Tightening Financial Conditions May Cause Us to Lose Circulation

Co-Authored by Pate Campbell, Analyst CFA

Managing the Risks Posed by Tightening Financial Conditions

Executive Summary

Financial conditions are tightening, primarily as a byproduct of the Fed’s interest rate hiking cycle. This portends that households and businesses may be less supportive of economic growth than they have been in the post-Covid period. Households have now worked off their surplus of savings built up from government stimulus checks as businesses face an incoming wall of debt refinancing that is due over the next few years.

More importantly for investors, tightening financial conditions also raise the risk of various other disruptions to financial markets. Specifically, a severe tightening of credit conditions, falling bank liquidity, and turmoil from asset-liability mismanagement are all more likely in an environment where interest rates have risen rapidly. While far from a death knell, the emergence of these risks argues for the importance of robust credit and risk management. Credit modeling services such as Capital Advisors Group’s Counterparty IQ may prove to be a useful tool for investors in this regard.

The Importance of Financial Conditions

‘Financial conditions’ is a term without an exact definition, but generally refers to the support (or lack thereof) that financial markets provide the economy. Single-measure indications of financial conditions attempt to consolidate information from disparate markets into a single impulse metric. This metric serves as an informant to users as to which direction markets may be pulling the macroeconomy. For example, if equity markets are selling-off, interest rates are rising, and credit spreads are widening, measures of financial conditions tend to be more restrictive – the logic being that all three of these things tend to put downward pressure on spending, credit, and investment. Conversely, if equity markets rally and credit spreads tighten, the assumption is that this will have a positive impact on spending and the availability of credit, and thus, measures of financial conditions will turn supportive.

Changes in financial conditions provide an important signal not only to market observers, but also to the Federal Reserve. The Fed’s dual mandate relates to the macroeconomy, but it can only achieve its goals via interactions with financial markets. The Fed funds rate regulates levels of short-term (and to some degree longer-term) interest rates in the economy, by impacting the cost of borrowing for a mortgage or a business loan. And the size of its balance sheet directly impacts the availability of liquidity in the market, which can have secondary impacts on the broader availability of credit.

Financial Conditions are Tightening

It is no surprise that the FOMC routinely cited financial conditions over the past 12-18 months as an important signal of the impact of policy tightening. Since May 2022, the FOMC has raised the Fed funds rate from 0.25%-5.50%, while also reducing the size of its balance sheet from 37% to 29% of GDP. This has correlated with a broad tightening of financial conditions.

Figure 1: Bloomberg, Federal Reserve, Goldman Sachs

On top of these financial market considerations, there has also been tightening in the household and business sectors. As noted in our recent blog What Dwindling Excess Savings Means for The Consumer, the household sector has now essentially worked off the excess savings it accumulated during the pandemic via a combination of government checks and lack of service spending. A byproduct of this is that delinquency rates on credit cards have begun to rise from near-historic lows, something which is likely to continue into 2024. So long as labor market conditions remain strong, there is likely a cap on how much consumer credit can deteriorate. However, the combination of lower savings and normalizing delinquencies is a negative for the consumer spending outlook.

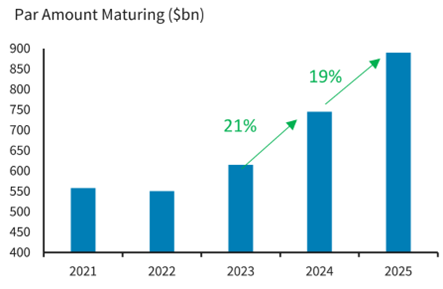

On the business side, the story relates to the rise in interest rates and how this could translate to interest expenses. The duration of corporate debt has nearly doubled over the past three decades, slowing the pass-through from rising interest rates to firms’ interest expenses. Moreover, firms issued a sizeable amount of debt from 2020-2021 to shore up balance sheets and take advantage of record low rates. The upshot of these two phenomena is that businesses have been more insulated from the impact of Fed tightening than in the past. This will likely begin to change within the next few years as some of that pandemic debt starts coming due. Barclays estimates that the investment grade universe (which issues the large majority of corporate bonds) faces a $745B wave of maturing debt in 2024, a 21% increase from the year prior. The trend continues into 2025, when maturing debt is expected to rise a further 19%.

Figure 2: Barclays FICC Research

Evidence suggests that this wave of refinancing will impact firms’ spending on non-debt related items. A study done by Goldman Sachs estimated that each dollar of incremental interest expense reduces capital expenditures by 10 cents and labor costs by 20 cents1. They go on to note that these impacts should in theory be captured by financial conditions indices, but that the lack of actual corporate refinancings until this point could elongate the pass-through period from tighter financial conditions to economic output.

All these factors seem to dampen the outlook for economic growth, which up to this point has proved to be more resilient than forecasters (including the Fed) had predicted. While still positive in the near-term, there are some risks to growth farther on the horizon, particularly in the context of tighter financial conditions.

Credit Crunch: Lay Off the Gas or Hard on the Breaks

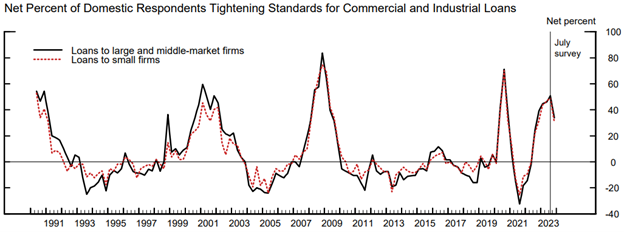

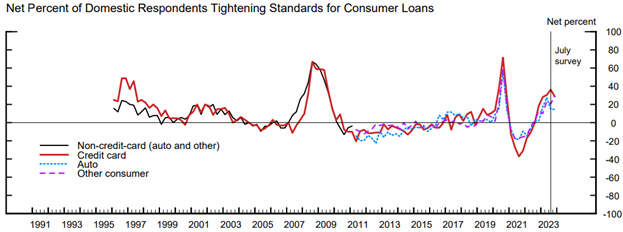

One way tighter financial conditions influence the real economy is by increasing real borrowing costs which then lowers the universe of levered investment opportunities that produce returns above the cost of capital and incentivizes saving over spending. This also tends to reduce investment and consumption, decreasing growth, in turn lowering the return on investment, which further reduces the levered investment opportunity set. Done in a controlled manner, this plays itself out in something akin to a driver laying off the gas, keeping the car moving forward but at a progressively slower pace. The October Senior Loan Officer Opinion Survey (SLOOS) showed something along these lines with roughly 30% and 20% of domestic respondents tightening lending standards for C&I and residential loans, respectively.2

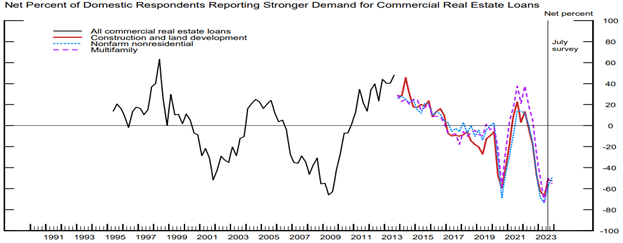

Additionally, higher borrowing costs and less credit availability is reducing demand for both C&I and residential loans, as businesses have less viable investment opportunities in the face of higher rates, and consumers are more enticed to save.

Source: October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

Despite reduced availability and demand for credit, Q3 2023 GDP came in at a blistering 4.9% annualized reading, driven by exceptionally strong consumer spending showing that financial conditions still have further room to lay off the gas.3 However, there were some signs tighter financial conditions were taking hold. Nonresidential fixed investment, which measures purchases of nonresidential structures, equipment, and intellectual property fell by 0.1% on an annualized basis during Q3, the first decrease since Q3 2021.

Tighter for longer financial conditions may create an environment where the cycle of tightening credit and lower growth can lead to a credit crunch, with potential recessionary implications. Following the March 2023 banking crisis, many were concerned that a lack of clarity around banking system health and commercial real estate asset performance in the context of a still aggressively hiking Fed could lead to a severe credit crunch. While this didn’t materialize, former Fed chair Ben Bernanke won a Nobel Prize for highlighting the role credit, or lack thereof, has in inducing, deepening, and prolonging recessionary cycles4. Notably, the asymmetry of information in lending markets, whereby the borrower knows more about their own capacity to repay debt than the lender does, leads lenders to tighten credit standards and reduce risk tolerance. This is done by increasing rates, adding covenants, or lowering borrowing limits.

The lower the clarity on the lenders’ side, the lower their risk tolerance, worsening the credit crunch. The October SLOOS highlighted this dynamic well; the two most cited reasons for tightening credit standards were the uncertain economic outlook (98% of lenders) and a reduced risk tolerance (70% of lenders)5. As it stands, higher rates are still easing off the gas, slowing but not stopping economic growth. However, if there is a period of tighter for longer financial conditions, all the pieces necessary to spark a credit crunch exist.

Money Markets’ Minimum Comfort Level

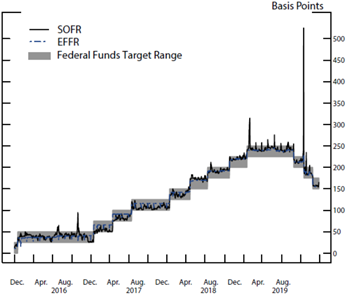

Under the second round of Quantitative Tightening (QT), the Fed is allowing up to $60B of Treasury securities and $35B of mortgage-backed securities to roll off its balance sheet each month6. QT tightens policy by increasing Treasury supply, while simultaneously removing bank reserves from the system. A side effect of this is, as primary dealers use reserves to purchase Treasury securities, which mainly take the form of deposits held at the Fed, they reduce their available pool of liquidity and capital. Given that banks are subject to strict capital & liquidity requirements, QT effectively reduces their financial flexibility.

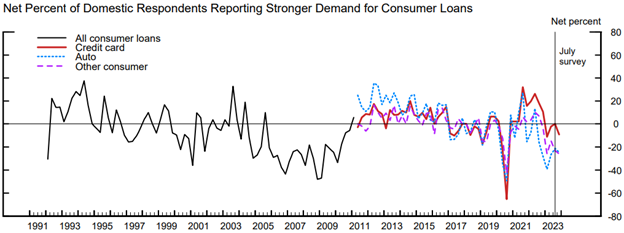

The operational nature of reserves mean that most banks have an internal lowest comfortable level of reserves (LCLOR). Generally, if banks encroach on this level they will borrow additional reserves, usually through the Fed funds market or Federal Home Loan Bank Advances. However, if cumulative bank reserves fall below the LCLOR, it can lead to a significant spike in overnight rates or a liquidity crunch. While this is well known, the issue with the LCLOR is it’s a non-quantifiable moving target, meaning the only sure way to find it is crossing it. One such episode led to a spike in overnight rates in September 2019, when in short, corporate tax payments and additional Treasury issuance shrank the supply of and drove up demand for reserves7. This ultimately drove overnight rates from the low-to-mid 2% range to upwards of 9% in a few days. You can read a more detailed recount of this in our piece, Repo Ruckus Reveals Fed’s Loosening Grip on Short-Term Rates.

Source: The Federal Reserve

In 2019, reserves dropped below $1.5T, roughly 7% of GDP. Keeping reserves consistent relative to GDP would suggest $1.9T in reserves could be the LCLOR8. However, the LCLOR is not a constant metric. The August 2023 Senior Financial Officer Survey suggested the LCLOR has risen by 20% or more since the question was last asked in 20209. This is likely in response to the liquidity issues which hit the banking industry in March 2023. If tight financial conditions persist, it may increase the chance of a liquidity, funding, or idiosyncratic event, likely further increasing the LCLOR. If our 7% of GDP reserve estimate has been revised higher, say to 10%–12% of GDP, this would represent a LCLOR of $2.7T–$3.3T. As of November 8th, 2023, reserves sat at $3.4T10.

Source: Federal Reserve Bank of St. Louis

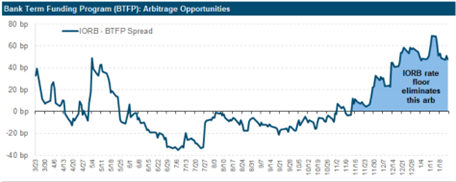

Since the 2019 episode, the Fed has implemented the Standing Repo Facility and the Bank Term Funding Program (expiring in March 2024). Both facilities increase emergency bank liquidity lines and could act as a canary in the coal mine if their usage picks up significantly. Additionally, banking system reserves have been supported by a roughly $1.3T fall in the Fed’s overnight reverse repo program (ON RRP) as money funds term out their holdings11. However, the ON RRP will not likely drop to zero as money market funds use it to manage liquidity requirements. Moreover, this downtrend in ON RRP assets could reverse quickly if the Fed decides to hike again. While draining system reserves is a critical part of monetary policy implementation, unfortunately, we won’t know how much is too much until issues arise.

Asset-Liability Mismanagement

Rates sitting at 22-year highs and the historically rapid pace which we got there has introduced greater financial market volatility than experienced in the 2009–2015 zero lower bound era or the 2016–2019 hiking cycle. This has created immense challenges for financial and investment officers whose missteps or misfortunes should act as a reminder to remain vigilant even in calm weather.

One of the first major issues to arise was the U.K. Guilt crisis in September 2022. During the low-rate pre-pandemic era, the U.K.’s defined benefit pension schemes faced low returns on fixed income assets, which resulted in widespread use of leverage through the repo and swap markets to enhance returns. Funds typically used Guilts or cash as collateral for these contracts. In 2019, it was estimated that the mean leverage target for U.K. pooled pension funds was 4x (meaning 1-part equity 3-parts debt)12. Additionally, U.K. pension funds had a very long liability duration of roughly 15–20 years, making their matched assets very rate sensitive. With proper management, all was well when the Bank of England began lifting rates in December 2021, but the release of the U.K. chancellor’s mini-budget in September 2022 started a dramatic sell-off in Guilt markets.

The resulting sell-off caused large mark-to-market losses on the collateral for these contracts leading to margin calls. To meet this immediate liquidity need, pension funds sold Guilt holdings, driving the price down further creating a fire-sale cycle. The resulting spike in yields was two to five time larger than what was seen during the dot-com bubble, global financial crisis, or COVID-19 pandemic, and only subsided once the Bank of England introduce a temporary Guilt purchase program13.

Source: Federal Reserve Bank of Chicago

Similar asset-liability management issues led to the collapse of Silicon Valley Bank (“SVB”) in March 2023. During COVID-19 pandemic, SVB’s deposit base grew 220%, much of which was invested in the bank’s hold-to-maturity (HTM) securities portfolio14. GAAP would force the bank to revalue the entire portfolio if they sold one security. Large unrealized losses in the portfolio therefore took this $91B pool out of the liquidity conversation. Once rates began to rise, the bank’s deposits, a very short duration liability, were rapidly dwindling as the funding environment for SVB’s client base dried up. Eventually SVB had to sell $21B of their available-for-sale (AFS) securities portfolio which led to a $1.8B after-tax loss15. Despite a $2.25B capital raise, depositors lost confidence in the bank and by the end of the week it was in FDIC receivership. You can read more about the SVB crisis in our blog Why SVB Was Unique.

While SVB was unique in many ways, it highlights the risks of a tighter for longer environment. A similar story played out this fall when City National, a U.S. subsidiary of RBC, realized a $2.7B loss on securities in its AFS portfolio during Q3 2023, selling them to RBC16. RBC has injected $2.9B into the bank so far this year, shoring up its capital and liquidity profile. While we have significantly less clarity on the City National situation, it appears similar in that we know City National posted a net loss of $1.6B for the first three quarters of 2023, and regional banks have come under significant funding pressure in the face of higher rates and credit concerns immediately following the banking crisis. This could mean deposit outflows and lack of internal capital generation led City National to sell their AFS securities portfolio for extra liquidity, realizing massive losses in the process. In this case, RBC could comfortably absorb the losses, however it is symbolic of the broader risks faced by the regional banking sector.

Credit Monitoring & Risk Management

It is important to keep in mind that the risks pointed out in this report have not materialized as of publication and may not. A tightening of financial conditions does not de facto result in an undermining of broader financial market stability or economic conditions.

Nevertheless, the potential credit challenges posed by tightening financial conditions argue for a robust system of credit monitoring and risk management. Investors should understand how their portfolios are positioned for a potential shift in financial markets or economic conditions. Credit ratings can provide a starting point for this, but more proactive management may also prove to be a valuable service in such an environment.

Capital Advisors Group’s CounterpartyIQ® (CPIQ) online risk management platform is a tool geared for Treasury teams and cash managers looking to take a more hands-on approach. CPIQ allows users to better understand and access credit risk by providing granularity on investment holdings and monitoring of credit quality. It provides real-time access to proprietary credit scores derived from hundreds of data points spanning fundamental, macroeconomic, and financial market sources. CPIQ can be used for investment discovery purposes, to set credit quality limits in an existing portfolio, or to assist in managing existing counterparty relationships (for instance, banking partnerships).

However cash managers choose to monitor counterparty exposures, it is important to note that risk is not stagnant. It is prudent then to have systems in place allowing for a response to changes in market conditions before they arise.

1 Goldman Sachs Economics Research, ‘The Corporate Debt Maturity Wall: Implications for Capex and Employment’, https://www.gspublishing.com/content/research/en/reports/2023/08/07/d2ab6cef-d9ea-453f-b4fa-912d22ab09ee.html#

2 Board of Governors of the Federal Reserve System, ‘The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices’: https://www.federalreserve.gov/data/sloos/sloos-202310.htm

3Bureau of Economic Analysis, ‘Gross Domestic Product, Third Quarter 2023 (Advance Estimate)’: https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

4 Economic Studies at Brookings, ‘Ben Bernanke’s Nobel Prize Lecture’, “Banking, Credit, and Economic Fluctuations”: https://www.brookings.edu/wp-content/uploads/2022/12/20221212_Hutchins_BernankeLecture2.pdf

5 Moody’s Investor Service, ‘Banks Continue to Tighten Underwriting, Suggesting Uncertain Economic Outlook’: https://www.moodys.com/research/Banks-US-Q3-2023-SLOOS-update-Banks-continue-to-tighten-Sector-Comment–PBC_1384196?token=LrvUgxUTQqNk1QJDUX9hb3WKcVbctCKk&cid=Y08N0JE2XZC2681&mkt_tok=NzUwLVZQWC00NzEAAAGPTf3mQqHykkBA3OT4gKgM2DzoS0TV0OJsy3XVlqEp8ZOyDYyZmZMUWh5pmebvSQCTy14X8vSaY7ZeprLxtOuK7iLibwPkF8Rrrqai47ESHUjx

6Board of Governors of the Federal Reserve System, ‘Implementation Note Issued November 1, 2023’: https://www.federalreserve.gov/newsevents/pressreleases/monetary20231101a1.htm

7Board of Governor of the Federal Reserve System, ‘What Happened in Money Markets in September 2019?’: https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.html

8Federal Reserve Bank of St. Louis, ‘The Mechanics of Fed Balance Sheet Normalization’: https://research.stlouisfed.org/publications/economic-synopses/2023/08/23/the-mechanics-of-fed-balance-sheet-normalization

9Moody’s Investor Service, ‘Senior Financial Officer Survey Suggests Ongong Pressure on Bank Funding; Less Room for QT’: https://www.moodys.com/research/Banks-US-Senior-Financial-Officer-Survey-suggests-ongoing-pressure-on-Sector-Comment–PBC_1376211

10Moody’s Investor Service, ‘Declining ON RRP Balances Support Banking System Reserves Even as BTFP Balances Ticks Up’: https://www.moodys.com/research/Banks-US-Declining-ON-RRP-balances-support-banking-system-reserves-Sector-Comment–PBC_1387745?token=jR1pR7kPS80LHqxfY%2F8hSctWhyvdDkNw&cid=Y08N0JE2XZC2681&mkt_tok=NzUwLVZQWC00NzEAAAGPZ72_KjihTlgBWzTKPaDOC5q_oEHZ798qvWaFksYsZloaHNjLqgI3qduk12OR7OaSopu03uhxBZEypWloBCPTq4aONAPhfu0G24S6YuqtJCEP

11 FRED, ‘Overnight Reverse Repurchase Agreements: Treasury Securities Sold by the Federal Reserve in the Temporary Open Market Operations’: https://fred.stlouisfed.org/series/RRPONTSYD

12NISA Investment Advisors, LLC, ‘LDI Markets in the US & UK – Four Structural Differences to Know’: https://www.nisa.com/perspectives/four-structural-differences-to-know-about-the-u-k-and-u-s-ldi-markets/

13 Federal Reserve Bank of Chicago, ‘UK Pension Market Stress in 2022 – Why it Happened and Implications for the U.S.’: https://www.chicagofed.org/publications/chicago-fed-letter/2023/480#ftn7

14Banking Drive, ‘RBC Pumped $2.95B Into City National This Year to Boost Capital’: https://www.bankingdive.com/news/rbc-pumped-295b-city-national-boost-capital/698631/?utm_campaign=Yahoo-Licensed-Content&utm_source=yahoo&utm_medium=newsfeed

15 Company Filings as of 1/31/22

16 Silicon Valley Bank, ‘Strategic Actions/Q1’23 Mid-Quarter Update’: https://www.sec.gov/Archives/edgar/data/719739/000119312523064680/d430920dex992.htm

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.