Understanding Commercial Paper

What is Commercial Paper?

Commercial paper (CP) is a type of short-term, unsecured debt instrument with a maturity of no more than 365 days. CP serves as an alternative to a business loan and is typically used by large corporations to finance their short-term operating needs such as accounts payable, payrolls and inventories. Generally speaking, CP is exempt from SEC registration according to the Securities Act of 1933: Section 4(2), which allows CP to be a simpler means of financing.

Who are the Issuers and Investors?

The typical issuers of commercial paper include corporations, finance companies, and banks. These issuers’ strong credit profiles help to reduce the risk of default and foster trust in CP. Since CP is issued at a discount with no coupon, usually in minimum denominations of $100,000, it is typically only available to institutional investors, such as mutual funds, insurance companies, corporations, and universities. CP is not generally accessible to most individual investors; however, it may be suitable for certain wealthy individuals.

What are the Terms?

Commercial paper may be issued out to 365 days. At the end of the maturity period, issuers either can re-issue or ‘roll over’ more commercial paper to pay off the old issuance.

Is Commercial Paper Unsecured?

Yes, commercial paper is unsecured, so an investor would not have a claim on company assets if the issuer were to default. With respect to the order of repayment in the event of a default, generally CP’s seniority is on par with the senior unsecured debt of corporate bonds. Issuers with high credit ratings and consistent revenue streams help mitigate the concern of default, but credit analysis of any issuer is always necessary to stay ahead of credit and rating events.

What is the Difference between Commercial Paper and Corporate Bonds?

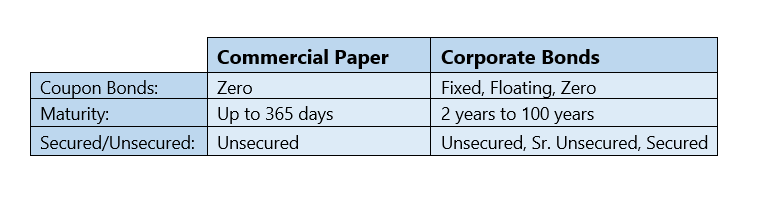

Commercial paper differs from corporate bonds in several ways. CP is always issued at a discount, has a fixed, short-term maturity, and is an unsecured funding vehicle. On the other hand, corporate bonds have longer maturity dates, varied coupon payments, and offer different levels of collateralization. The chart below illustrates these differences.

What is the Current Market for Commercial Paper?

The commercial paper market remains strong, but higher rates have depressed market levels from $1.3B to $1.1B outstanding in the first half of the year. This decrease is also likely partially driven by strong corporate earnings reducing companies’ reliance on CP to meet short-term liabilities. While markets are healthy for now, severe market turmoil, such as the COVID-19 pandemic, can make markets illiquid. However, in the past, the Federal Reserve has established lending facilities to support the CP market, helping to enhance liquidity and maintain functionality in market in times of extreme stress.

What makes Commercial Paper Suitable for a Cash Portfolio?

CP may be suitable for a cash portfolio for three main reasons. First, its short maturity typically aligns well with cash investors’ time horizon. Second, CP is issued at a discount and is almost never subject to calls, increasing certainty of maturity timing. Lastly, CP is typically issued by high-grade (Tier-1) corporate issuers, aligning it with cash investors’ low risk tolerance.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.