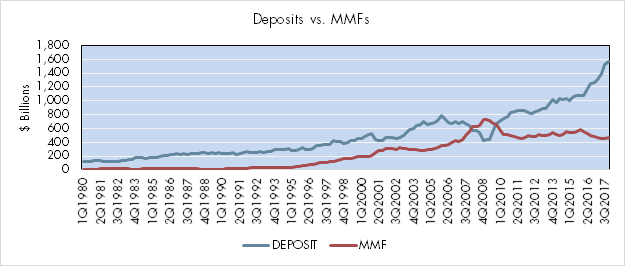

Deposit Betas Rising but Still Falling Short

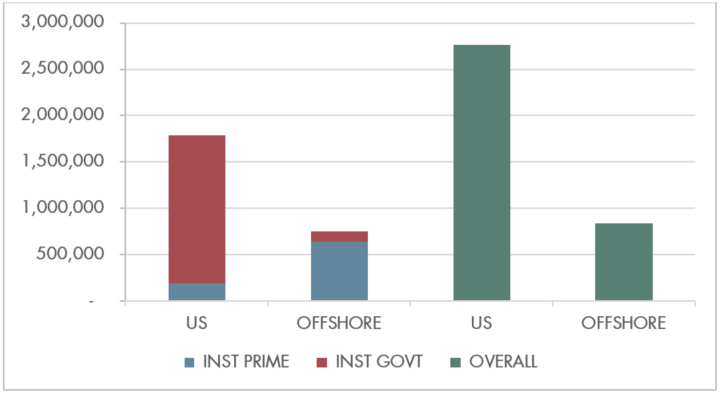

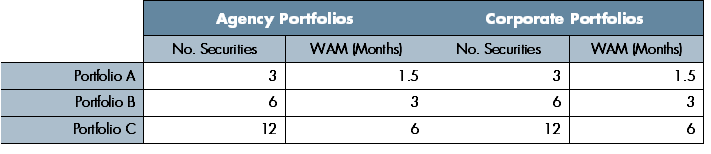

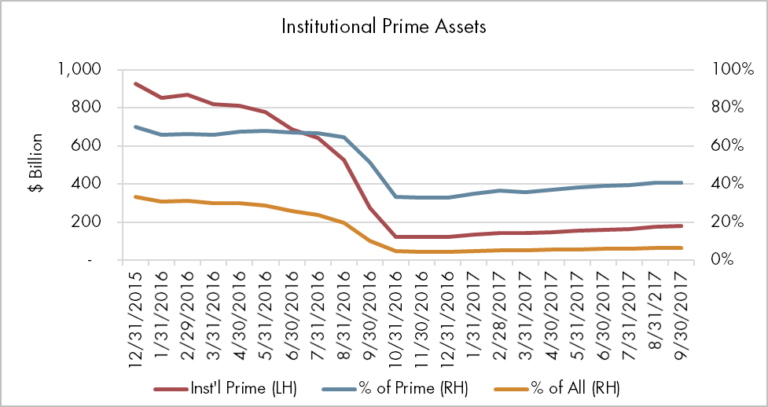

9 min readAbstract Deposit rates are starting to increase as we move further into a rising rate environment. Banks still have not rewarded depositors sufficiently with a 21% average deposit beta, although some executives expressed moving it above 50%. The wait for higher rates continues unless depositors are willing to consider market-based instruments. There, several options exist…