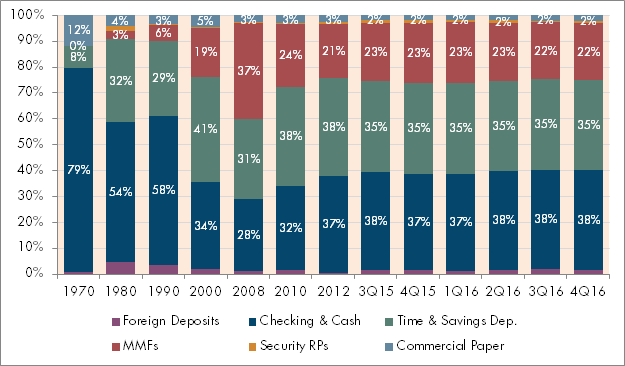

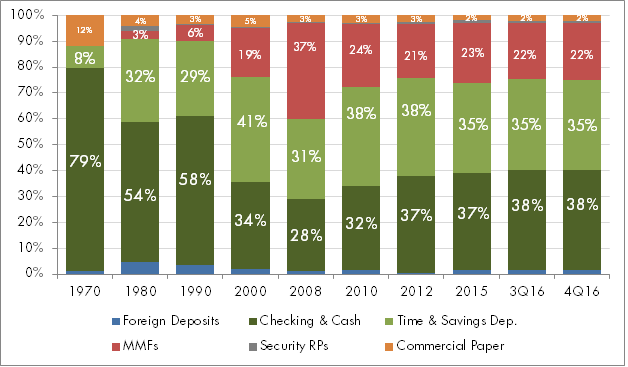

The Long Wait for a Better Rate on Deposits

1 min readBanks have traditionally been a little slow to follow interest rate hikes by the Fed with comparable rate increases on their own deposit accounts. But this time around they seem to be moving more slowly than ever. Our August research report―Higher Deposit Rates-Where Art Thou?―looks back at the past two Fed tightening cycles and compares…