Rates, Commodities and Consumer Finance: Three Themes to Watch in 2023

Introduction

By Lance Pan, CFA

Since we started publishing the annual “themes to watch” series in 2008, this edition marks our 16th anniversary of looking at key market-moving trends for institutional cash investors. To shake off our Covid-induced autophobia (fear of being alone), I enlisted members of my credit research team to co-author last year’s “Rates, Supply Chain, ESG and Stablecoins: Three (+1) Themes to Watch in 2022.” We continue this collaborative effort this year to name three notable market developments relevant to US-based high grade institutional liquidity portfolios.

The themes for 2023 are:

a) interest rates nearing an inflection point in the cycle

b) higher commodity prices, despite smoother supply chains

c) banks fending off higher consumer finance risks.

2022 proved to be a humbling experience for most market participants, including us on this call. We were on target regarding the timing of the Federal Reserve’s interest rate lift-off in March, but our forecast for a 0.75%-1.00% fed funds target range at year end was off the mark by a wide margin.

Our prediction that supply chain logjams would be less of a hinderance was partially correct. Large retailers, including Walmart, had to rid themselves of overstocked merchandise at bargain basement prices, while other firms such as Apple continued to face backlogs due to China’s zero-COVID restrictions.

We scored big on the environmental, social and governance (ESG) front, as several items we noted came through. The SEC unveiled its proposed rule changes and slapped the hands of a few asset managers for alleged greenwashing and misrepresentation in their funds. The Federal Reserve’s focus on climate-related risks on financial stability motivated six of the largest US banks to start assessing their exposure and risk management.

And while the FTX bankruptcy dominates news in the crypto realm these days, our warning on the systemic risk to money markets by stablecoins rang true by the crash and burn of the TerraUSD stablecoin in May. Since then, other stablecoins have received closer scrutiny on their investment makeups and holdings “attestation,” while voices on proper financial oversight grew louder.

Apparently, our biggest miss was Russia’s invasion of Ukraine and the resulting shortages and price surges in energy and commodities. Our excuse is that we are better at detecting trends impacting cash investment portfolios than military campaigns and geopolitics. Without further ado, here are our 2023 installment on rates, commodities prices, and bank health.

Interest Rates Near An Inflection Point

By Matthew Paniati, CFA

The Federal Reserve’s 50 basis-point hike at its December meeting marked the first downshift in its monetary tightening cycle. With the end of the hiking cycle now seemingly in sight, it makes sense for investors to add some duration to capture the positive impacts of cumulative tightening. However, it is our view that they should remain balanced amidst the risk that the Fed raises rates more than is currently expected.

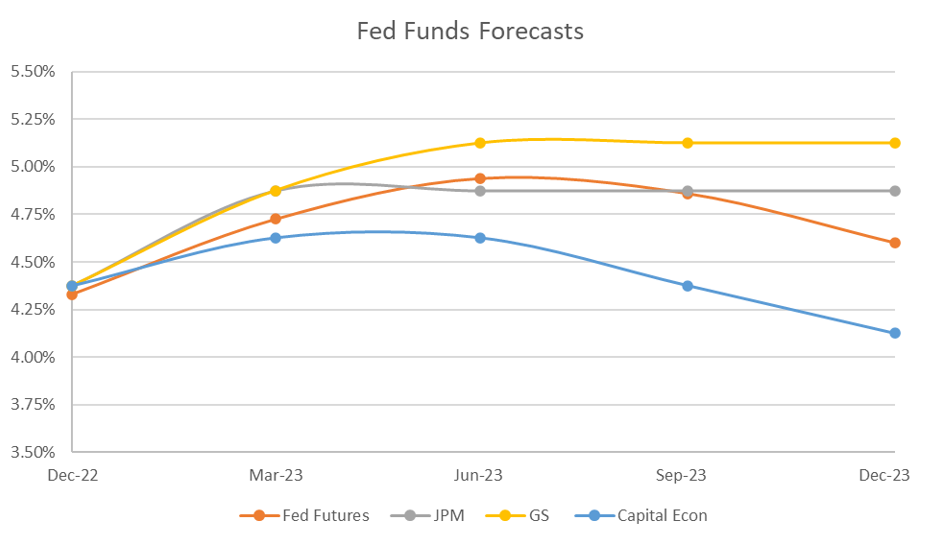

The fed funds futures market is projecting a terminal fed funds rate of 4.98% in June, followed by 50bps of cuts in the second half of the year. Private sector forecasts are in line with this, with most divergence erring to the downside.

Exhibit 1: Fed Funds Forecasts

Source: Bloomberg

The somewhat downbeat forecast is consistent with the economic outlook for 2023. The confluence of global monetary tightening and fiscal consolidation have acted to suppress global output. Inflation is showing downward momentum but remains elevated, in part due to the impact of dual energy and supply chain crises. Typical recession indicators are blaring red: the yield curve is deeply inverted, housing activity has ground to a halt, and consumer and business sentiment indicators have deteriorated.

In this context, it’s not hard to imagine a scenario in which the economy enters a recession while inflation is declining but well remains above target. Should this occur, the Fed will find itself in a tough spot, forced to choose between credibility on its inflation mandate or support for the job market. Fed Chair Powell’s comments suggest that inflation is remains the central bank’s priority but given the amount of political pressure and hardship that comes with rising unemployment, completely ruling out a reversal on this stance would be short-sighted.

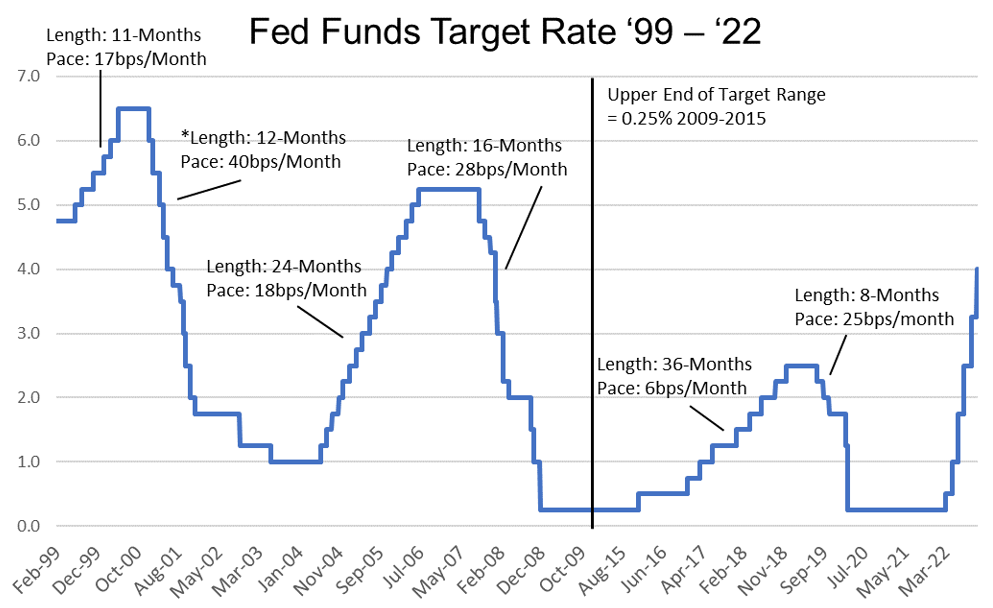

The Fed’s own history lends further credence to this point. Looking at past hiking cycles, the trend is that the Fed has needed to cut rates relatively soon after its tightening cycle ended. This makes sense intuitively if one pictures a framework that the Fed is operating like a pilot with faulty tools, who wants to err on the side of caution. It tends to overshoot its mark and is forced to course-correct to compensate for this.

Exhibit 2: Fed Funds Target Rate ’99- ’22

Source: Federal Reserve Board, Bloomberg

The risk for investors who take this view is one in which progress on inflation stalls. Should inflation remain entrenched, perhaps due to the combination of surging wage growth and weakening productivity, rates could go higher than the market or the Fed are currently projecting. A Taylor Rule would put the appropriate Fed funds rate in this scenario at north of 6%.

The long and short of it is this: elevated tail risk to rates in both directions. The central forecast makes sense as the baseline Fed policy; however, it’s possible that rates verge sharply higher or lower depending on how economic developments unfold. For investors, it makes sense to lock in some gains but remain flexible for the road ahead.

Higher Commodity Prices Despite Smoother Supply Chains

By Andrew Tong, CFA, and Alexander Goldman

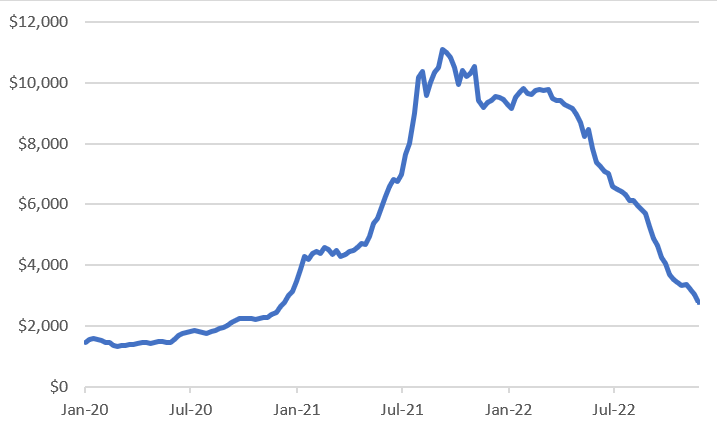

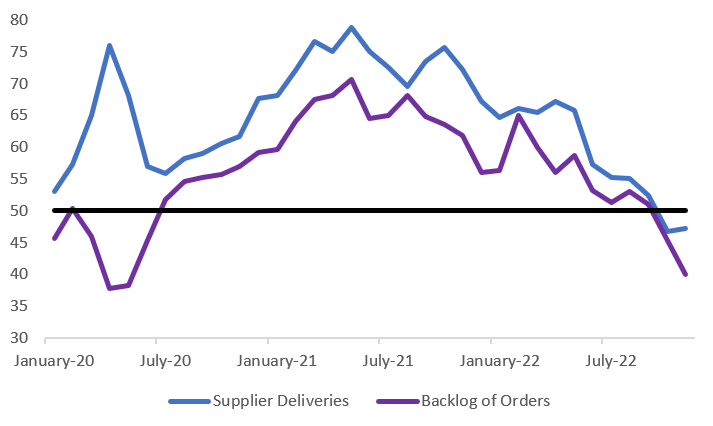

Supply chain bottlenecks were major headaches in 2021 and into 2022, with the invasion of Ukraine adding an additional hiccup in a potential recovery. The situation has since recovered remarkably, as shipping rates fell sharply from the spring of 2022, with the average market rate dropping roughly 77% from its peak, albeit still above pre-pandemic levels. Additionally, lead times have improved and backlogs have eased, indicating smoother operations. Slower global demand also helped normalize the supply-demand imbalance, as higher interest rates and persistently high inflation reduced consumer demand and relieved pressure on backlogs. These elements will continue into 2023 as central banks look to temper global demand.

Exhibit 3: Freightos Global

Source: Freightos Data, Bloomberg

Exhibit 4: ISM Manufacturing Indexes Show Signs of Easing Supply Chain Snarls

Source: Institute for Supply Management, Bloomberg

Note: A reading under 50 indicates contracting levels, while a reading above 50 indicates expansion

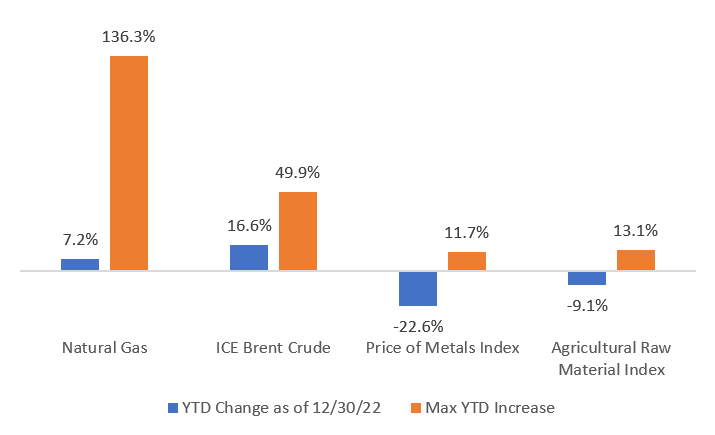

Upside risk for commodity prices—particularly oil and natural gas—looks poised to persist in 2023 as the conflict in Ukraine continues. Although shipping and freight costs have largely come under control, commodities have had a more uneven recovery. The conflict in Ukraine provided an additional supply shock which increased the price of energy, metals, and agricultural goods, of which Russia and Ukraine are major suppliers. Although prices for these goods, including Brent oil and natural gas, are broadly below peak and trending back to pre-war levels, there are some exceptions. Efforts by national governments to ease pressure through the release of oil reserves, price caps, and LNG imports to replace pipeline gas failed to counteract the effects from supply shocks. The shutdown of the Nord Stream 1 Pipeline kept Europe’s natural gas prices high due to its heavy reliance on Russia. Moreover, OPEC cut oil output by 2 million barrels on expectations of lower oil demand, sending oil prices even higher. The recent retreat in crude and natural gas prices may not last. Even if global oil demand falls in 2023, output cuts could put upward pressure on import costs, prompting margin pressure across industries. Disruptions to agricultural goods may also negatively impact food stocks, keeping prices high. In a nutshell, supply shocks and geopolitical tensions may keep energy prices as the most prominent source of commodity inflation in 2023.

Exhibit 5: Commodity Prices Peaked in 2022, but Energy Prices Remain Elevated

Source: Bloomberg, St. Louis Fed

Another area of interest linked to supply chains has been China’s ongoing “zero-COVID” policy. As other countries gradually opened their borders and loosened COVID restrictions, China was the last domino to fall on the path to a “new normal” when it ended draconian lockdowns to combat the spread of COVID-19 at the end of 2022. The zero-COVID policy had two main effects: a) supply constraints to manufacturing, limiting production; and b) depressed consumer spending, both of which hampered China’s economy. Following civil unrest, China began to roll back its restrictions in early December by ending most testing requirements, loosening quarantine policies, and reducing local governments’ ability to shut down regions of the country. The chaotic abandonment of COVID restrictions notwithstanding, the move could boost China’s economy in 2023 and reduce supply chain volatility, leading to smoother global supply chains. At the same time, a rebound in China could also increase global demand, driving commodity prices higher. Thus, the trajectory of China’s reopening could present a double-edged sword of better supply chain operations and worse commodities inflation.

Banks Fending Off Higher Consumer Finance Risks

By Pate Campbell

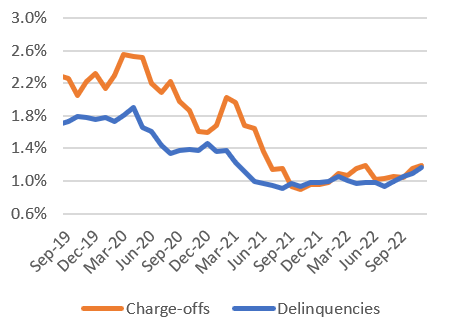

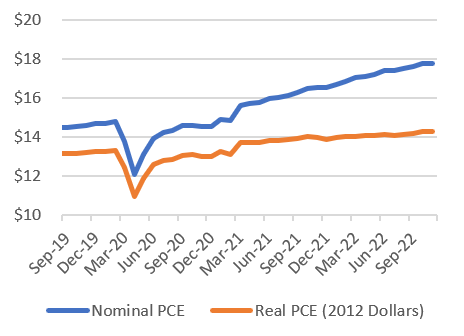

Entering 2022, benign markets and strong economic conditions had left consumer finances as strong as ever. As the year progressed, high inflation, tightening financial conditions and the lack of COVID-era consumer support measures slowly chipped away at household balance sheets, leaving consumers in a far more uncertain situation than a year prior. Nonetheless, consumers continued to spend and service their debt comfortably supported by a historically low 3.5% unemployment rate and an estimated $1.7T1 in excess savings as of Q2 2022. To this end, credit card delinquency and charge-off rates have remained low while real personal consumption expenditures have recovered to 2019 levels.

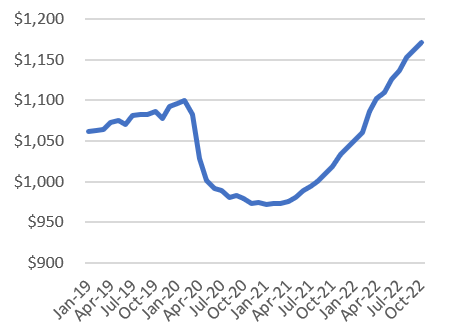

Exhibit 6: Credit Card Charge-offs & Delinquencies

Source: Credit Card Trust Reports, Simple Average of Trust Metrics Trusts Sampled: AMXCA, CHAIT, CCCIT, DCENT, BACCT

Exhibit 7: Personal Consumption Expenditures (T)

Source: FRED

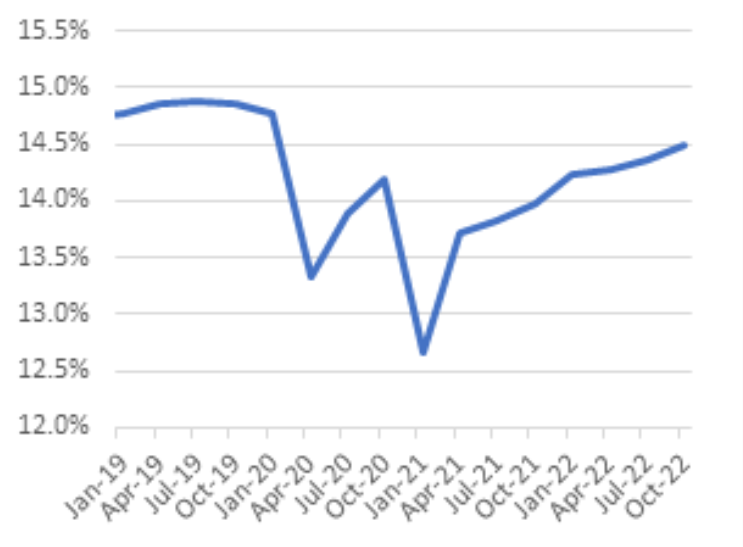

Looking forward, 2023 will not be as easy for consumers, as the pillars that helped shield household balance sheets—a strong labor market and excess savings—may be likely begin to erode. So far, the labor market has seemed mostly immune to rate hikes by the Federal Reserve; however, cooling the labor market has been a key objective in the Fed’s fight against inflation2. While the Fed may prefer to see lower job openings while keeping unemployment low, it projects the unemployment rate will rise to 4.6% by the end of 20233. Additionally, the burden of inflation is beginning to wither away households’ excess savings, which the Fed estimates peaked in Q3 2021 at roughly $2.3T, then fell to $1.7T in Q2 2022 and has likely fallen further since4. The financial pain will be particularly acute amongst those in the lower income cohorts. Households have already turned to borrowing to supplement spending, leading to a large uptick in outstanding revolving credit. While the personal savings rate has fallen to 2.4% as of November5 as higher prices have impaired consumers ability to build wealth. The current situation has caused a rise in the household financial obligations ratio to just under 2019 levels.

Exhibit 8: Household Financial Obligations as % of Disposable Income

Source: FRED

Exhibit 9: Outstanding Revolving Credit (B)

Source: Federal Reserve

As these pillars fall away, bank asset quality should begin to normalize from the extremely strong levels seen in the last two years. This pattern emerged in banks’ third quarter earnings, as net charge-offs at the five largest U.S. retail banks6 grew to $2.7B from $2.4B in the same quarter in 20217. While part of this increase can be attributed to strong loan growth over the prior year, bank CEOs have voiced more concerns about worsening consumer asset quality. A potential increase in the unemployment rate will likely expedite this trend in 20238. Moody’s expects credit card charge-offs to reach 2019 levels by mid-2023 and top out at 5% in 2024, vs 3.5% in 2019, and auto loan charge-offs to top out at 1.5% in 2024 vs 1.0% in 2019. The largest five U.S. retail banks are preparing for the more challenging outlook by booking a collective $2.3B of provisions for credit losses in Q3 2022, a trend that we expect to continue into 2023, positioning them well headed into the new year9.

Conclusion: Positioning Institutional Cash Portfolios for 2023

In the current volatile global political and economic environment, additional concerns will surely rise to the surface for managers of institutional liquidity portfolios. But a close focus early in the year on the course of interest rates, on commodity prices as supply chains continue to smooth out, and on how banks are responding to rising consumer debt will provide a strong foundation for managers positioning cash portfolios for a dynamic 2023.

What to watch for:

A. Interest rates nearing an inflection point

B. Higher commodity prices despite smoother supply chains

C. Banks fending off higher consumer finance risks

1Aditya Aladangady, David Cho, Laura Feiveson and Eugenio Pinto, “Excess Savings During The COVID-19 Pandemic”, October 21, 2022. https://www.federalreserve.gov/econres/notes/feds-notes/excess-savings-during-the-covid-19-pandemic-20221021.html

2Refer to Chair Powell’s speech “Inflation and the Labor Market” on November 30, 2022 at the Hutchins Center. https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm

3Refer to the Fed’s December Summary of Economic Projections. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20221214.pdf

4Aditya Aladangady, David Cho, Laura Feiveson and Eugenio Pinto, “Excess Savings During The COVID-19 Pandemic”, October 21, 2022. https://www.federalreserve.gov/econres/notes/feds-notes/excess-savings-during-the-covid-19-pandemic-20221021.html

5Refer to the Bureau of Economic Analysis’ Personal Income and Outlays October Release. https://www.bea.gov/news/2022/personal-income-and-outlays-november-2022

6Five Largest U.S. banks by retail deposits: JPMorgan, Bank of America, Citi, Wells Fargo, U.S. Bancorp

7Data pulled from company filings.

8“Mild 2023 Recession to Push Consumer Loan Charge-offs Above 2019 Levels; Peak in 2024” Moody’s Investor Service, November 30, 2022. https://www.moodys.com/research/Banks-US-consumer-loan-performance-monthly-update-Mild-2023-recession–PBC_1349927?token=Dbj7nKJaPvtyYFj6t5ry0mDBIHFN4esb&cid=Y08N0JE2XZC2681&mkt_tok=NzUwLVZQWC00NzEAAAGIbUhAqpYImTVv6X2xko0v-zZnw18VUQohNoOOajt_8woMrU8LSqqFNZKEPu1WkmFy6sFFXclurpEuhLf6SNAaVvtKEwzxsBkVBJLYzzW-Hdn6

9Data pulled from company filings.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.