Offshore Money Market Funds in an Age of Change

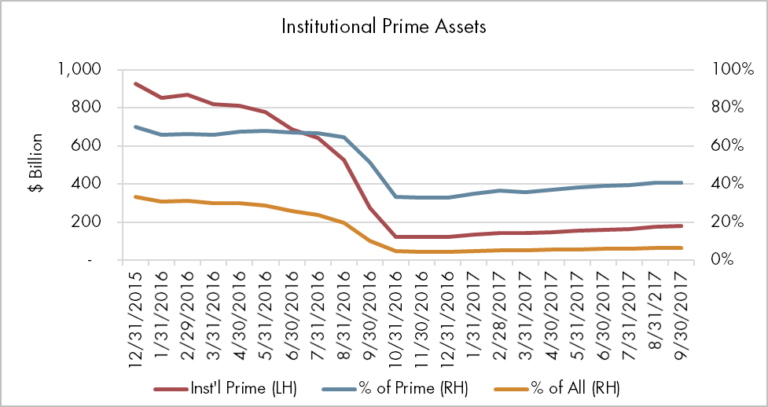

3 min readAbstract Offshore institutional money market funds (MMFs) have largely sat in the periphery for US-centric liquidity investors, but European reform and repatriation of overseas profits may result in transformational changes. Offshore fund investors will have few alternatives other than low volatility net asset value (LVNAV) funds. Public debt funds may not accommodate large inflows. A…