September Mid-Month Portfolio Update

Fed Cut Rates by 50 Basis Points – But 50 is Not “the New Pace”

At the September 18th FOMC meeting, the Fed cut the federal funds rate for the first time in over 4 years by 50 basis points to a new range of 4.75%-to-5.00%. Heading into the meeting, Fed Chair Powell made clear that the Fed was going to cut rates in September, saying in late August that “the time has come for policy to adjust.” Here are some of the key takeaways:

- FOMC Statement

The Fed acknowledged recent labor market softening saying job gains have “slowed” (previously labelled as “moderated”) and acknowledged continued improvement on inflation saying, “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent.” Notably, there was one dissent from Fed Governor Michelle Bowman who was in favor of a 25 basis point cut. This was the first dissent seen since 2022 and the first dissent from a governor since 2005. - Summary of Economic Projections

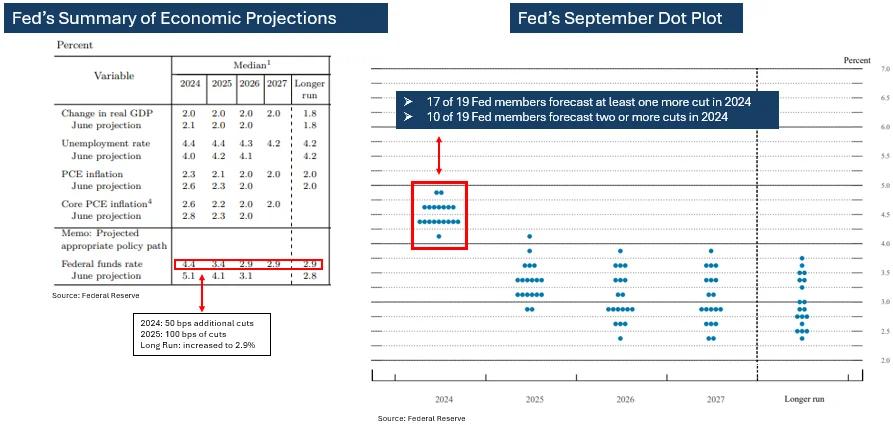

The Fed updated their economic projections by forecasting an additional 50 basis points of rate cuts by the end of 2024 and 100 basis points of rate cuts in 2025. In their previous Q2 update, the Fed had only factored in 25 basis points of rate cuts in 2024. However, the Fed’s total 100 basis point of cuts for 2025 is unchanged from their previous forecast back in June, except that the actual rate levels are lower given the larger 2024 cuts (see chart below). The Fed also increased their unemployment rate target for 2024 and 2025 to 4.4% and slightly lowered their 2024 GDP target from 2.1% to 2%. On inflation, they lowered their 2024 and 2025 targets for PCE and Core PCE. For their longer run forecast, it’s notable that they increased their long run federal funds target estimate to 2.9% which they have increased twice this year from 2.5% at the end of 2023. - Powell Press Conference Statement

Regarding cutting rates, Powell said “This decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 percent.” On future cuts, he said that they are not on any pre-defined course and will continue to make decisions meeting by meeting. - Press Conference Q&A

Regarding questions about whether the FOMC could continue with a 50 basis point cut pace, Powell said a few times they are in no rush to bring down rates and that no one should assume that “this is the new pace” for reductions going forward. It was notable that Powell said “we might have” cut rates in July if policymakers had known the July employment report results – which highlights their recent pivot to shifting their focus on maintaining a healthy labor market. On the overall economy, Powell said more than once that the “U.S. economy is in a good place” and our decision today “is designed to keep it there.”

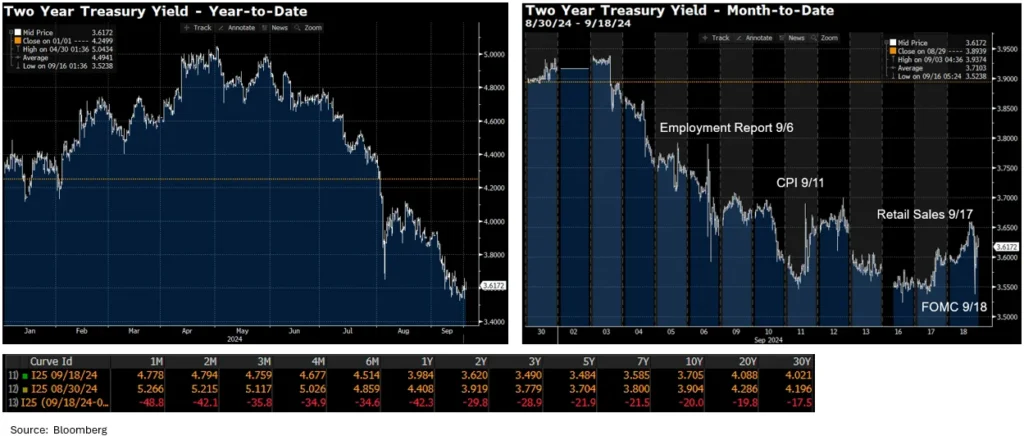

Market reaction was muted with credit spreads and equity indexes closing little changed on the day. The two-year Treasury yield ended the day unchanged at 3.617%. With two more FOMC meetings this year (November 7th and December 18th), the Fed is likely to cut 25 basis points at each meeting, based on the dot plot and Powell’s comments. Should the economy continue to show easing inflationary pressures and a balanced labor market, the Fed is likely to shift to quarterly 25 basis point cuts in 2025, which would align with Powell’s comment that the Committee is not in a rush. However, the FOMC has said, “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Mixed Economic Data

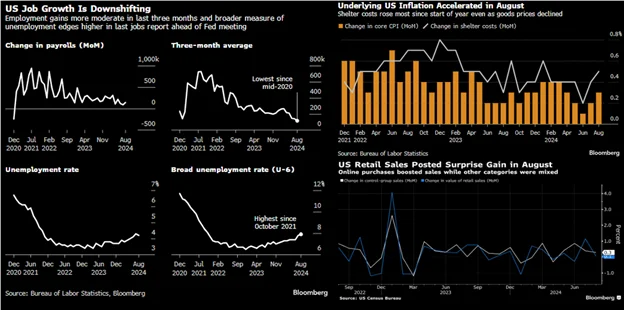

The labor market continued to show a cooling trend while a higher-than-expected Core CPI reading raised some concern that inflation will remain sticky while consumers continue to spend.

- The August employment report was mixed: nonfarm payrolls rebounded from the previous month rising 142,000 but came in below expectations of 165,000. The prior two months’ data saw downward revisions of 86,000 with July’s reading declining 25,000 to just 89,000, the lowest monthly print since 2020. However, the unemployment rate ticked down to 4.2% despite 120,000 people entering the labor force (which normally would increase the unemployment rate).

- For the 5th consecutive month, headline CPI declined and now stands at 2.5%, a 3-year low. However, the monthly reading on Core CPI came in higher than expectations at +0.3%, the largest monthly gain since April. Leading the rise in core inflation was the +0.5% jump in owners’ equivalent rent, the most in 7 months. Before the pandemic, it typically came in at less than +0.3%. The 1/3/6-month annualized readings for Core CPI all increased, led by the 1-month reading rising from 2.0% to 3.4% and the 3-month reading rising from 1.6% to 2.1%.

- The retail sales report was also mixed: headline retail sales came in higher than expectations at +0.1% vs. expectations for a drop of -0.2% while core-readings (ex auto and gas) came in lower than expectations. The Control Group, which is used to calculate GDP, rose +0.3%. The Control Group sales rose at a solid annualized pace of +5.7% for the past 3 months which was the fastest rate since August 2023. However, looking at the underlying details, 8 of the 14 categories posted declines with online shopping being one of the main gainers as a result of back-to-school shopping.

Entire Treasury Curve Falls Below 5%

Yields in September have declined, led by the front-end with all yields across the curve now trading below 5%. As you can see in the year-to-date chart, yields have been declining since hitting their peak in May after improving inflationary data in the second quarter. Within the corporate bond market, issuers took advantage of lower yields and demand from investors and set the single-day record with 29 different companies coming to market – the previous record was 21 different issuers on a single day back in 2021. The 29 issuers priced $43 billion of corporate bonds which was the 3rd largest for any single session on record.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.