2020 Vision – Watch the Fed, Repos and ESG Investing

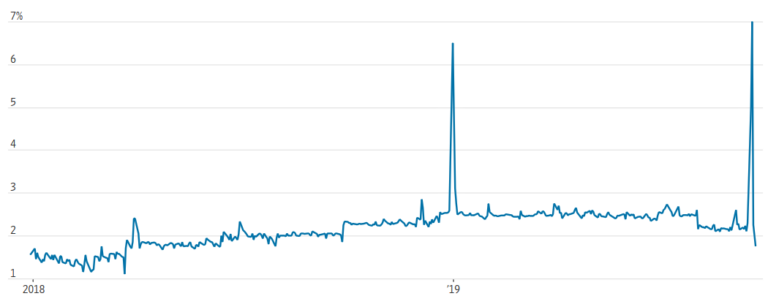

14 min readDOWNLOAD FULL REPORT Abstract We identify three themes to watch for cash investors each year. For 2020, we comment on the Fed’s neutral stance, the continued non-solution for repo market liquidity, and the popularity of ESG (environmental, social and governance) investing. Introduction At the start of each year, we typically name three broad themes that…