Powell are establishment figures rather than firebrands.

That being said, it seems almost certain that Trump would maintain a high-pressure campaign on the Fed, supported by his advisory team. This could leave the Fed in its most vulnerable position since the 1970s and open the door to a subtler undermining of its independence over time as norms around its autonomy shift.

[1] Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence. Authored by Alberto Alesina and Lawrence H. Summers, published in Journal of Money, Credit and Banking, May 1993

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.