Interest Rate Outlook: Controversial May Employment Report

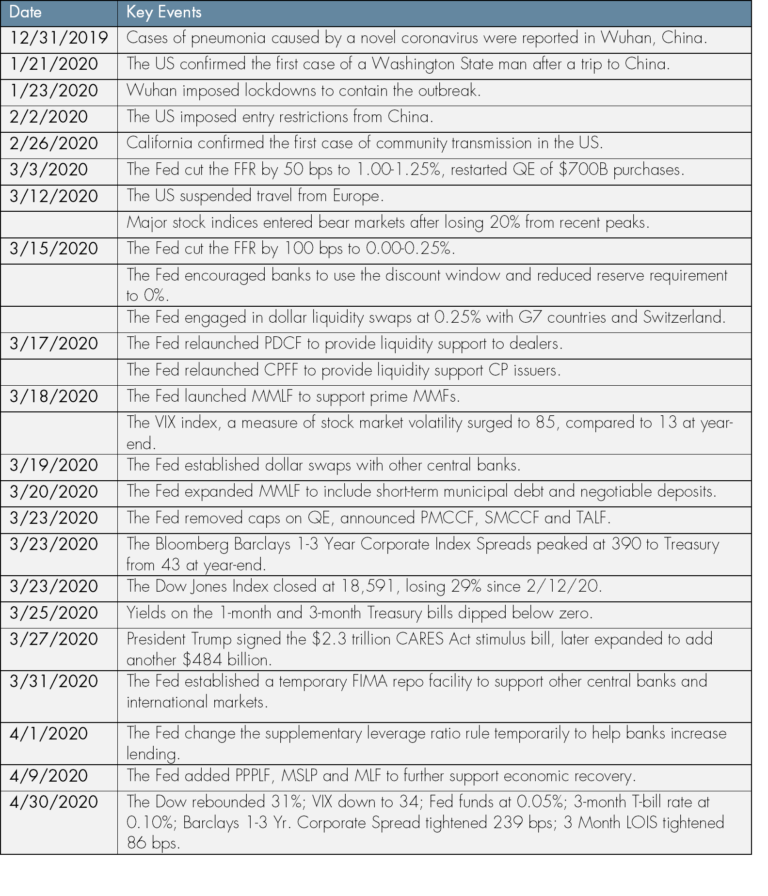

2 min readFOMC Meeting The Federal Reserve’s Open Market Committee met last week and Chair Jerome Powell spelled out a bleak outlook for the U.S. economy. The Fed’s year-end median expectation for the unemployment rate is 9.3%, with 2020 GDP growth projected at negative 6.50% and core PCE inflation at 1.0%. At the press conference following the…