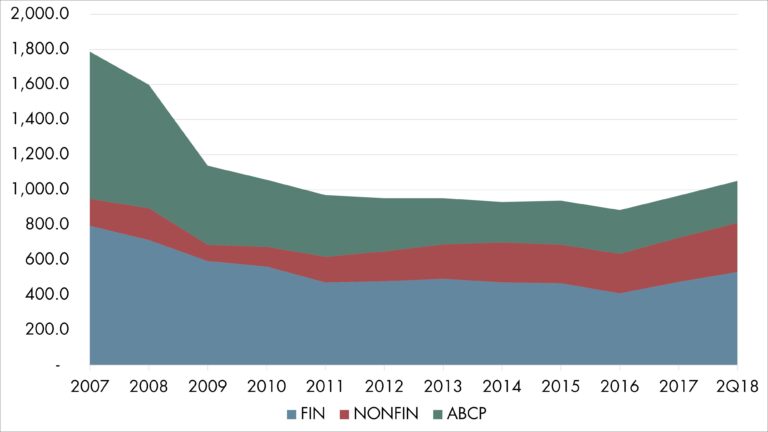

A Decade of the Commercial Paper Market and Its Role in Institutional Liquidity Portfolios

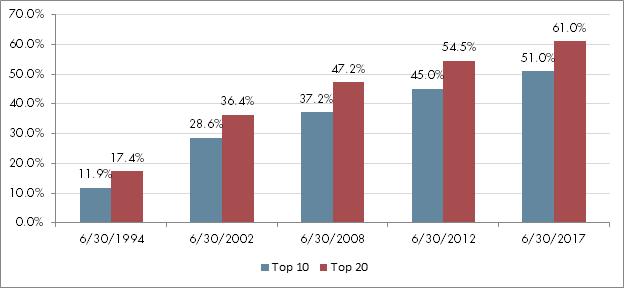

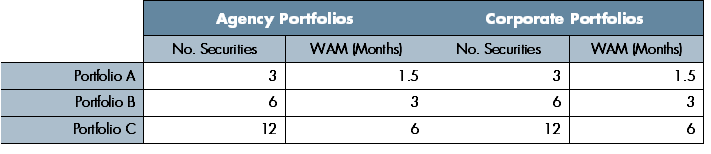

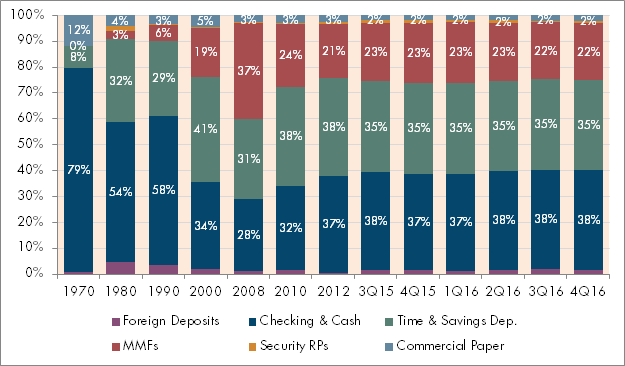

13 min readAbstract Many liquidity investors came to know commercial paper (CP) through holdings in prime money market funds (MMFs). We notice higher interest in direct CP investing since the 2016 MMF reform. This paper provides an overview of the market over the last decade and evaluates financial vs. non-financial, U.S. vs. foreign, and Tier 1 vs….