How to Navigate COVID-19 Credit and Interest Rate Risks

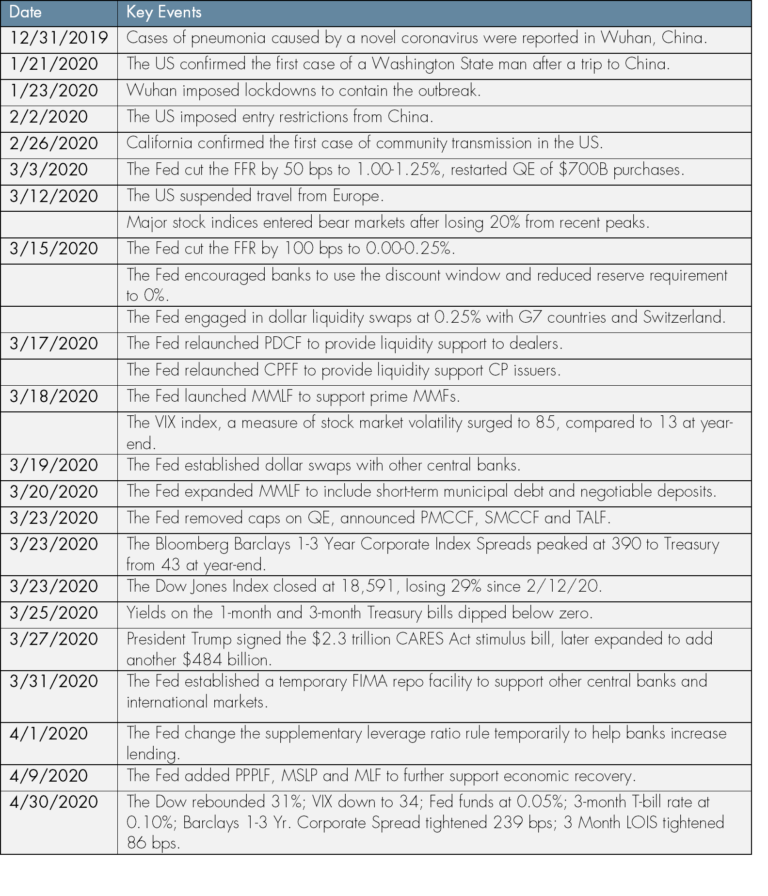

2 min readTrillions of dollars of support from the Fed have helped keep financial markets open. Trillions more from Congress are supporting consumers. But what will the next phase of the COVID-19 crisis bring? And what does it mean for institutional cash managers? You can find many of the answers in our latest research report, Institutional Cash…