Watch for $1 Trillion to Migrate to New or Different Accounts in the Coming Year

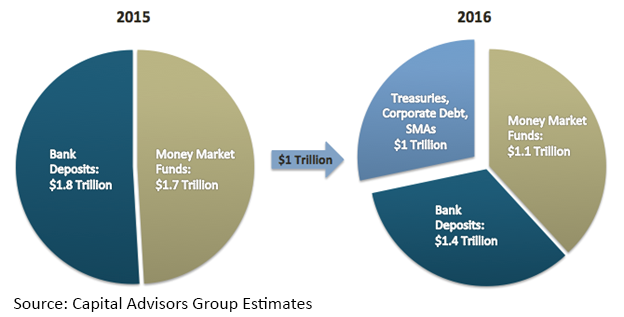

Money market fund reforms, new banking regulations, and the prospect of rising interest rates are motivating a top-to-bottom restructuring of many corporate cash portfolios in 2015 and 2016. As corporate treasurers strike a new balance of bank deposits, reconstituted institutional money market funds, and separately managed portfolios of directly purchased short-term securities, we expect to see more than $1 trillion in corporate cash migrate into new or different accounts in the coming year.

Following are estimates from the Capital Advisors Group research team of total expected outflows from bank deposits and institutional money funds:

- Bank deposits: Dodd-Frank banking reforms and Basel III accords tightening capital requirements have made traditional deposits more expensive and less available. These changes are already leading large banks to reduce the percentage of uninsured deposits of corporate cash. We estimate $450 billion of the $1.8 trillion* held in deposits at the top four global systemically important banks will move into safe but low-yield government securities and other vehicles.

- Money funds: With SEC-mandated money market fund reforms in 2016, we will see floating net asset values, redemption fees and liquidity gates at institutional money funds. These changes may increase potential risk and lessen potential liquidity and yields, making money funds less attractive as repositories for corporate cash. We estimate $615 billion of the $1.7 trillion* in corporate cash held in institutional money funds will move into low-yield government funds and other vehicles.

Given these changes, what’s an appropriate strategy for corporate treasury executives? In a rising interest rate environment, many may be seeking yields higher than what will be available in government securities. Those who do may be able to achieve their goal of a higher yield along with safety and liquidity by directly purchasing short-term securities offering yields higher than what’s available in government securities.

Managing your own securities—or having an advisory firm manage a portfolio of directly owned securities in a separately managed account (SMA)—eliminates the risk associated with sharing ownership of assets in pooled accounts such as money market funds. Weighted average maturity (WAM) of securities can be set to provide needed liquidity, and counterparty risk can be managed with appropriate research and monitoring. Yield targets may be managed within guidelines set by the corporation’s investment policy.

Of course, capital preservation and managing counterparty risk will most often remain top priorities. For that reason, a corporate treasury team often may find it useful to enhance its own fund management, research and credit management capabilities with an experienced advisory firm with a deep research and credit management bench that can set up and manage separate accounts of directly purchased securities.

*Capital Advisors Group estimates based on press reports, industry surveys and analyst projections.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.