The Bottom Line of a Global Baseline for Sustainability Reporting

Market participants seeking guidance on what sustainability means for their business and how to implement something more than a working definition have led financial regulators and standard setters to start crafting sustainable reporting frameworks. While still in their infancy, they mark a significant step towards effectively integrating sustainability concerns into financial markets. Broadly speaking, these proposed and implemented rules are either issuer- or investor-focused. In addition to traditional financial data, issuer-focused frameworks delineate what sustainability measures an issuer needs to present. In contrast, investor-focused frameworks aim to make investors better disclose how sustainability data is incorporated in their investment process, and what constitutes their definition of sustainable investment. However, their development has not been linear, and there remains significant alignment work to be done. The IFRS Foundation, European Union and the U.S. Securities and Exchange Commission have been three of the most prominent bodies to formally propose and implement these frameworks. As they develop, cash investors will be able to reap the benefits of more transparent and standardized ESG data, ultimately leading to more efficient capital markets and improved downside risk mitigation.

The Issuer Issue

The primary issue facing consistent sustainability reporting is the question of how and what issuers should report. The Taskforce for Climate Related Financial Disclosures (TCFD), created by the Financial Stability Board in 2009, made the first and broadest attempt at setting reporting guidelines. TCFD has since been responsible for producing the Greenhouse Gas Protocols and a globally recognized reporting framework, broadly focusing on disclosure in four thematic areas: governance, strategy, risk management, and metrics & targets. This broad and well-established framework has seen some success in creating a global benchmark for sustainability reporting, including having regulators, such as Britain’s Financial Conduct Authority, implement rules that involve issuer-made, TCFD-aligned disclosures.

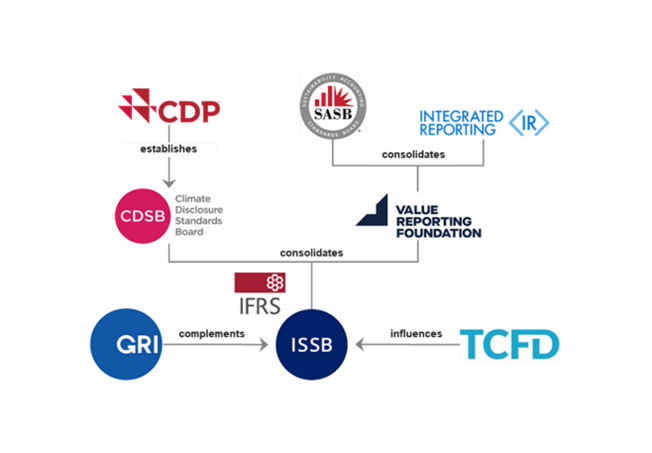

TCFD’s framework has been a jumping-off point for many other standard setters such as the IFRS Foundation’s International Sustainability Standards Board (ISSB). While not a regulator themselves, ISSB is aiming to create a global baseline of sustainability reporting which regulators can then choose to adopt. After being established at COP26, ISSB looked to quickly reconcile regional reporting standards by proposing two universal standards -the General Requirements for Disclosure of Sustainability-Related Financial Information and the Climate Related Disclosure. The General Requirements for Disclosure of Sustainability-Related Financial Information aims to encourage regulators to mandate issuers to report general sustainability material to their business models. Climate Related Disclosure, on the other hand, aims to promote specific guidance on climate disclosures within several different themes. ISSB is working to finalize these disclosure frameworks by the end of 2022, and the use of TCFD standards as a guide will make it easier for national regulators who have already adopted TCFD-aligned disclosure requirements to reconcile with this reporting framework.

Source: Kirkland & Ellis

Source: Kirkland & Ellis

Regulatory bodies in Europe and the U.S. have taken similar steps to define the sustainability topics and metrics that issuers need to report. The European Union’s Sustainable and Social Taxonomies classify what economic activities are sustainable or contribute to the Union’s social goals, respectively. The goal of these classifiers is to aid the transition to a more sustainable economy by removing the grey area surrounding ‘good’ and ‘bad’ activities, setting clear guidelines to mitigate greenwashing. This then increases the utility of information issuers currently report under the Non-Financial Reporting Directive (NFRD) and the soon to be implemented Corporate Sustainability Reporting Directive (CSRD). Both regulations require issuers to disclose how they mitigate environmental and social impacts. The CSRD is an expansion of the NFRD that increases the number of companies which fall under the regulation, introducing a more detailed level of required reporting and requiring an audit of the information.

The SEC has taken a similar step by proposing The Enhancement and Standardization of Climate-Related Disclosures for Investors. The public comment period ended on June 17, and the SEC has a planned phase-in date of January 1, 2023. If implemented as is, this rule would require companies with publicly traded securities to report information on climate risks likely to have a material impact on their operations, financial condition, or business, including scope 1 & 2 emissions for all companies and scope 3 emissions for the largest companies. Even as more jurisdictions begin to implement their own issuer focused reporting frameworks, there will be a migration towards a global baseline, allowing for greater compatibility and utility of sustainability related financial information.

The Investor Issue

On the other side of the sustainability coin, regulators have been proposing and implementing investor focused disclosure requirements to mitigate greenwashing within the investment community. Many critics of sustainable investing point out repeated instances of greenwashing which have occurred as asset managers have scrambled to meet rising demand for sustainable investment products. To combat this problem, the EU has begun to implement the Sustainable Finance Disclosure Regulation (SFDR), which requires investors to disclose how ESG considerations are integrated into investments, whether or not they are marketed as sustainable investments. The SFDR enhances transparency around what sustainability means for a given investment product, allowing for a better understanding of the methodology and performance of sustainability-related investments.

The SEC has proposed similar legislation targeting greenwashing in investment products. First is the ESG Disclosures for Investment Advisors and Investment Companies, which would require investment companies and advisors to disclose how they incorporate ESG considerations into sustainable investments. This regulation sets tiers for fund disclosure requirements based on the extent of ESG factor integration. By separating sustainability funds into Integration Funds, ESG-Focused Funds, and Impact Funds, the rules mitigate greenwashing by creating greater transparency into how ESG factors are integrated into the investment processes.

The SEC has also proposed amendments to the Fund Names Rule, extending the SEC’s ‘Names Rule’ to any fund whose name suggests it invests in assets with ESG or Sustainable criteria. It requires greater disclosure surrounding a fund’s name in the prospectus, and restrict use of the term ‘ESG’ to funds that consider ESG factors over traditional financial factors. A significant result of the extension would be to ensure that funds labeled ‘ESG’ invest at least 80% of their assets in accordance with the fund’s ESG investment process, helping to address greenwashing concerns common with ESG funds. The SEC is currently reviewing public comments on both these proposals.

Toward a Global Sustainability Reporting Baseline

Sustainability-related disclosures currently lack the scope, specificity, and uniformity which is taken for granted in traditional financial reporting. The resulting variances in issuer disclosures and inconsistent investor practices create a market more akin to the wild west. However, standard-setters and regulators worldwide are beginning to creep toward a global baseline for issuer- and investor-focused sustainability disclosures. As this crawl continues, sustainable investment factors will continue to provide greater and more consistent insight into investments, improving downside risk mitigation and asset owners’ understanding of their portfolio. Even though full global uniformity may never come, these steps further integrate sustainability factors into financial markets, making them increasingly integral to any investor’s decisions.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.