Will There Be a Renaissance for Prime Money Market Funds?

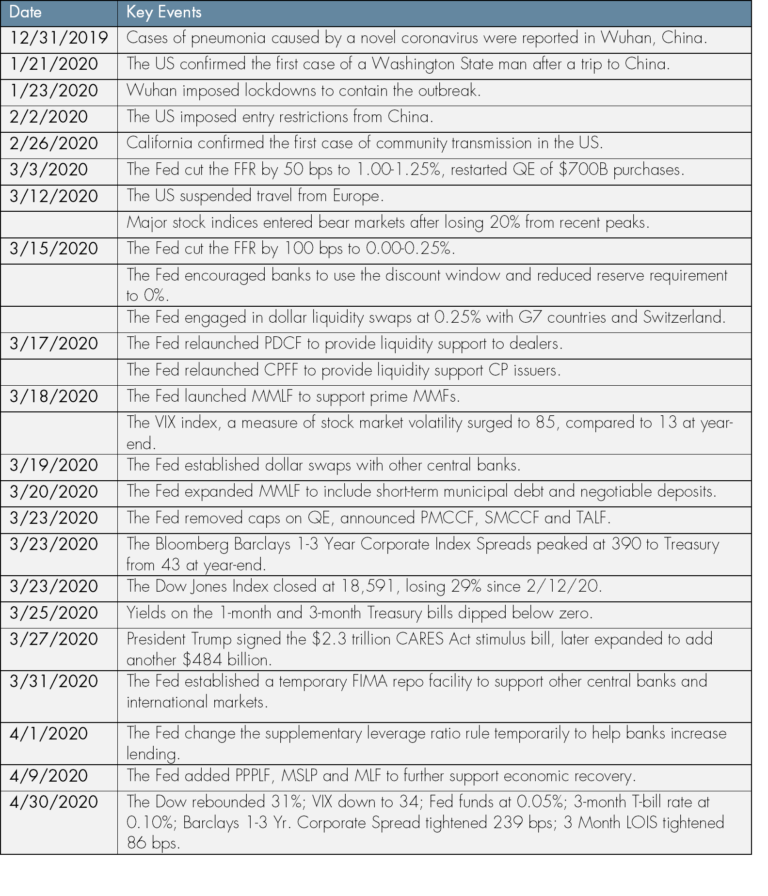

13 min readAs the market’s attention was drawn to the war in Ukraine, supply chain disruptions, runaway inflation, and higher interest rates, a significant deadline quietly passed. April 11 marked the end of the comment period for the new round of money market fund (MMF) reforms proposed by the Securities and Exchange Commission (SEC). As the Fed…