Interest Rate Outlook: Coronavirus

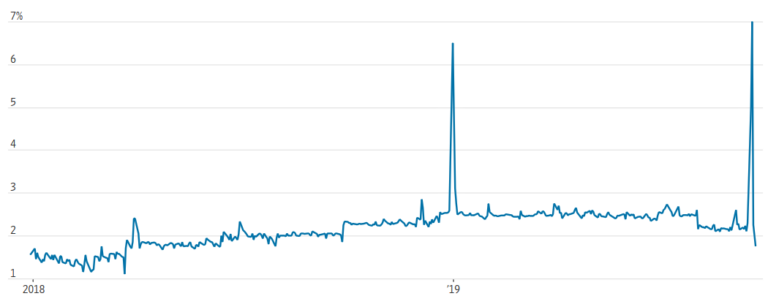

2 min readCoronavirus While domestic economic growth began the year on solid footing, the worldwide spread of the coronavirus along with its effects on global supply chains and potential effects on aggregate demand are likely to dominate financial market movements through springtime. U.S. equity markets sank 15% last week in the fastest ever return to correction territory…