September Month-End Portfolio Update

Treasury Yields Surge (as of 10/3/2023)

September saw Treasury yields rise to the highest levels in decades. Several factors may have led to the increase, including:

- Higher oil prices – both Brent and WTI are reaching new highs for the year and are close to $100 per barrel.

- Higher-for-longer narrative – the Fed’s updated projections suggest that the Federal Funds Rate will remain at an elevated level.

- Solid economic growth – the economy continues to grow, with Q2 GDP rising 2.1%, while estimates for Q3 GDP range from 3% to 4%.

- Large fiscal deficits / increased Treasury supply – this naturally leads to higher yields and is also occurring at a time when the Fed is reducing their purchases (quantitative tightening).

- Term premium rising – term premium is the extra yield for holding longer maturities and it has recently turned positive for the first time since 2021.

- Hawkish Fed commentary – several Fed members have said further rate hikes are likely needed.

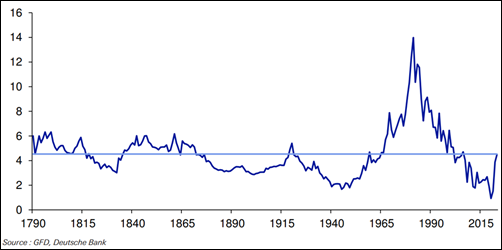

The 1-year T-bill has reached the highest level since 2000, September’s 2-year note auction came at the highest yield in more than 17 years and the 10-year yield has reached levels not seen since 2007. To add some historical perspective on the 10-year, going back to 1790, the long-term average of the 10-year is 4.5% so it is notable that we’re back at historical normal levels. A little over 3 years ago, the 10-year hit an all-time intraday low of 0.31%.

10 year US Govt yields back to average for the first time since 2007

Source: GFD, Deutsche Bank

Source: GFD, Deutsche Bank

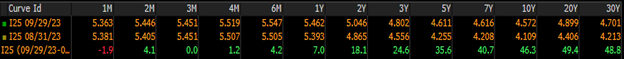

Month to Date Change – US Treasuries  Source: Bloomberg

Source: Bloomberg

Government Shutdown Avoided – For Now

This past Saturday, just ahead of a potential government shutdown, Congress passed a 45-day Continuing Resolution funding bill, kicking the can down the road to November 17th. Should a shutdown eventually occur, analysts estimate that it would shave 0.2 percentage points off GDP every week. As we enter the last quarter of 2023, the markets will be staring at a few additional threats to the economy. Individually, none would be substantial threats to growth but with all potentially occurring in the same quarter, there may be some risk to the overall economy.

- UAW Strike – Although this is the first time the UAW has conducted walkouts at all three automakers at the same time, the initial impact of a limited strike was expected to be modest. If it ends up being a prolonged and broad strike, it’s estimated that 0.05 to 0.10 percentage points could be shaved off GDP for every ongoing week.

- Student Loan Payments – In March 2020, the Education Department paused student loan payments in an effort to lessen the impact of the Covid-19 pandemic. On October 1st, the resumption of student loan payments began for 40 million borrowers, which could divert approximately $100 billion in regular spending. Analysts estimate that economic output could drop 0.1% in 2023 and 0.3% in 2024 as a result.

- Oil Prices to Remain Elevated – In the 3rd quarter, oil prices rose nearly 30% and are approaching $100 per barrel, translating into higher gasoline prices for consumers. Analysts expect prices to hover near $90 per barrel for the remainder of the year.

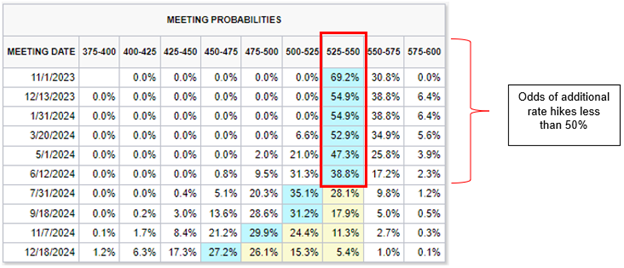

FOMC – Higher For Longer

One of the main takeaways from the September 20th FOMC decision was the change to the Fed’s Summary of Economic Projections (SEP). It showed a large upward revision to 2023 GDP, rising from 1.0% to 2.1%, and if you recall, in February of this year the Fed was forecasting a 2023 GDP reading of just 0.4%. The Committee’s Fed Funds projections still show one additional rate hike in 2023 but the 2024 rate cut forecast was lowered from 100 basis points of cuts to 50 basis points of cuts. During his press conference, Fed Chair Powell said “carefully” 13 times, saying that the FOMC will “proceed carefully” and will make decisions “meeting by meeting.” The Fed Funds futures market also reflects a ‘higher for longer’ narrative, with no additional rate hikes fully priced in, and for the Fed to begin cutting rates in the second half of 2024. Earlier this year, the market was pricing in rate cuts to begin by the end of 2023.

Here is a link to our latest research blog which discusses the possibility of changes in the economy leading to a potentially higher neutral rate and how that affects the cash market space. http://www.capitaladvisors.com/where-is-the-neutral-rate/

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.