Vaccines, ESG and LIBOR Replacement – Three Themes to Watch in 2021

We identify three themes to watch for cash investors each year. For 2021, we focus on vaccines, ESG and LIBOR replacement.

Introduction

At the start of each year, we typically name three broad themes that we think will have the greatest potential impact on the short-term debt markets. Our 2020 picks posed three questions: a) Would the Fed give in to the market’s expectation of further rate cuts? b) When and how would the repo market return to normal? c) And was ESG investing in cash management a fad?

As it turned out, the biggest factor that dominated everything else in 2020 was the Covid-19 pandemic that dramatically changed the ways we live, work, and interact, if not invest.

As we look towards 2021, a consensus emerges that, beyond a tumultuous 2020 and a long dark winter, a bright future awaits us as individuals and as an economy. Yet, global central banks’ commitment to continued monetary policy assistance could mean historically low interest rates for longer and more risk-taking behaviors on assets, both of which can be challenging for cash investors.

Of these contrasting outlooks, we offer our three picks of the trends to watch in 2021 that may shape cash investment strategies: a) a path of recovery dependent on successful vaccine rollouts; b) ESG investing going mainstream; and c) SOFR replacing LIBOR as the benchmark for floating rate debt issuance.

1.Vaccine-Based Herd Immunity Determines the Path of Recovery

Despite sharply lower economic activities that ended the longest expansion on record last March, extraordinary monetary and fiscal measures helped to stabilize the US economy and set it on an upward trajectory. Since last summer, encouraging economic indicators in labor, retail sales and GDP led economists to revise up the timetable towards full recovery. In more recent weeks, however, the expiration of economic assistance programs, the resurgence of positive cases, and reimposed partial shutdowns call into question the recovery’s strength and durability. In conversations and press releases, Fed officials and corporate executives increasingly pivot their economic forecast on the timing of vaccination to reach herd immunity by next summer. Globally, damage from the pandemic and the accessibility to vaccines will similarly impact the pace of recovery and growth imbalances between developed and developing economies.

Vaccines prominent in recovery projections: The long winter months will worsen the healthcare crisis and make the path of recovery more uncertain. While economists liked to use letters from the alphabet (V, U, W, or K) to describe the potential shape of the recovery last spring, many switched to the more traditional best-, normal-, and worst-case scenarios for 2021, with vaccine news embedded in their projections. For example, at the post-FOMC press conference on December 16, Fed Chairman Jerome Powell described vaccine rollouts as a “light at the end of the tunnel” to make the second half of 2021 a strong period. “Vaccine(s)” and “vaccinate(d)” appeared 12 times in his speech and Q&A session1. Morgan Stanley projects US and global growth rates to accelerate to 5.9% and 6.4% next year, respectively, partially boosted by positive news flow on vaccine developments2. JPMorgan noted that following a winter slowdown, “widespread vaccination will allow US growth to surge later in 2021, precipitating a relatively fast rebound from a deep recession3”. The baseline projection for Fitch Ratings calls for activity to bounce back in the second half of the year, with vaccine rollouts and listed “setbacks in efficacy or distribution of vaccines” as a risk to this projection4. Suffice it to say that a lot of hope rides on the efficacy and distribution of vaccines to continue the paths to recovery.

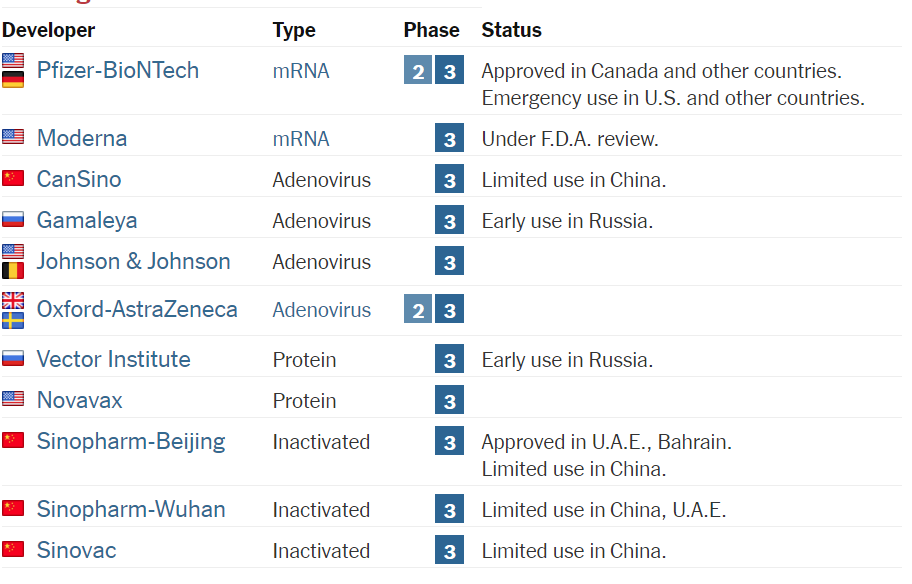

Promising news so far: News out of the vaccine front has been cooperative. According to the New York Times Coronavirus Vaccine Tracker, there are currently 63 vaccines in clinical trials on humans, 18 of which have reached the final stages of testing. At least 85 others are under active investigations on animals5. Vaccines based on the mRNA technology developed by Pfizer/BioNTech and Moderna have been shown to be highly effective, at 95% and 94% efficacy rates, respectively, and at least one has been approved for use in the UK, EU, Canada and the US, among other countries. The Oxford University/AstraZeneca vaccine based on the “vector” technology showed an efficacy rate of 62-90% on 8,900 Phase III participants and may soon receive conditional approval while researchers try to clear up its dosage issue. Other firms with promising candidates in phase III include Johnson & Johnson and Novavax. China and Russia also have multiple vaccines in phase III trials, with some reportedly already in use on humans before final trial results are analyzed. Compared to previous pandemics when vaccine development took multiple years, these achievements represent a giant leap in life science and a true game changer in the fight against the pandemic.

Figure 1: Leading Vaccines in Development

Source: New York Times Coronavirus Vaccine Tracker

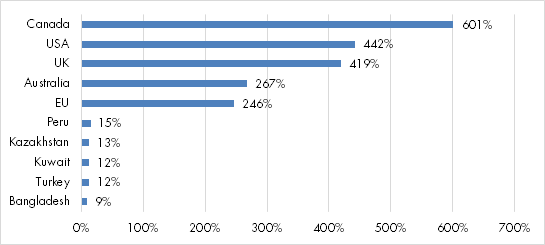

Distribution in focus: The success of vaccine development is only the first step towards widespread availability to the public. Headlines point to massive logistical challenges of quickly moving vaccines requiring rigid temporary storage and other requirements on a global scale, especially to less developed and rural locations. Setbacks in approval (e.g., Oxford-AstraZeneca) and manufacturing and delivery issues (e.g., Pfizer) may further complicate the matter, pushing back inoculation timetables and tempering rosy projections of recovery in the second half of 2021. The optics of rich countries “hoarding” vaccines in “panic buying” sprees also raises concerns of an uneven recovery between developed and developing nations6. According to data compiled by Duke University’s Global Health Innovation Center, potential dose purchases range from more than 600% of population in Canada to 9% in Bangladesh. None of the African nations made the Duke list.

Figure 2: Reserved Vaccine Counts by Countries/Blocks (As of December 11, 2020)

Source: Bloomberg, New York Times

Figure 3: Reserved Vaccine Count as Percentage of Population (as of November 30, 2020)

Source: Launch and Scale Speedometer, Duke Global Health Innovation Center

Overcoming resistance to vaccination: The ambitious pace of the Trump administration’s Warp Speed initiative and the politicization of the fight against Covid-19 have resulted in notable resistance to vaccination. This is significant as the government’s projection of approaching herd immunity by summer’s end and “normality” by the end of 2021 requires 75% to 80% of Americans vaccinated by the second quarter, according to Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases7. If vaccination levels are lower, say at 40-50%, it could take a very long time to reach that level of protection, according to Dr. Fauci. Memories of historical medical experimentation on racial minorities led to higher levels of mistrust in certain communities, as a recent study showed only a third of Latinos and 14% of Black people said they mostly or completely trust a vaccine8.

Meanwhile, the anti-vaccine movement, which was already a threat to public health prior to the pandemic, grew its influence through social media. A report by the UK-based Centre for Countering Digital Hate said in October that at least 31 million people follow anti-vaccine groups on Facebook, with 17 million subscribing to similar accounts on YouTube9. After healthcare workers and public figures including Vice President Mike Pence received vaccination, public sentiment may be improved. A Kaiser Family Foundation poll showed the number of Americans willing to be vaccinated grew to 71% in December, from 63% in an August/September poll. The same poll also indicates that politics remains a factor in vaccine acceptance, as 56% (up from 47% in August/September) of self-identified Republicans will probably or definitely get a vaccine, compared to 86% among Democrats10.

In conclusion, as projections for sustained recovery in employment, business activity, corporate earnings and asset quality depend heavily on successful execution of vaccinating most of the population by summer of 2021, it represents the biggest risk on the economy and cause for reversal if news on the vaccine front disappoints in a major way in the coming months. While remaining hopeful, cash investors should be mindful of how setbacks and reversals can impact portfolio liquidity.

2. ESG Investing Goes Mainstream

The acronym that stands for environmental, social and governance (ESG) investing may have been unfamiliar to some in the cash management community only a few years ago. This is no longer the case thanks in no small part to the damage caused by the virus to human societies, trade and commerce, and financial assets including investment portfolios.

A year of reckoning for sustainability: A year ago, we identified ESG as one of the three trends to watch for 2020. The horrific reality of rising death tolls, crumbling social institutions, and ravaged economies caused by the coronavirus drove home the dire consequences of ignoring ESG risks around us. In addition to the pandemic, 2020 also brought our attention to forest and wildfires in Australia, India, Brazil, and California, flash floods in Indonesia, locusts from East Africa to East Asia, Black Lives Matter protests brought on by the killing of George Floyd and others, allegations of massive voter fraud in the US Presidential election…. Even for the strictly capitalist investors among us, the sudden seizing up of international trade, negative oil prices, empty shopping malls, smashed-in retail establishments, and the near collapse (again!) of the world financial system make a strong case for the profound impact of ESG or sustainability issues on financial asset returns.

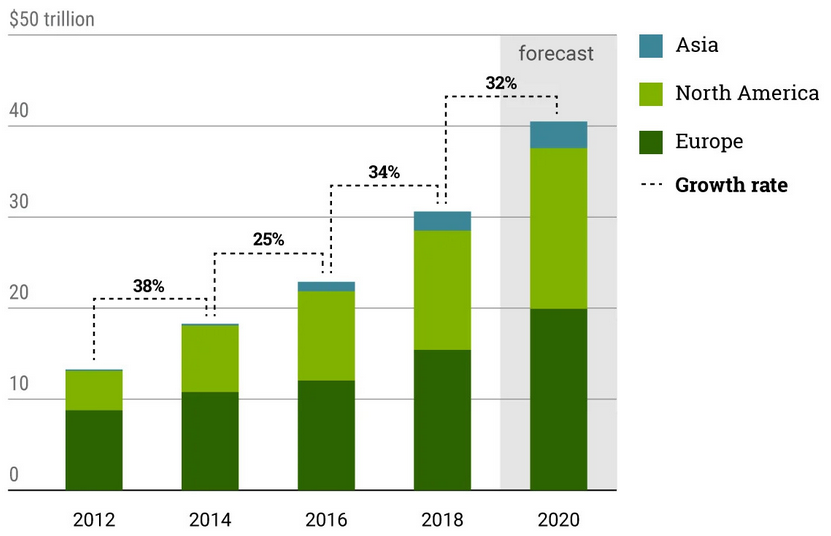

Figure 4: Growth of ESG Investments, 2012-2020

Source: GZERO Magazine, December 13, 2020

Investor’s Rising Appetite: Investors already took notice of this trend. According to a recent TD Ameritrade survey, about one-third of Americans have considered making sustainable investments11. This demand led to the launch of exchange traded funds (ETFs) focused on ESG practices that reached $27.4 billion in 2020, nearly doubling the size for the sector, according to data from FactSet12. The surge in ESG popularity in a pandemic year answered the lingering question of whether the goal of responsible investing ever crosses paths with financial well-being. At least for the time being, the S&P 500 ESG Index outperformed the S&P 500 Index year-to-date at 15.21% vs. 13.49%13. This rising appetite should continue in 2021, sparking discussions on transforming cash portfolios with ESG priorities.

Industry’s Response: On the industry front, here are a few things that happened in 2020: In January, BlackRock, the largest asset manager in the world, announced that it would put sustainability at the heart of its investment decisions and begin divesting investments in fossil fuel companies14. At about the same time, Goldman Sachs vowed not to take a company public in the U.S. or European if it lacks a female or diverse director15. In November, General Motors announced that it withdrew from a litigation brought by the Trump Administration against the State of California to roll back the state’s tough emission standards. In December, Bank of America finally joined other Wall Street firms (JPM, C, GS, MS, WFC) in announcing that it will not finance oil and gas exploration in the Arctic following pressures from environmentalists16.

Pro-ESG Policy Shift: With the incoming Biden administration, expectations are running high for a new direction of legislation and regulation aimed at issues such as climate change, labor practices, safety protection, equality and diversity in the workplaces and the marketplace, and boardroom accountability. This is not a mere reversal of a short-term trend from the previous administration, but a reversion to a secular trend endorsed by governments in many developed nations. President-elect Joe Biden vows to rejoin the Paris Climate Agreement, a global pact forged years ago under the leadership of the US but one the Trump Administration parted ways with last November17. Biden also named John Kerry, a former Secretary of State as a presidential climate envoy to lead the administration’s global climate initiatives as part of the White House’s National Security Council. The European Union, which has been ahead of the US on ESG policy initiatives, mandated ESG disclosures for investment advisors and portfolio managers as of March 10, 202118. Even China, the world’s largest developing economy and the largest producer of carbon emissions, has in recent years adopted environmental policies to fight pollution and grow renewal technology investments at sums larger than the US and EU combined19.

Converging Disclosure and Regulatory Standards: A well-known obstacle to widespread adoption of ESG investing has been the lack of reliable and consistent data to measure, verify, and monitor ESG metrics. As discussed in our recent blogs, international efforts from governments, non-government organizations (NGOs), accounting standards boards, and industries are converging towards common standards and best practices. In an interview with Barron’s, Janine Guillot, head of the Sustainability Accounting Standards Board (SASB), a major participant in these efforts, said common standards could come in the next 12 to 24 months. In the same interview, CEOs from Bank of America and BlackRock endorsed these standardization efforts to achieve the UN Sustainable Development Goals, announced in 2015 to provide a common set of economic, social, and environmental outcomes for member countries, by 2030. The Big Four accounting firms, the International Financial Reporting Standards (IFRS) Foundation, and the Financial Accounting Standards Board (FASB) in the US are also behind this momentum in developing common reporting standards and resolving differences between US GAAP and the IFRS standards, according to these executives20.

Steady March in ESG Cash Investing: For institutional liquidity investments, assets managers continue to find ways to meet investor preferences for sustainability by introducing various ESG strategies such as “green” and “impact” funds. While unique challenges for cash portfolios exist, as we recently highlighted21, we believe a long-term trend is well under way to rotate out of certain industries into sustainable investments, to increase issuance of green and social bonds, and to apply pressure on financial issuers to demonstrate their commitment to ESG initiatives in lending and market-making activities. As 2020 demonstrated, sustainable investing may bring the direct benefits of reduced volatility and lower credit risk in addition to doing good for the planet and society.

3. LIBOR Receives an Extension, but SOFR Is Here to Stay

The ubiquitous benchmark for floating rate debt, the London Inter-Bank Offered Rate (LIBOR), was slated to end its checkered history and die a peaceful death at the end of 2021. On November 30, Intercontinental Exchange (ICE), the administer of LIBOR, said it will continue to publish the overnight, one-, three-, six- and 12-month USD LIBOR rates through June 30, 202322. On the same day, US financial regulators including the Federal Reserve, FDIC and OCC released a joint statement encourage banks to stop entering into new contracts that use USD LIBOR as a reference rate as soon as practicable and no later than December 31, 202123.

LIBOR phasing out: LIBOR rates are the most widely used short-term benchmarks for loans, derivatives, and floating rate bonds in five major currencies. The system produces average interest rates in several maturities based on estimates from a group of internationally active banks. The LIBOR Scandal in 2012 revealed the rate-setting mechanism’s lack of transparency and susceptibility to abuse during the financial crisis. The authority of LIBOR was transferred from a private bank association to a UK government agency, which announced that the benchmark would be phased out by 2021.

Beneficial to market stability: Major challenges to LIBOR transition stem from the handling of outstanding financial obligations tied to the legacy benchmarks. In the US, no clear solution has been found on the application of a “fallback” spread to compensate holders of the existing contracts based on LIBOR, which has embedded credit risk assessment, when they switch to a broad Treasury repo financing rate, the Secured Overnight Financing Rate (SOFR), that does not include a credit risk component. The extension to June 2023 will allow most of these legacy obligations to mature without going through conversion. This should reduce potential volatility to the financial system. Among USD investment-grade floating-rate notes, Barclays Capital estimates that about 41% ($135 billion) will mature before the original LIBOR termination date of December 31. A delay to June 30, 2023 will allow 80% ($264 billion) of such debt to mature. In addition, 72% of the remaining LIBOR-based debt were issued after the UK regulator’s announcement and included specific fallback language on conversion24.

SOFR replacing LIBOR on new debt: As the joint statement from US financial regulators indicates, the deadline extension does not apply to newly issued USD debt. Issuers are “encouraged” to stop using LIBOR rates as benchmarks as soon as practicable but no later than December 31, 2021. This means that starting in 2021, new floating rate debt will likely be tied to benchmarks other than LIBOR. Investors should get used to its replacement for USD LIBOR, the Secured Overnight Financing Rate (SOFR). In June 2017, the Alternative Rates Reference Committee (ARRC), the committee tasked by the Federal Reserve to find viable alternatives to LIBOR, officially adopted SOFR. Its advantages include transaction-based rates, a wide coverage of Treasury repos, and daily rates published by the New York Fed25. Government sponsored enterprises (GSEs) and financial firms have been pioneers in issuing SOFR-based bonds, although more corporate issuers have also caught on as the deadline approaches. However, challenges to widespread adoption remain. For example, since SOFR is a daily average of Treasury repo rates, a term interest rate needs to be derived from actively traded SOFR futures, which lacks a reliable track record. As noted earlier, investors are wary of debt issued with credit risk but benchmarked to the Treasury-based SOFR index and are unsure how their bonds will behave during a market downturn relative to the benchmark.

Figure 5: Yield Spread of 3-month LIBOR to Daily SOFR

Source: Bloomberg

We advise that cash investors continue to monitor developments in SOFR debt issuance. As the Federal Reserve is committed to keeping short-term interest rates low for an extended period, the demand for floating rate debt may be low in the foreseeable future. To the extent investors consider SOFR bonds, GSE issuers may be the first place to start for their better liquidity and lower credit risk concerns.

1Refer to Chair Powell’s Press Conference Transcript (PDF) at the December 15-16, 2020 FOMC Meeting.https://www.federalreserve.gov/monetarypolicy/fomcpresconf20201216.htm

22021 Global Macro Outlook: The next phase of the V, Morgan Stanley Research, November 15, 2020.

3“Market Insights: The Investment Outlook for 2021”, JPMorgan Asset Management, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/investment-outlook/introduction/

4“Fitch Rating coronavirus scenarios: Baseline and downside cases – Update”, Fitch Ratings Credit Policy Group, December 7, 2020.

5Carl Zimmer, Jonathan Corum and Sui-Lee Wee, Coronavirus Vaccine Tracker, The New York Times, Updated December 17, 2020.https://www.nytimes.com/interactive/2020/science/coronavirus-vaccine-tracker.html

6Miacheleen Doucleff, How rich countries are ‘hoarding” the world’s vaccines, in charts, NPR, December 3, 2020.https://www.npr.org/sections/goatsandsoda/2020/12/03/942303736/how-rich-countries-are-hoarding-the-worlds-vaccines-in-charts

7Alvin Powell, Fauci says herd immunity possible by fall, “normality” by end of 2021, The Harvard Gazette, December 10, 2020.https://news.harvard.edu/gazette/story/2020/12/anthony-fauci-offers-a-timeline-for-ending-covid-19-pandemic/

8Anthony Orozco, Building trust in Covid-19 vaccine marred by misinformation and America’s racist medical past, Penn Live Patriot-News, updated December 4, 2020.https://www.pennlive.com/news/2020/12/building-trust-in-covid-19-vaccine-marred-by-misinformation-and-americas-racist-medical-past.html

9Tahla Burki, The online anti-vaccine movement in the age of Covid-19, The Lancet Digital Health, October 2020.https://www.thelancet.com/journals/landig/article/PIIS2589-7500(20)30227-2/fulltext

10Colin Dwyer, Poll: Americans are growing less reluctant to take Covid-19 vaccine, NPR, December 15, 2020.https://www.npr.org/sections/coronavirus-live-updates/2020/12/15/946761737/poll-americans-are-growing-less-reluctant-to-take-covid-19-vaccine

11TD Ameritrade lauches socially aware portoflios, expanding access to ESG investing, BusinessWire, September 06, 2018.https://www.businesswire.com/news/home/20180906005134/en/TD-Ameritrade-Launches-Socially-Aware-Portfolios-Expanding-Access-to-ESG-Investing

12Michael Wursthorn, Investors Pile into ETFs Devoted to ESG, the Wall Street Journal (Markets | ETFs), December 16, 2020.https://www.wsj.com/articles/investors-pile-into-etfs-devoted-to-socially-responsible-esg-11608114604?mod=djemMoneyBeat_us

13Portia Crowe, How the pandemic helped drive a surge in ESG demand, Business Insider, December 8, 2020. https://www.businessinsider.com/how-the-pandemic-helped-drive-a-surge-in-esg-demand-2020-12

14Joanna Partridge, World’s Biggest Fund Manager Vows to Divest form Thermal Coal, The Guardian, January 14, 2020.https://www.theguardian.com/business/2020/jan/14/blackrock-says-climate-crisis-will-now-guide-its-investments

15Jena McGregor, Goldman Sachs CEO says it won’t take a company public without diversity on its board, Washington Post, January 23, 2020.https://www.washingtonpost.com/business/2020/01/23/goldman-sachs-ceo-says-it-wont-take-companies-public-without-diverse-board-member/

16Rachel Frazin, Bank of America Pledges No Financing for Arctic Oil, The Hill, December 1, 2020.https://thehill.com/policy/energy-environment/528146-bank-of-america-pledges-no-financing-for-arctic-oil

17Emma Newburger, Biden will rejoin the Paris Climate Accord, CNBC.com, November 20, 2020.https://www.cnbc.com/2020/11/20/biden-to-rejoin-paris-climate-accord-heres-what-happens-next-.html

18Anna Maleva-Otto and Joshua Wright, Schulte Roth &Zabel LLLP, New ESG Disclosures Obligations, Harvard Law School Forum on Corporate Governance, March 24, 2020.https://corpgov.law.harvard.edu/2020/03/24/new-esg-disclosure-obligations/

19Explainer: China’s environmental goals, World Economic Forum, September 8, 2015. https://www.weforum.org/agenda/2015/09/explainer-chinas-environmental-goals/

20Leslie P. Norton, ESG standards convergence could happen next 12 to 24 months, accounting body chief says, Barron’s, December 14, 2020.https://www.barrons.com/articles/esg-standards-convergence-could-happen-in-next-12-to-24-months-accounting-body-chief-says-51607968355

21Please refer to our whitepaper Demystifying ESG Investing – Considerations for Institutional Investors in the June 2019 issue of the Capital Advisors newsletter.

22ICE benchmark administration to consult on its intention to cease the publication of one week and two month USD LIBRO settings at end-December 2021, and the remaining USD LIBOR settings at end-June 2023, ICE, November 2020. https://ir.theice.com/press/news-details/2020/ICE-Benchmark-Administration-to-Consult-on-Its-

23See the Joint Press Release: Agencies issue statement on LIBOR transition, November 30, 2020. https://www.federalreserve.gov/newsevents/pressreleases/bcreg20201130a.htm

24Brian Monteleone and Dennis Kilic, Investors should benefit from likely extension of 3mo LIBOR end date, Barclays Credit Research, December 1, 2020. https://live.barcap.com/PRC/publication/DR/FC_RU1BSUxfQ09OVElOVUVfUkVBRElOR35sYl8xNTYxNTY2NTI3OTMwfiB-IH4gfiB-_5fc650c621386c7cdf40b0a2

25ARRC releases second report on transition form LIBOR, Federal Reserve Bank of New York, March 5, 2018.https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-second-report-press-release

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.