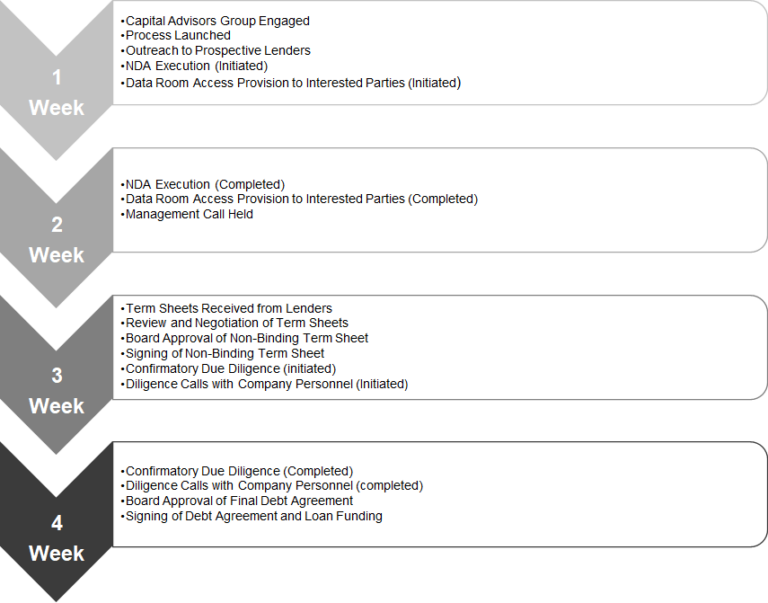

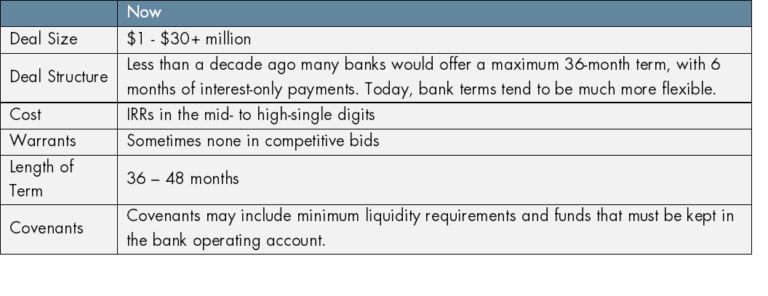

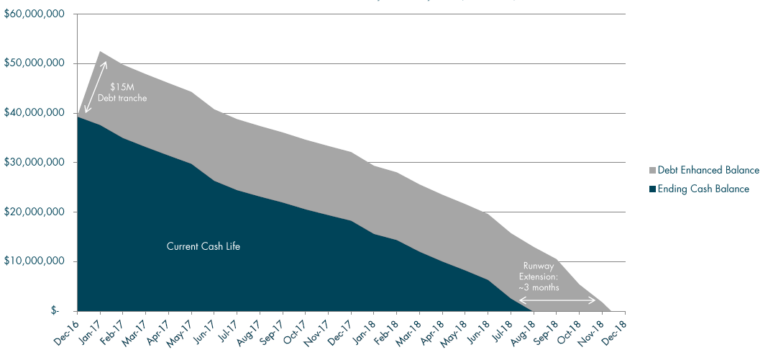

Debt Market Quarterly Update

3 min readAuthor’s Note Since compiling the data for our Q4 2022 debt market quarterly update, the market has faced unprecedented turmoil led by the collapse of Silicon Valley Bank. In order to provide consistent updates on the debt financing market, we are distributing our Q4 2022 report but also want to provide context on the current…