Separate Accounts for the Rest of Us

Many people tend to believe that the world of corporate cash investments revolves around two limited choices: bank deposits and money market funds. But several decades ago before the rapid adoption of prime money funds, a third choice—direct purchase and management of marketable securities in separately managed accounts (SMAs)—was routinely used for cash management.

After institutional prime money market funds appeared on the scene in the 1990s and proved irresistible for managing liquidity, cash investors didn’t necessarily abandon separate accounts. But they often started to regard the SMA more as an investment vehicle designed to deliver enhanced yield than as a tool to manage liquidity. Separate accounts were used in many instances to invest excess cash when liquidity wasn’t a priority and credit or duration risk could be employed to deliver higher returns.

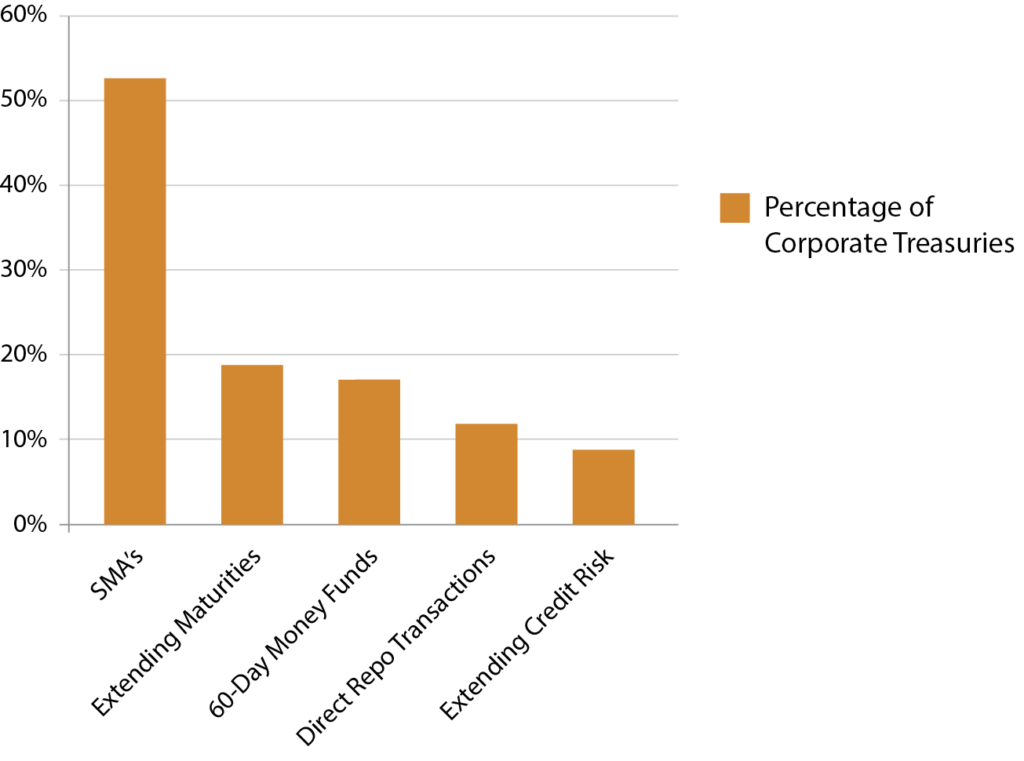

Now we find ourselves in a “back-to-the-future” moment, with SMAs again being considered the go-to solution for short-term liquidity management. With bank reforms expected to make deposits less available as repositories of corporate cash, and with prime money market funds instituting SEC-mandated floating net asset values (NAV) and potential liquidity gates and redemption fees in October 2016, many cash investors are taking a new look at separately managed accounts. In fact, in its 2015 Liquidity Survey, the Association of Financial Professionals found that 52 percent of corporations are considering separately managed accounts as an alternative investment option for cash management.*

Figure 1: Treasury Managers Considering SMA’s as an Alternative to Prime Money Market Funds

*Source: 2015 AFP Liquidity Survey

Those who remember the days when separate accounts were more the norm may be pleasantly surprised at how they have changed. Separate accounts are now more appealing for liquidity management than ever:

- Daily transparent reporting makes them easier to monitor and manage. New web-based tools enable efficient real-time monitoring of investments, with online reports that can be seamlessly and automatically integrated with accounting systems.

- Liquidity targets can be managed effectively. Better and more comprehensive information available to portfolio managers enables more accurate modeling of weighted average maturities to provide overnight-, seven-day or longer-term availability of cash as needed.

- They are easier to set up than ever before. Better reporting and automation of other back-end tasks means SMAs can be managed more efficiently, lowering management costs and streamlining setup processes. As a result, SMAs now are attractive liquidity management vehicles for mid-market companies and startups as well as for larger companies.

In the recent past there may have been a perception that separately managed accounts were mainly for large organizations with in-house staff to manage large cash investment portfolios. Because SMAs were typically relegated to “excess-cash” investing roles, with prime money market funds used to manage liquidity, you might have been required to maintain a minimum balance of $50 million or more in your separate account.

Our experience at Capital Advisors Group is slightly different. As an independent SEC-registered investment advisor (RIA), we started managing separate accounts in the days before prime money funds became the go-to vehicle for managing liquidity. We have always managed SMAs not only for large corporations needing liquidity to run their day-to-day operations, but also for early-stage venture-backed companies who need liquidity to fuel their product-development burn rates.

That’s why we are calling the current environment a “back-to-the-future” moment. At a time when corporate cash managers are starting to consider alternatives to bank deposits and prime money funds, the SMA is an appealing liquidity solution that already exists—and it’s looking better than ever. We still offer a range of SMA solutions spanning the liquidity and risk-return investment horizon, from Liquidity Accounts to Intermediate Accounts to 1-to-3-Year Accounts. And to make it even easier to use an SMA to manage liquidity, we have also recently introduced our new Capital Advisors Group 90-Day Liquidity AccountSM, a buy-and-hold portfolio of cash- and cash-equivalent investments intended to provide the ease and utility of money market funds.

So there’s good news for cash managers looking ahead to the changes coming in 2016, especially for those who take a careful look back at separately managed accounts as an attractive alternative for managing liquidity. At Capital Advisors Group, we intend to stay at the forefront of the trend toward easier and more accessible separately managed liquidity accounts, so stay tuned. In the meantime, for additional background on SMAs, I encourage you to download our white paper on Six Advantages of Separately Managed Accounts.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.