Repo Ruckus Reveals Fed’s Loosening Grip on Short-Term Rates

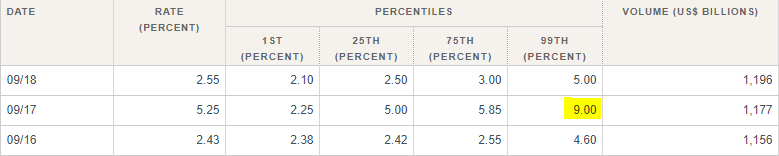

This past week saw some nearly unprecedented chaos in repo markets. Beginning late Monday and extending into Tuesday morning, funding in overnight cash markets essentially dried up, sending investors scrambling for liquidity. This resulted in a surge in repo rates for those who did transact, with overnight rates jumping from the low-to-mid 2% range to upwards of 9% on certain transactions (Figure 1).

Figure 1: Secured Overnight Financing Rate (SOFR) Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

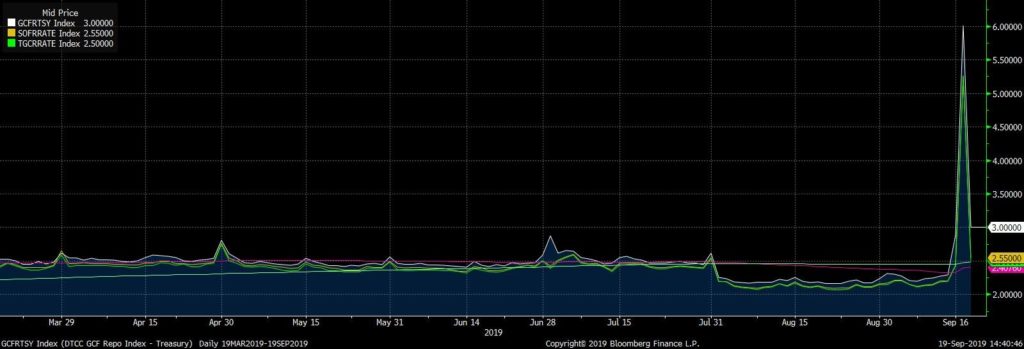

The dust didn’t settle until the New York Fed jumped into the mix, opening a $75 billion repo facility for those in need of liquidity. Even then, the facility experienced some malfunctions and was issued too late in the day to have a material impact for many borrowers. The end-of-day result was one of the biggest jumps in repo rates in recent memory (Figure 2).

Figure 2: DTCC GFC Repo Index – Treasury  Source: Bloomberg

Source: Bloomberg

How it Happened

The question is then, how could something like this occur? Normally, 10 bp moves in repo markets are noteworthy, much less moves in excess of 300 bps. Shouldn’t this sort of seismic event in money markets be foreseeable, especially when it didn’t coincide with broader economic or financial chaos?

To a certain degree this was the case. As the Bank Policy Institute noted at the beginning of September, remittances to the Treasury were likely to be high this month due to corporate tax receipts being owed and heavy Treasury debt issuance. Both factors would act to drain banks of cash, in turn creating potential stress in money markets. Sure enough, both of these things came to pass, with Tuesday seeing shortages of liquidity as primary dealers looked to fund their purchases of Treasuries, and as lenders (both on the bank and money fund side) were constrained due to cash outflows.

The NY Fed certainly knew this was a possibility, as it regularly communicates with the primary dealers and other market participants. What it, and no one else, anticipated was how strong these factors would work in confluence with larger structural issuers to squeeze liquidity.

Why it Could Happen Again

The reality is that because of the current configuration of short-term lending markets, this sort of event is more likely to happen than in the past. This is due to three distinct features that were implemented post-crisis:

- The Liquidity Coverage Rule (LCR): The LCR essentially requires banks to hold more cash in order to hedge against short-term liabilities. This makes the banks more resilient, but at the expense of them being less able to lend to other parties.

- Interest on Excess Reserves (IOER): The Fed implemented IOER during the crisis and now uses it as its primary tool for implementation of monetary policy, rather than the fed funds rate. By paying the banks money to sit on their cash the Fed disincentivizes these very same institutions from making loans with said cash.

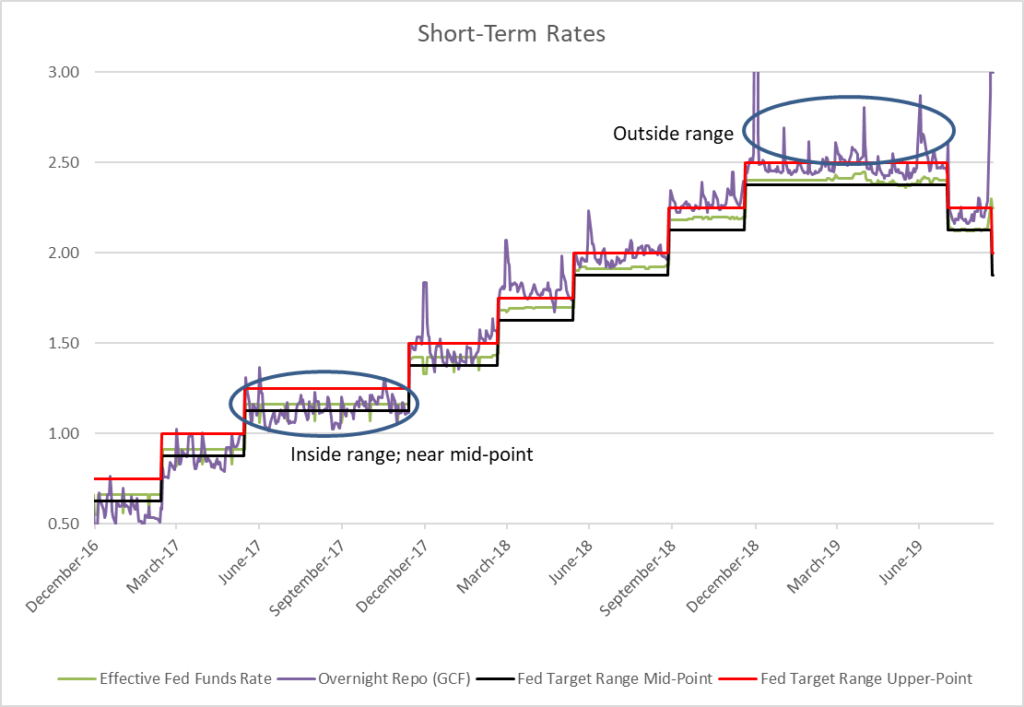

- Quantitative Tightening: The opposite of quantitative easing, the Fed’s program to run down its balance sheet coincided with a commensurate fall in banks’ excess reserve balances (Figure 3). This increased scarcity of reserves, in which institutions are required to hold more cash by regulators, increased the likelihood of a liquidity crunch.

In his press conference after the September 18 Fed meeting, Chair Jerome Powell said that the disruptions in money markets don’t have “any implications for the broader economy or for the economic outlook, nor for our ability to control rates.” He went on to say that the Fed is prepared and has the tools to deal with short-term market fluctuations. Indeed, the Fed’s $75-billion facility is currently operating for its fourth day in a row, and its application has largely calmed short-term funding markets.

Three Ways the Fed May Address the Problem

Nevertheless, in a very big way the stress in repo markets illustrates the Fed’s loosening grip on short-term interest rates. As Figure 3 shows, over the past year and a half, short-term interest rates have moved from the middle to the top end (and sometimes even outside) of the Fed’s target range.

Figure 3: Short-Term Rates Source: Bloomberg

Source: Bloomberg

The Fed has less control of short-term rates than it used to, and it will have to make changes on either the operational or regulatory front in order to rectify that. There are a variety of options available:

- Introduce a Standing Repo Facility: This would make permanent the temporary facility the Fed introduced this week. It would pair well with the existing Reverse Repo Facility the Fed already has in place.

- Resume Growth in the Balance Sheet: This seems the most likely solution, as Powell mentioned “organically” growing the balance sheet to resupply reserves to the banking system.

- Reduce the LCR: On the other hand, this seems the least likely solution, with Powell saying this is “not something we think (should be done) right now.” He did leave open the possibility of it being scaled-back in times of stress.

It’s very possible (perhaps even likely) that the Fed just stands pat for now. Ultimately though, it seems likely that the Fed will need to implement some sort of change to its current operating or regulatory procedures to ensure that there is ample access to liquidity in the cash space. The healthy functioning of the financial system depends on it.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.