Do BBB Corporate Bonds Belong in Treasury Management Portfolios?

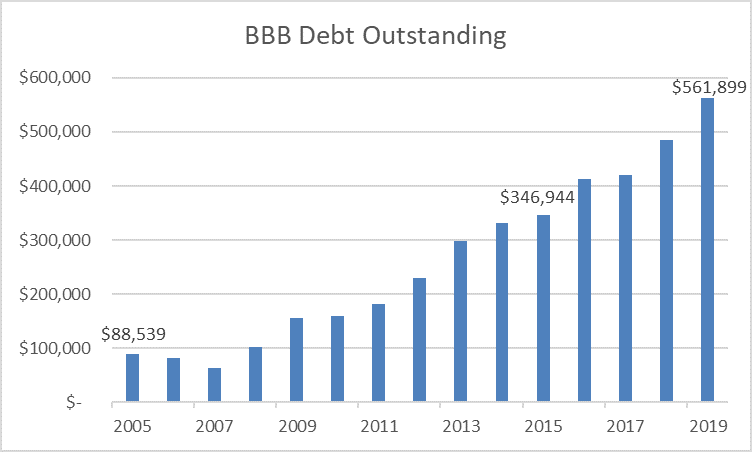

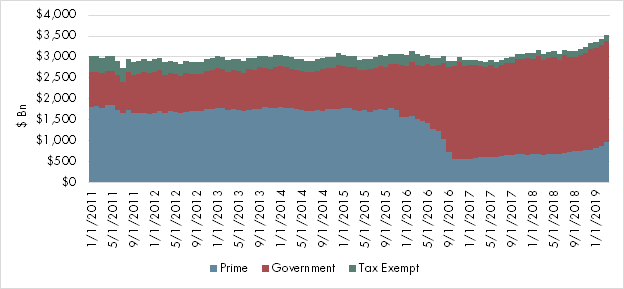

13 min readCo-authored by: Matthew Paniati, CFA® DOWNLOAD FULL REPORT Abstract BBB-rated debt continues to offer new possibilities for cash investors. Though it involves taking on incremental credit risk, allowing the purchase of these securities may help alleviate supply shortages while also offering additional return opportunities. Should investors investigate adding BBB names to their portfolios, we recommend…