Steel and Aluminum Tariffs Test Consumers’ Mettle

In the latest of President Trump’s proposed tariffs, the White House announced plans to impose a 25% tariff on steel and aluminum imports, effective March 12th, 2025. This is not the first time that Trump has imposed tariffs on these metals: in 2018 Trump imposed a 25% tariff on steel and a 10% tariff on aluminum, but made a number of temporary exemptions for certain countries.[1] In this second round, the aluminum tariff has increased by 15% and no exemptions have been provided, suggesting the new tariffs could have a more significant impact. The implementation of these tariffs will likely add to cost inflation, testing the resilience of the consumer.

Not all Metals are Imported Equal

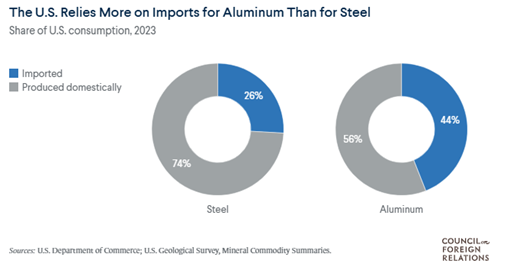

While the tariffs on steel and aluminum have been lumped together, there are some differences to note. According to the Council on Foreign Relations, 74% of US steel consumption was met by domestic supply in 2023, compared to 56% of domestic aluminum.[2] Moreover, domestic producers of steel have greater ability to increase output to meet greater demand. Currently, steel producers are only operating at around 70% capacity,[3] compared to around 90% for aluminum.[4]

Source: Council on Foreign Relations

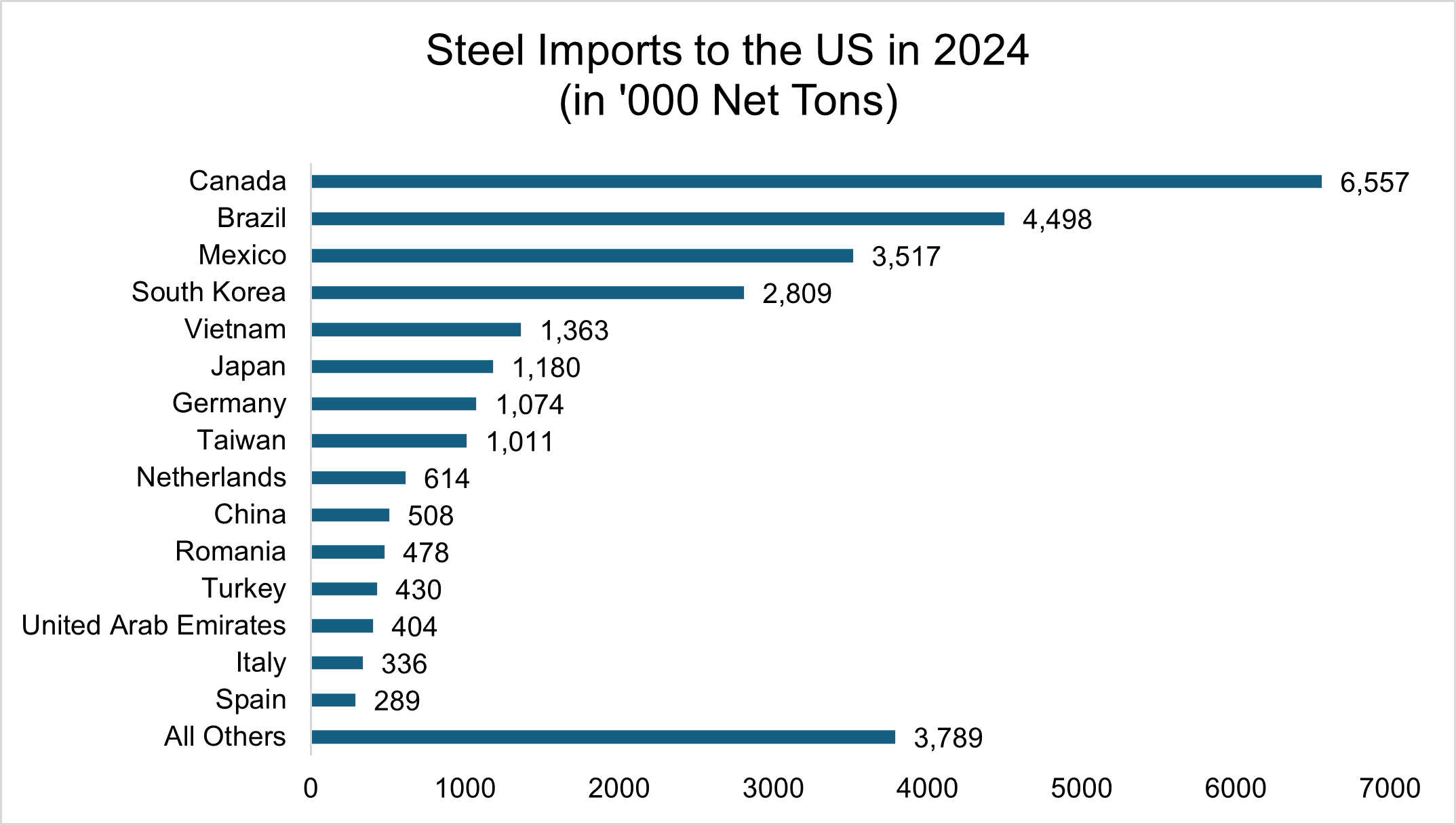

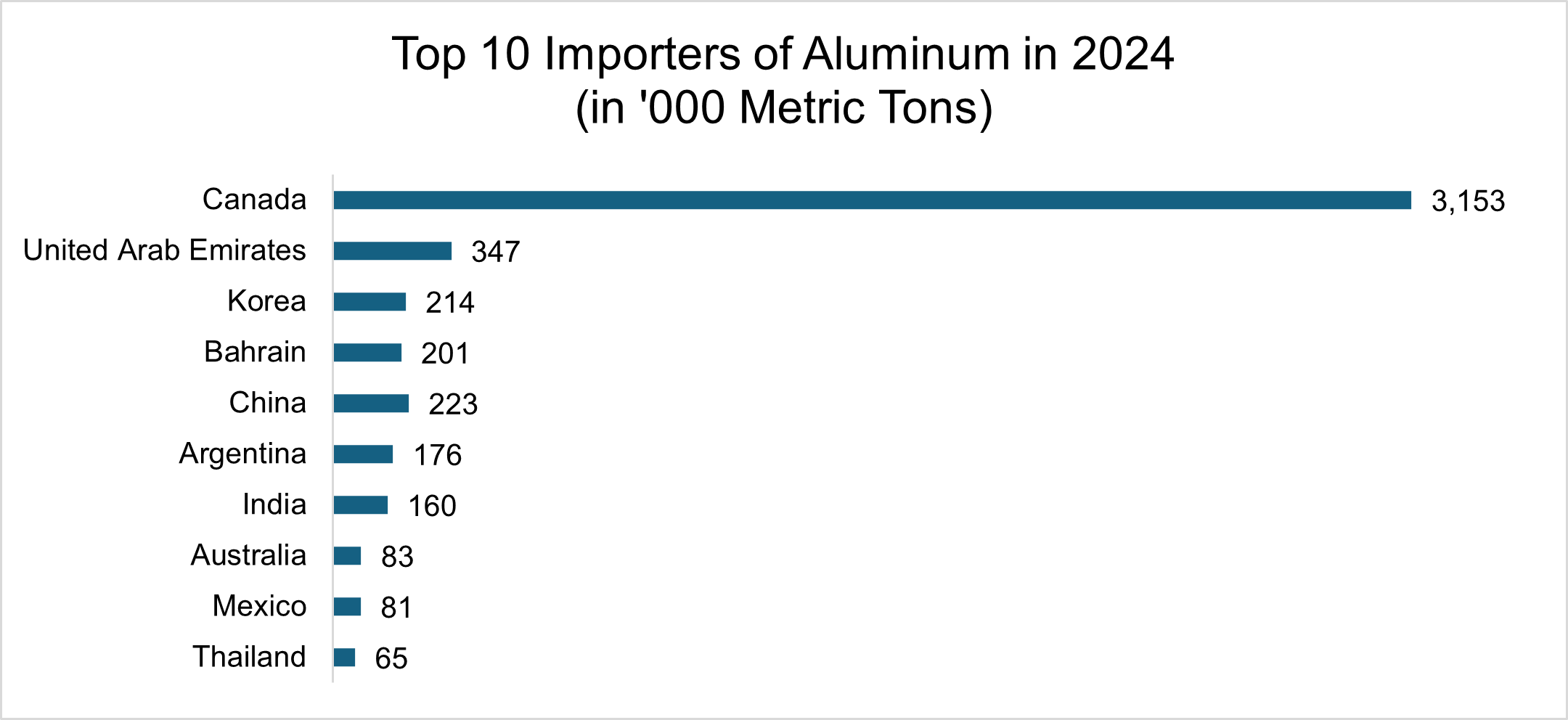

While steel imports comprise a lower percentage of consumption, the total amount of steel imported is greater than total aluminum imports. In 2024, the US imported 28.9 million net tons of steel[5], compared to around 5.4 million tons of aluminum,[6] meaning the US imports roughly 5.3x more steel than aluminum.[7] In other words, although more steel is subject to tariffs, the domestic supply of steel creates more wiggle room to help mitigate the tariff impact.

Source: American Iron and Steel Institute

Source: International Trade Administration

The Impact

The most obvious effect of the tariffs will be on the producers of steel and aluminum, likely benefiting domestic producers but hurting foreign ones. While this may support domestic production and job growth in the short run, this benefit will likely be offset by the cost inflation for purchasers who will face margin pressure.

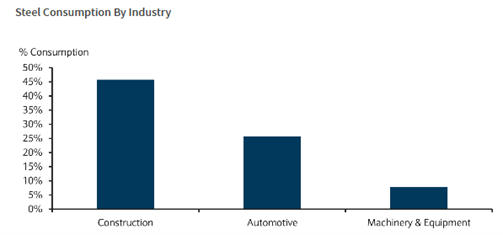

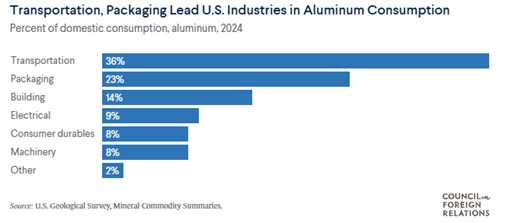

The manufacturers of durable goods appear most vulnerable to the supply shock from steel as they are the largest purchasers of these metals. This includes construction firms, automotive manufacturers, and machinery and equipment producers. Although these industries also face exposure to aluminum tariffs, the transportation and packaging sectors tend to be more reliant on aluminum. While some sectors have more concentrated exposure, the tariffs may have broader impacts, such as for beverage producers who use aluminum cans.

Source: Barclays Research

Source: Council on Foreign Rations

Businesses facing higher costs will likely attempt to pass them on to consumers by raising prices. However, the current state of the consumer is weaker than during the previous round of supply shocks. As a result, passing on these price increases may be more challenging without negatively affecting sales or profitability.

Things Could Get Better

The proposed tariffs on steel and aluminum are far-reaching and unforgiving, but there is reason to believe that implementation will be less severe than currently written. At present, the tariffs apply to all importers with no exceptions, but negotiations could reduce the number of countries subject to tariffs. In 2018, Trump temporarily exempted several countries, including Brazil, South Korea, Mexico, and Canada from these tariffs, that combined represented 60% of total steel imports last year. 2,[8] If sizable importers receive similar exemptions, the overall scope of the tariffs may be reduced, softening the price impact. Furthermore, companies could alter their supply chains to source more local metals, as there is some capacity to ramp up domestic production. Alternatively, many globally integrated manufacturers have “in region, for region production”, which reduces their reliance on imports.[9] Other businesses with this approach may have less exposure to trades and thus less exposure to tariffs.

Or Things Could Get Worse

On the other hand, tensions with trade partners could escalate, exacerbating the ripple effects through the economy. The main risk to producers is that major exporters of steel and aluminum may respond with retaliatory tariffs, which could put additional pressure on domestic steel and aluminum prices. Even without such retaliation, the price of US steel could increase due to higher demand as well as increased pricing power of producers. And while supply chains have become much more flexible following the pandemic, some exposures cannot be hedged. For instance, some machines, such as oil drills, require specialized alloys designed to withstand extreme temperatures which are not made in the US. While some metals can be sourced elsewhere, more specialized metals may not be able to be re-created or re-distributed easily.

For Credits, Bigger is Better

Credits with lower exposure to steel and aluminum will likely face less material impact for these tariffs. Even for those with higher exposure, there may be ways to preserve sales volumes and control costs, particularly for larger companies. Avoiding tariffs may require supply chain restructurings, and high-grade credits with financial flexibility are better equipped to handle these changes. Alternatively, companies can raise prices to offset the increased cost, with market leaders likely facing less pushback given their brand positions. Finally, companies could choose to absorb some of the cost increases to support sales, for which the impact on credit quality would be less substantial for companies with lower leverage and ample liquidity.

There is much uncertainty surrounding the latest round of proposed tariffs, and additional tariffs from the Trump administration are likely to follow. In the meantime, the best way for investors to handle this uncertainty is to monitor their risk exposures and emphasize credit quality to help preserve principal protection.

[1] https://www.bbc.com/news/articles/c360dz384n5o

[2] https://www.cfr.org/article/what-trumps-aluminum-and-steel-tariffs-will-mean-six-charts

[3] https://www.nytimes.com/2025/02/11/business/economy/tariffs-steel-aluminum-manufacturing.html

[4] https://www.federalreserve.gov/releases/g17/current/table1c_sup.htm

[5] https://www.steel.org/wp-content/uploads/2025/01/IMP2412.pdf

[6] https://www.trade.gov/data-visualization/us-aluminum-import-monitor

[8] https://www.wsj.com/articles/white-house-names-allies-to-receive-tariff-reprieve-1521779675?mod=article_inline

[9] https://www.moodys.com/research/Corporates-North-America-Tariffs-are-credit-negative-for-a-wide-Sector-In-Depth–PBC_1438077#3f1d9945a25e91822629651a0aa56ea7

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.