The Billion-Dollar Deportation Dilemma: Cutting Jobs to “Save” Jobs?

As President Trump’s administration kicks off its second term, one of its most contentious executive orders—the mass deportation of undocumented immigrants—is already stirring debate. The policy is primarily aimed at widening enforcement of immigration laws, which could have a seismic impact on U.S. macroeconomic conditions. In this blog, we will dissect how the deportation policy might impact labor markets, GDP, inflation, as well as its implications on short-term credits.

Deportation Policy in a Nutshell

Trump’s new executive actions aim to “protect the American people against invasion”[1] by aggressively enforcing immigration laws. This includes[2]:

- Expanding expedited removal to deport immigrants without a court hearing if they’ve been in the country for less than two years.

- Requiring all noncitizens to register and be fingerprinted.

- Revoking work permits for those without full legal status.

- Mobilizing local law enforcement, federal agents and, if necessary, the military to support border and interior operations.

While these measures may be meant to secure borders and reduce illegal immigration, they also signal the start of a mass deportation regime that, by some estimates, could target 11 million people—plus an additional 2.3 million recent arrivals[3].

Macroeconomic Ripples

Labor Markets Contraction & GDP Downturn

The removal of millions of undocumented immigrants—who, as the end of 2022, made up nearly 23.8% of the immigrant workforce—poses a threat to several industries[4]. According to Pew Research, the sectors with the highest share of unauthorized immigrant workers are construction (13%), agriculture (12%), and hospitality (7%).[5] These sectors could face a destabilizing paradox. Depending on the concentration and extent of deportation, employers in these industries may have to scramble to fill gaps by offering higher wages to domestic workers. While higher wages may boost household balance sheets and domestic purchasing power for some, it may also create a wage spiral that translates into upward pressure on consumer prices while simultaneously slowing overall output. As cost rises and consumer demand weakens, overall output may slow down further, intensifying labor shortages and perpetuating the cycle.

Here’s a scenario of how this cycle could play out: higher paychecks for farm workers inflate grocery bills; steeper wages for hotel staff drive up travel costs; pricier construction labor balloons housing prices. As cost rises and consumer demand weakens, overall output could slow down further, intensifying labor shortages and perpetuating the cycle.

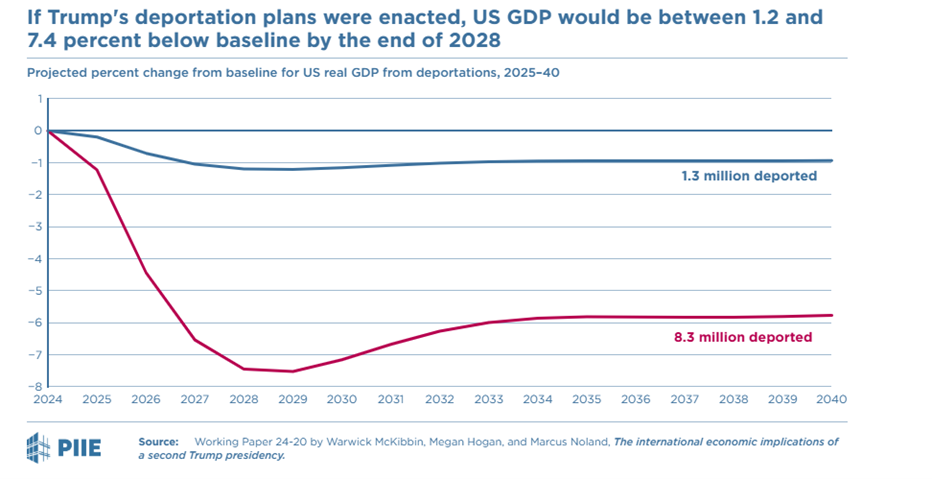

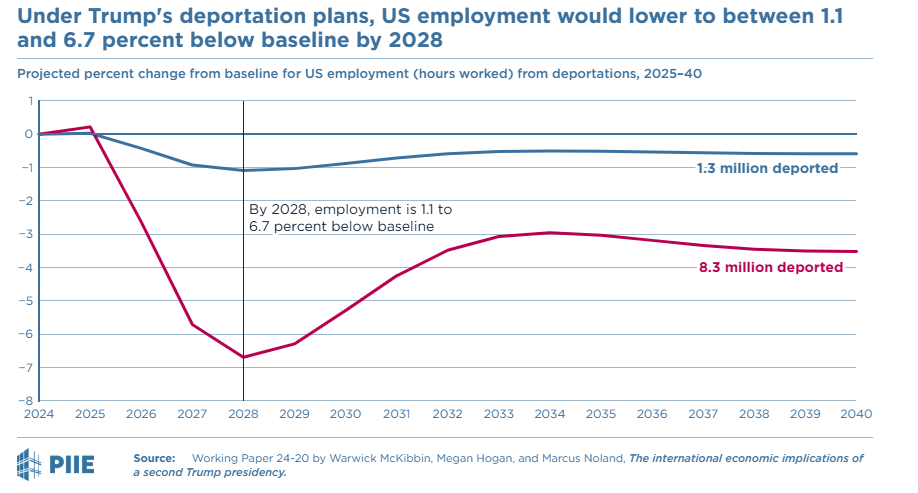

Estimates from the Peterson Institute for International Economics suggest that even a “low” deportation scenario (removing 1.3 million people) might reduce GDP growth by around 1.2% and cut employment by 1.1% relative to a 2028 baseline, whereas a more aggressive scenario (8.3 million deportations) could reduce GDP by 7.4% and employment by 6.7%—figures that paint a grim picture for economic expansion[6].

Exhibit 1: Projected GDP Impact — Trump’s Deportation Policy Could Lower U.S. GDP by 1.2 to 7.4 Percent Below Baseline by 2028

Source: Peterson Institute for International Economics, Working Paper by Warwick McKibbin, Morgan Hogan, and Marcus Noland

Exhibit 2: Projected Labor Market Impact — Trump’s Deportation Policy Could Reduce U.S. Employment by 1.1 to 6.7 Percent Below Baseline by 2028

Source: Peterson Institute for International Economics, Working Paper by Warwick McKibbin, Morgan Hogan, and Marcus Noland

Stagflation’s Double-Edged Sword

This wage-driven inflation could collide head-on with a parallel crisis: demand destruction[7]. Removing millions of workers doesn’t just shrink the labor pool—it can also reduce spending. Undocumented immigrants aren’t just laborers; they’re renters, grocery shoppers, and small-business patrons. Their sudden absence would leave vacant apartments, unsold goods, and shuttered mom-and-pop stores in communities like Houston, Miami, and Los Angeles. The result? A toxic imbalance where prices soar in immigrant-dependent sectors even as overall consumer spending contracts.

For the Federal Reserve, this duality may create a policy straitjacket. Raising interest rates to cool inflation could further stifle demand, deepening economic stagnation. Lowering rates to stimulate spending risks turbocharging prices in already-volatile sectors. Businesses, meanwhile, may face a lose-lose calculus: absorb unsustainable labor costs or risk alienating price-sensitive consumers. In essence, the economy may get squeezed from both sides.

Short-Term Credit Implications: Cash Flow and Capital at Risk

Corporate Liquidity Squeeze

Industries like construction and agriculture, already operating on razor-thin margins, face potential strain. Soaring labor costs could slash profits, impairing debt repayment and freezing expansion plans. Lenders, sensing turbulence, may tighten underwriting standards or pull back from segments of the market altogether. Meanwhile, heightened government borrowing for enforcement could put upwards pressure on interest rates, “crowding-out” more productive private sector investment.

Lessons from Trump’s First Term

During his first term, President Trump made bold promises to build a “deportation force” capable of expelling 11 million unauthorized immigrants[8]. In practice, however, interior enforcement fell well short of those pledges, hampered by sanctuary policies and COVID-19. Yet even this limited crackdown may have contributed to post-pandemic labor shortages, which Fed Chair Jerome Powell linked to 1.5 million missing workers and inflationary wage spikes[9].

Today’s policy environment is starkly different: pandemic constraints have lifted, and the new Trump administration is mobilizing unprecedented enforcement tools. If Trump’s second-term deportation policy is fully enforced, its economic consequences could be more pronounced than in his first term.

Conclusion: A Policy That Redefines the Economic Landscape

The Trump administration’s deportation policy isn’t just a border issue; it’s one with significant economic implications. Immediate labor shortages, inflationary volatility, and credit market tremors could derail growth, while long-term losses in innovation and productivity loom.

Yet, several questions remain:

- Can the government deport the number of people the Trump administration has targeted? Early signs suggest there are a few barriers to mass deportations on the scale President Trump has described, namely staffing, detention capacity, and court backlogs. Recent updates show that ICE is currently arresting between 600 and1100 people per day[10], which is between 2 to 3 times the pace seen in President Biden’s last year in office.

- Can domestic hiring and productivity enhancements eventually offset the initial labor shock?

- How will local and state governments adapt to declining tax revenues and higher public service costs in immigrant-heavy regions?

- Will tighter credit conditions and elevated risk premiums persist, or will market adjustments restore stability over time?

While immigration enforcement is often framed as a security issue, its economic implications can be profound. As the debate unfolds, policymakers, businesses, and financial markets will be forced to navigate one of the most consequential shifts in U.S. labor policy in modern history.

[1] https://abcnews.go.com/US/trumps-immigration-border-executive-actions/story?id=117887828

[2] https://www.whitehouse.gov/presidential-actions/2025/01/protecting-the-american-people-against-invasion/

[3] https://www.americanimmigrationcouncil.org/research/mass-deportation

[4] https://www.americanimmigrationcouncil.org/research/mass-deportation

[5] https://www.pewresearch.org/short-reads/2024/10/21/most-us-voters-say-immigrants-no-matter-their-legal-status-mostly-take-jobs-citizens-dont-want/

[6] https://www.piie.com/blogs/realtime-economics/2024/mass-deportations-would-harm-us-economy

[7] https://www.youtube.com/watch?v=ZZj6sYL7Pyg

[8] https://www.congress.gov/congressional-record/volume-164/issue-29/senate-section/article/S930-5

[9] https://www.forbes.com/sites/stuartanderson/2022/12/05/fed-chair-finds-trump-era-immigration-policies-still-harm-economy/

[10] https://www.axios.com/2025/02/13/trump-immigration-deportation-obstacles

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.