Strikes – Potential Impacts to Credit and Labor

What effects have the labor strikes had on credit markets and how may the Fed’s tightening cycles create further impact?

Introduction

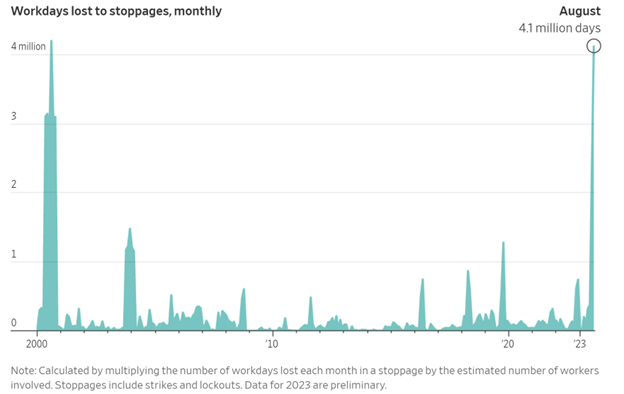

The U.S. lost 4.1 million days of work to strikes in August, the most in 23 years. The end to the Writers’ strikes brought this figure down to 3.6 million in September, but 33,000 United Auto Workers (UAW) members remain on strike, as do many actors who are in the Screen Actors Guild. While these strikes have taken the recent spotlight, narrowly avoided strikes of 300,000 UPS workers last August and the unionization efforts at two Amazon warehouses in 2022 are not ancient history. The recent strikes and efforts point to a clear trend across sectors of workers demanding better wages and rights, which may have long-term implications on credit.

Source: Labor Department, Wall Street Journal

The Catalysts

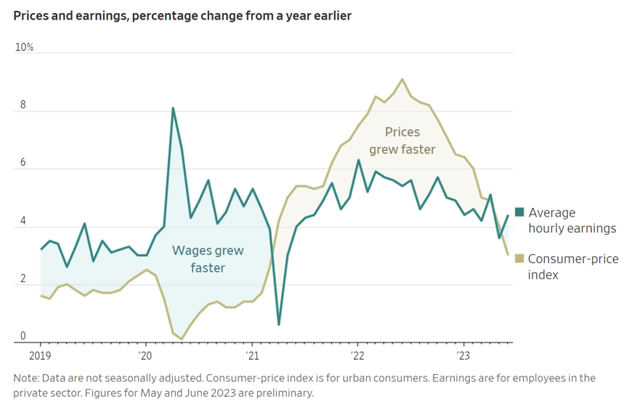

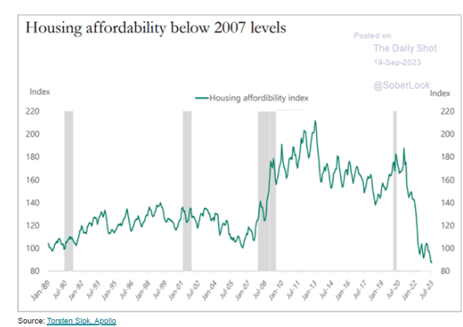

A tight labor market and decades-high inflation following initial pandemic lockdowns were the likely catalysts for the recent increase in labor action. In the last few years, historically low unemployment and labor force participation rates increased the bargaining power of workers, as evidenced by stronger wage growth and “The Great Resignation.” However, these wage increases failed to outpace inflation for roughly two years, while corporate profits reached record levels during the same period. At the same time, housing affordability reached its lowest levels due to pandemic supply constraints and a sharp rise in mortgage rates. In short, a workforce disgruntled with inflation found themselves in a unique bargaining position due to labor shortages, which led to demands for better wages and working conditions.

Source: Bureau of Labor Statistics, St Louis Fed, Wall Street Journal

Source: The Daily Shot

Potential Impacts on Credit

To date, the impact of strikes has been largely confined without significant impacts to the broader economy or credit markets. A prolonged UAW strike, however, could change that, as the auto industry accounts for around 3% of GDP.1 While higher pay is a universal demand, other implications tend to be industry-specific, partially responding to varying threats to job security. The Hollywood writers’ strike, for example, sought higher residuals and prohibitions on generative AI in response to the rise of streaming. The UAW, on the other hand, is seeking pay raises and lower hours in response to the transition to EVs, which is putting pressure on jobs related to gas powered vehicles. However, the potential impact of generative AI could be a catalyst for broader worker action in the future, including white collar industries for which collective action has been rare.

The rise in worker action suggests an increasing risk that businesses will face higher labor costs, which would likely translate to higher prices in goods and services to offset this. The impact on credit is highly uncertain. On the one hand, if consumers see higher purchasing power due to wage increases, this could prove a tailwind to economic growth, allowing earnings to grow even if operating margins are pinched due to higher overall revenues. Large corporations would be better equipped to deal with rising costs and higher prices, which may support credit quality. On the other hand, small businesses, which make up over 40% of the US economy2, may also face higher labor costs to compete with larger corporations. They would likely have a more difficult time passing on costs to the consumer which could translate to higher unemployment and headwinds to growth. It would also certainly lead to structurally higher inflation which could lead to central bank tightening. Ultimately, the impact of current strikes will likely take years to fully play out.

Risks of Structurally Smaller Labor Force

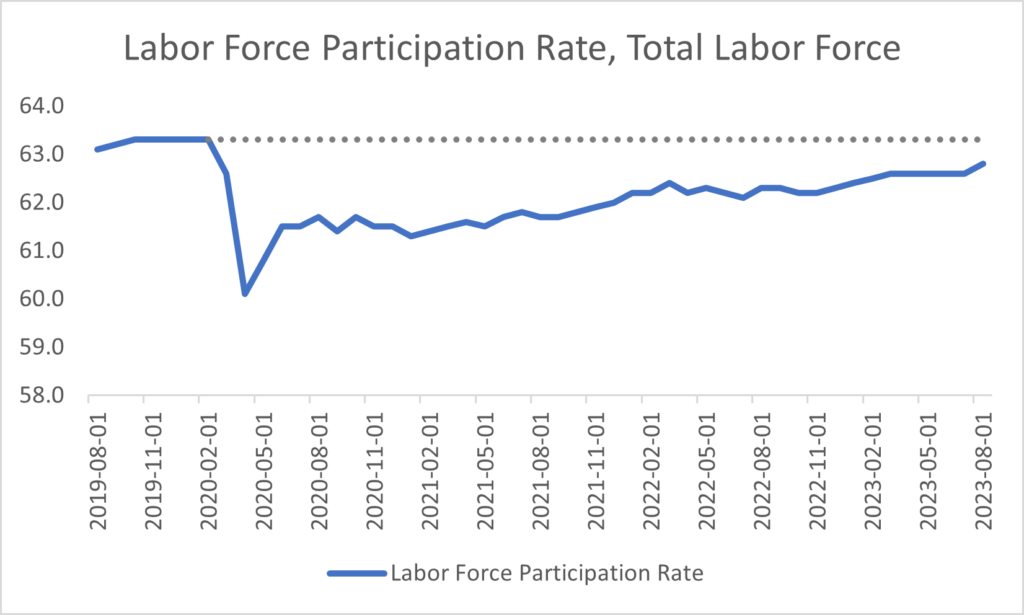

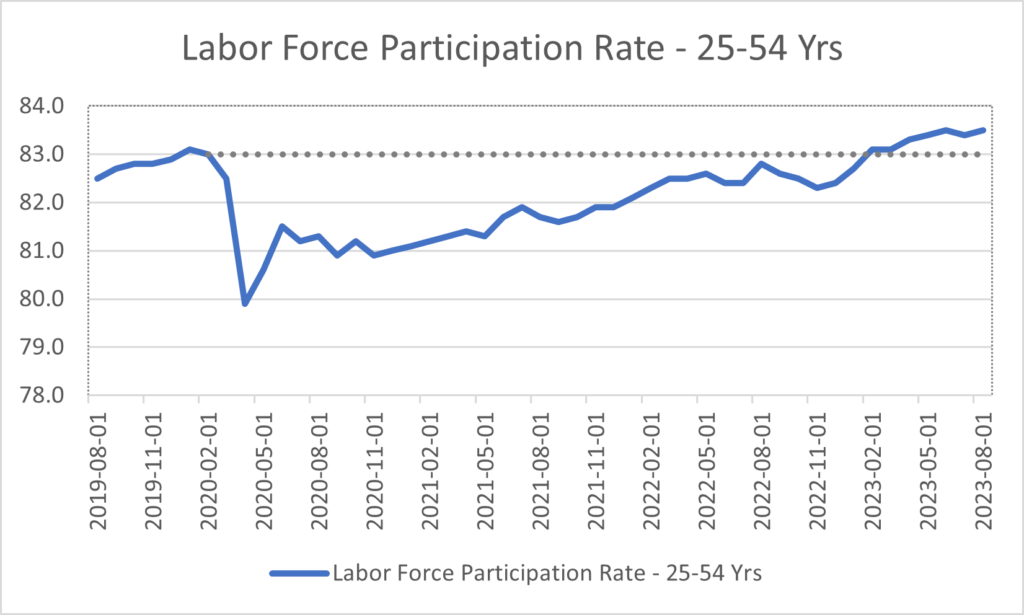

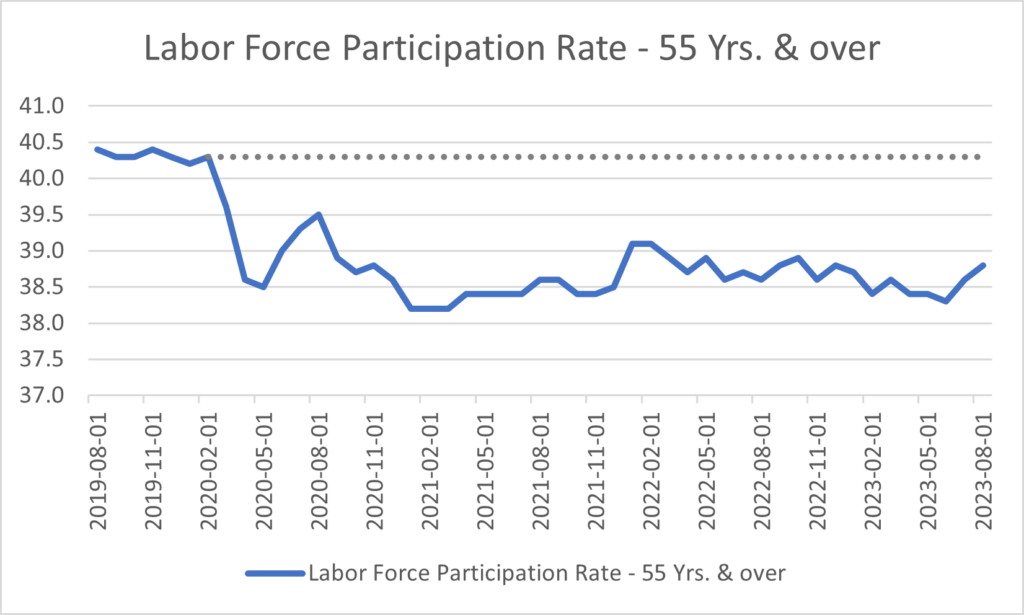

Two trends suggest that tightness in the labor market may continue, as could higher labor costs. First, the labor force participation rate, which has steadily increased since plummeting in April 2020, has yet to reach its pre-pandemic levels. Tightening economic conditions has brought back prime-age workers, but the participation rate of Americans 55 years and older has yet to recover, suggesting many Americans took an early retirement and will likely not return. Combined with an aging work force and decreasing birth rates, this suggests the labor force could be structurally smaller in the future without an influx of immigration or a boom in population growth. This, all else equal, would increase the bargaining power of workers and increase the likelihood of higher wage growth and possibly productivity disruptions if collective action becomes more common.

Source: Bureau of Labor Statistics

Additionally, the increasing prevalence of nearshoring in response to pandemic supply shocks as well as rising geopolitical tensions, may further reduce the global available work force. The Inflation Reduction Act and CHIPS Act both demonstrate the push to increase domestic manufacturing. This may lead to upward wage pressures and structurally higher costs, as comparatively higher wage costs could face further upward pressure due to a reduction in the available global workforce.

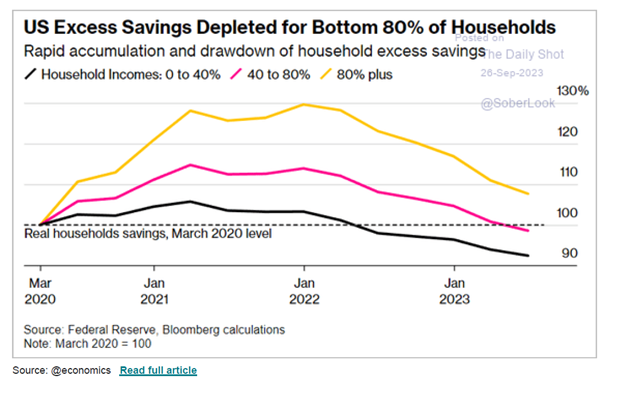

Tightening Credit Markets Threaten Strike Momentum

That being said, the impact of tightening credit by the Federal Reserve may prove a headwind to the current momentum, particularly in the short-term. This pressure is best evidenced by the steady decline in the quits rate coinciding with the Fed’s tightening cycle, with wage growth cooling as well. Similarly, the unemployment rate has remained low, but ticked up in August and is widely forecasted to rise further next year. Moreover, Bloomberg calculates that excess savings—previously touted as a key driver of recent economic expansion—has run out for all but the top quintile of Americans. These signals suggest many Americans are losing the cushions that precipitated the rise in worker action and could limit future activity, but to what magnitude is highly uncertain.

Source: The Daily Shot

Something for Cash Investors to Keep in Mind

The current large-scale strikes have had limited impact on US credit markets so far. While this trend could continue in the future, headwinds from the Fed’s tightening cycle may mitigate pressure on wages and worker leverage. Cash investors, therefore, likely need not be too concerned. However, going forward, an evolving labor market could put pressure on corporations if businesses cannot adequately adapt, such as through price increases or increased capital investment to boost productivity.

1https://www.nytimes.com/2023/09/20/opinion/uaw-strike-economy-biden.html

2https://advocacy.sba.gov/2019/01/30/small-businesses-generate-44-percent-of-u-s-economic-activity/

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.