September Mid-Month Portfolio Update

CPI – headline spike all energy related

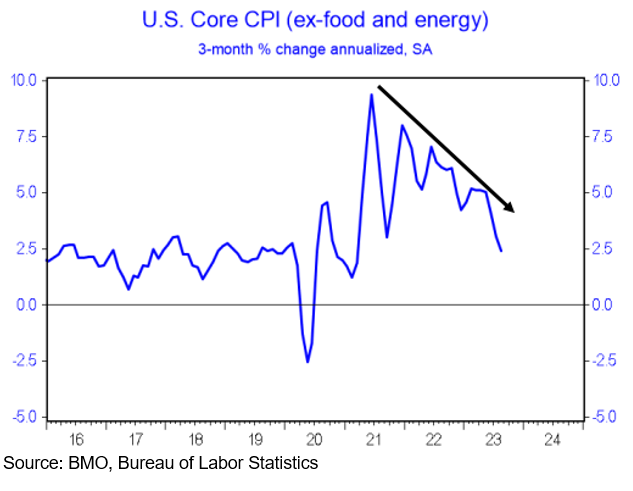

Headline inflation had been forecasted to increase in August as a result of the highest fuel prices so far this year. So, it came as no surprise that CPI rose +0.6% in August, which marked the highest monthly increase since June of 2022. However, markets were surprised that core CPI came in slightly higher than expectations at +0.3% vs consensus of +0.2%. Year-over-year CPI also jumped from +3.2% to +3.7%. Core CPI fell from +4.7% to +4.3%, marking the lowest rate since September 2021, and was largely attributable to base effects. The headline reading was driven by gasoline costs, which rose over 10% and accounted for over half of the total CPI increase. Core prices rose primarily on rent increases and transportation services, which includes car repair, car insurance, and airfares, for example. In fact, car insurance spiked over +19% – the largest increase since 1976. Despite the increase in core prices, the 3-month annualized pace continues to decline, falling from 3.1% to 2.4%, the lowest since March 2021 (see chart below). Looking ahead, the focus will likely be on how the Fed views the increase in headline CPI due to rising energy prices and how this could filter into other components of inflation.

Source: BMO, Bureau of Labor Statistics

Retail Sales – solid headline reading but weak underlying growth

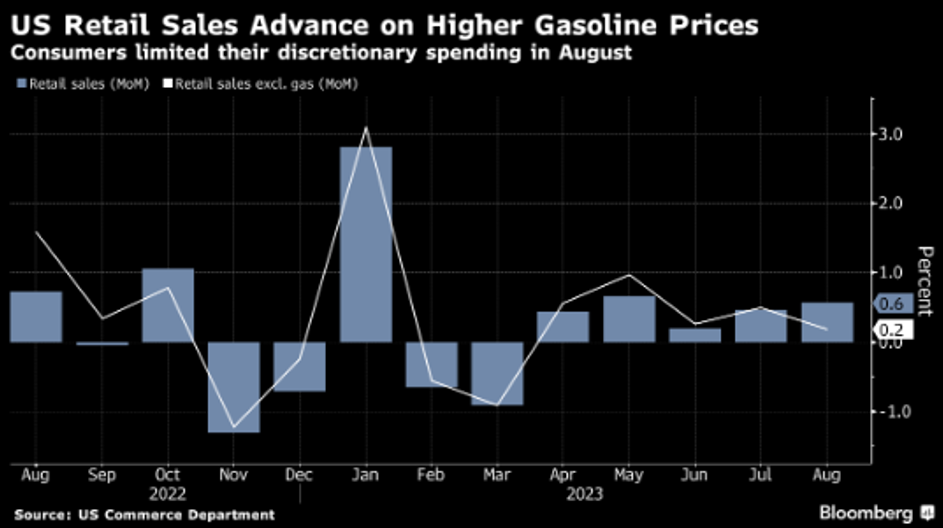

Similar to CPI, the headline retail sales report spiked due to higher gasoline prices, as retail sales are measured by dollar volume and not adjusted for inflation, leading the report to reflect not only price changes but shifts in consumers’ preferences. However, when auto and gas sales are excluded, there are signs of slowing consumer spending as the prior month was revised lower from +1% to +0.7% and the August reading rose just +0.2%, the 3rd lowest reading of the year. Of the underlying 13 categories, the only service sector category included is sales at restaurants and bars, which came in at the lowest level in 5 months at +0.3%. The Control Group – which feeds into the GDP calculation – rose +0.1%, which is one of the weakest readings of the year. This change was reflected in the Atlanta Fed’s Q3 GDPNow forecasting model which was revised down from +5.6% to 4.9%.

Source: US Commerce Department

ISM Services – 8th expansionary reading

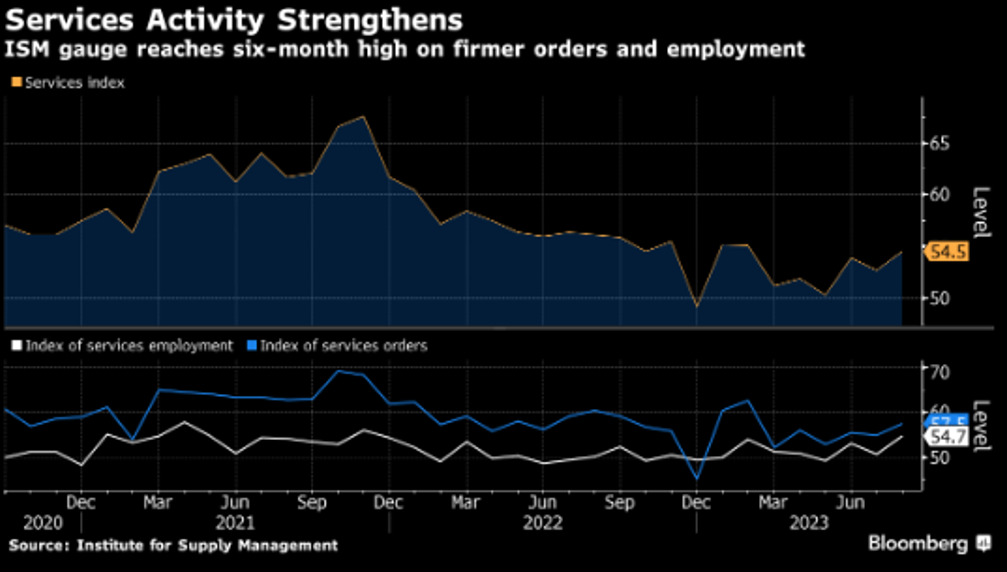

ISM Services PMI came in above 50 for the 8th month in a row, to 54.5, which is the highest reading since February. An index reading above 50 indicates an expansion in the non-manufacturing economy. The employment component rose to the highest level since 2021 with respondents signaling that a lack of supply held back service jobs from moving even higher. However, on the inflation front, the prices paid component rose to the highest level since April, a concern for the Fed as they head into their upcoming FOMC meeting.

Source: Institute for Supply Management

FOMC meeting – no rate increase forecasted

The FOMC is expected to keep rates unchanged at 5.25%-5.50% when they release their statement on Wednesday, September 20th. However, the focus will likely be on their Summary of Economic projections, which is updated quarterly and will be released at this meeting. The Fed is currently forecasting one additional rate hike for 2023 and 100 basis points of rate cuts for 2024. They are likely to keep their 2023 forecast unchanged in order to give them some flexibility to raise rates at the last two remaining FOMC meetings, should the need arise. In addition, this will be the first time they will be releasing 2026 projections. Several Fed officials spoke ahead of their blackout period, which began on September 8th; many indicated that monetary policy is sufficiently restrictive but emphasized the need to continue to monitor incoming data.

- Fed Governor Waller said “there is nothing that is saying we need to do anything imminent anytime soon….we can just sit there and wait for the data”

- New York Fed President Williams said the Fed is “in a good place” and “we are restrictive, still an open question whether we are sufficiently restrictive”

- Atlanta Fed President Bostic said he is grateful that we have seen inflation come down and “I feel like we’re in a restrictive space now. And now we just need to let that restriction play out.”

- Dallas Fed President Logan was a little more on the hawkish side saying “another skip could be appropriate” in September but “skipping does not imply stopping” and her base case “is there is work left to do.”

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.