The Fed’s Inflation Headache Continues

Given their aggressive efforts to tame price pressures over the past few quarters, Chair Powell and the Federal Reserve were likely to have been very disappointed by the release of August’s Consumer Price Index. Despite a 2.25% increase in the overnight lending rate over just four meetings, the reading came in higher than expected with headline inflation increasing 8.3% y-o-y. While CPI decelerated slightly compared to July’s 8.5% rate, it increased 0.1% from the previous month versus no change from June to July. Core (excluding food and energy) prices increased by 6.3% y-o-y, up from the July reading of 6.3%, and monthly, core consumer costs surged by 0.6%.

Recent Fed Commentary

Several Federal Reserve officials have recently signaled their continued commitment to a hawkish stance. Fed Vice Chair Lael Brainerd commented on CNBC that “we are in this for as long as it takes to get inflation down” and “we have expeditiously raised the policy rate to the peak of the previous cycle, and the policy rate will need to move further.” Governor Chris Wallace also revealed his intent to vote for a further “significant” interest rate increase this month, saying “this is a fight we cannot, and will not, walk away from.”

September 20th/21st FOMC Meeting

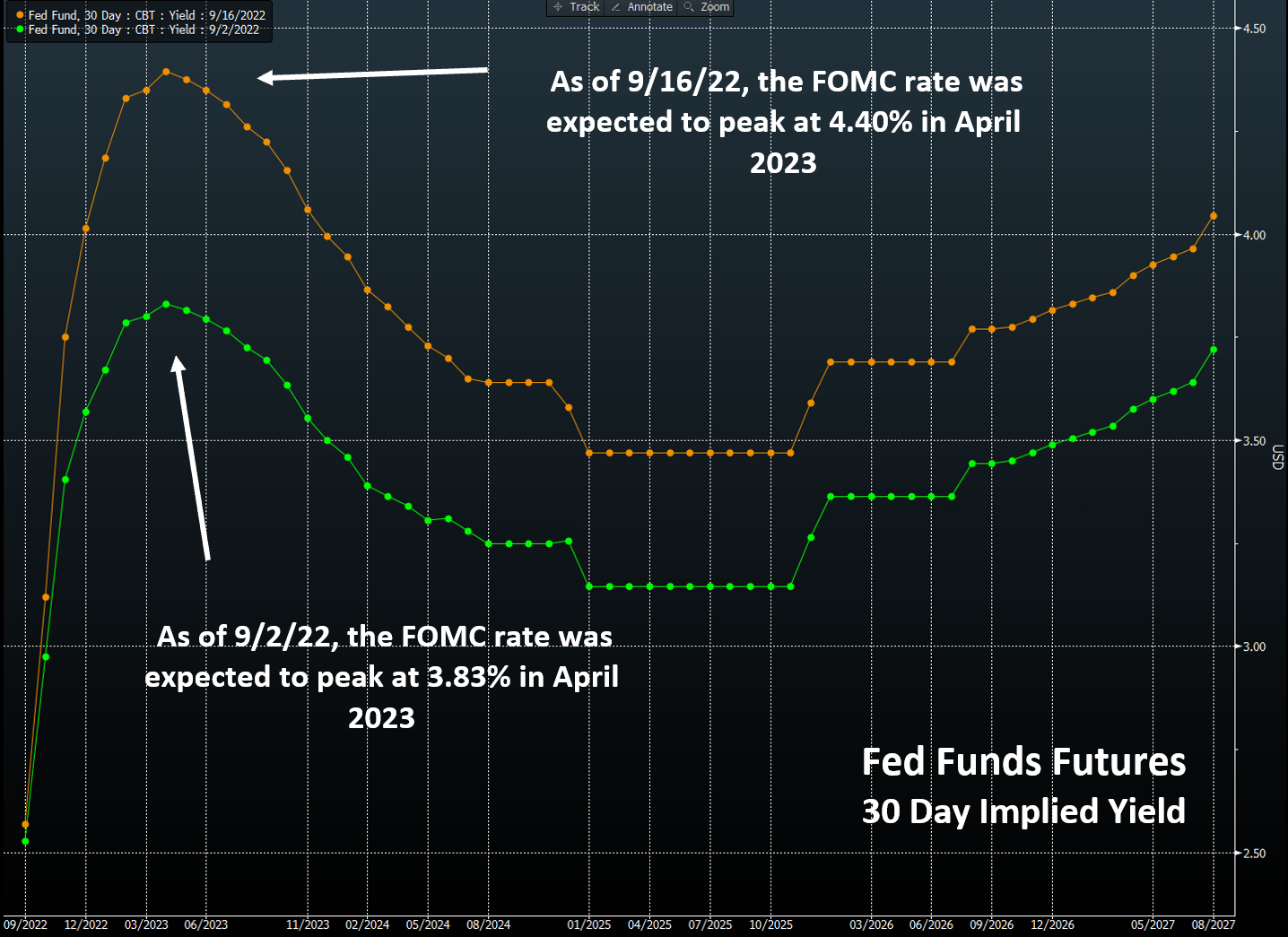

The Federal Reserve’s overnight target range is currently set at 2.25% to 2.50%, and the FOMC is expected to raise rates again when it meets this week on Wednesday. With the Fed in its pre-meeting blackout period and no major economic releases on the calendar before the meeting date, the market is betting that the Fed will hike rates by 75 basis points. Looking forward to the two final meetings of 2022, fed funds futures contracts are pricing in a further 75 basis point hike in early November and a hike of at least 25 basis points in mid-December, with 60% odds of a 50 basis point move at the year’s final meeting.

Investors are pricing in a 2023 peak rate of approximately 4.50%, and while futures contracts continue to suggest that the Fed could begin cutting rates as early as Q3 next year, the Fed has made no mention of any such plans. The FOMC is scheduled to release an updated ‘dot plot’ revealing each Fed official’s estimate of future interest rates in its Summary of Economic Projections following its meeting this week.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.