After Three Rate Cuts Since July, What’s the Fed’s Next Move?

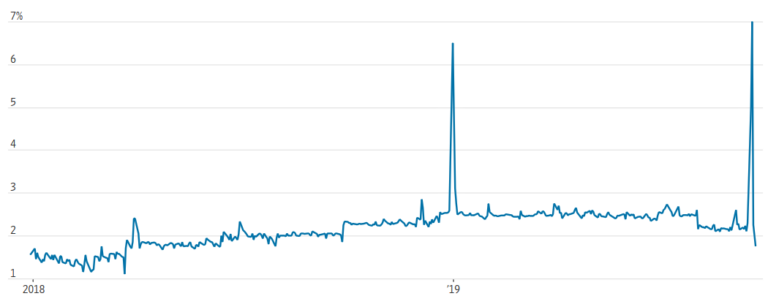

4 min readIn a move that surprised no one, the Federal Open Market Committee (FOMC) cut rates by 25 basis points at its October meeting, the third cut in as many months. The current Federal Funds rate range now lies at 1.50%-1.75%, still relatively high compared to short-term rates in other G8 economies and still well off…