Rates, Supply Chain, ESG and Stablecoins: Three (+1) Themes to Watch in 2022

Introduction

It has been our tradition to offer up three broad themes that will likely have the greatest impact on cash investments in the new year. After the research staff endured 20 months of work-from-home, I wanted to reward endurance by inviting them to each pick a theme for this look-ahead piece, hence the “three +1” themes of higher rates, supply chain recovery, ESG inroads, and cryptos encroaching cash.

A year ago, our crystal ball told us that 2021 would be impacted by strong vaccine rollouts, ESG going mainstream, and SOFR replacing LIBOR as benchmarks. All three turned out to be right on point. Highly effective vaccines helped reopen economies; sustainability became a major catch phrase in capital markets and among governing bodies; and benchmark replacements went on without much fanfare.

With that said, we did not foresee curveballs on the covid variant front, namely Delta and now Omicron, that render existing vaccines less potent against the virus and make investment projections more challenging. Make no mistake, the economy is still in the tug-of-war of growth vs. health. Which side wins out will have meaningful impact on the directions of interest rates and credit trends. Let’s dive in.

Expect Interest Rates to Lift Off, but How High?

By Matthew Paniati, CFA®

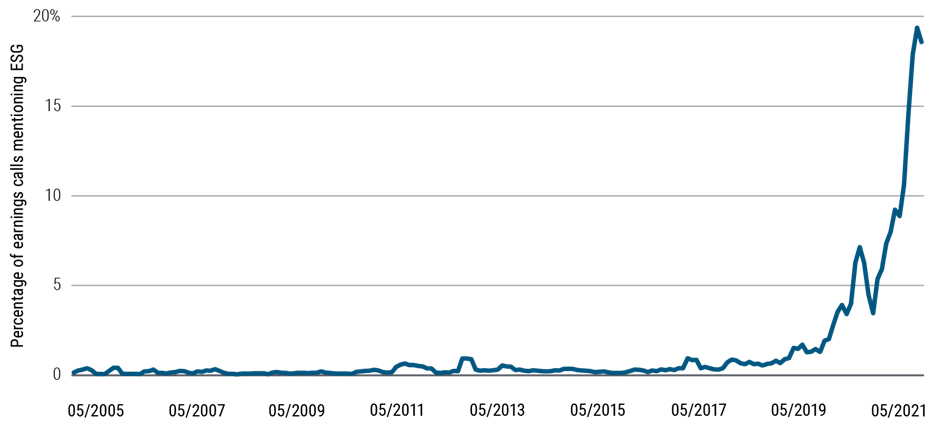

As we discussed in our December whitepaper, the dual reality of rapidly increasing inflation and a tight labor market forced the Fed to radically alter its outlook for monetary policy. At its December meeting, the Fed doubled the pace of tapering from $15B to $30B a month and updated the consensus forecast by FOMC officials to three rate hikes in 2022 (each assumed to be 0.25%). This would obviously mark a big change for cash investors, since short-term rates have been stuck near-zero since the beginning of the pandemic. With the foregone conclusion that the Fed will “lift off” from 0% interest rates in 2022, cash investors beg the questions: 1) When will the lift-off occur? 2) How high will rates go in 2022?

On the first question, Chair Powell has indicated that interest rate hikes will not commence until the taper is finished. Based on the current rate of $30B a month, the taper program is expected to be done by March, which would theoretically be the earliest time they could raise rates. The May and June meetings were initially being talked about as more natural points for lift-off but following the release of the minutes from the Fed’s meeting the timeline has been pulled forward. As of January 7th, the futures market has assigned a 78% probability of a 0.25% increase at the March 16th meeting and 100% by the May 4th.

While this scenario could change quickly, the current base case is that lift-off is now likely to happen in the first quarter.

Exhibit 1: Federal Reserve’s Monthly Asset Purchase Schedule

Source: The Federal Reserve

On the second question, the answer once again comes down to the markets and the Fed. As mentioned, the Fed is now projecting three rate hikes next year. The market is roughly in line with this with 3.4 hikes priced in by the December 14th, 2022, meeting. Normally, the Fed tends to converge to the market. All things being equal, we should expect three hikes, taking the fed fund target range to 0.75%-1.00%, with four hikes being the next most likely outcome.

However, the probability “bands” around this outcome are quite wide. There are several factors that could impact the pace of tightening, including developments with supply chains, the pandemic, inflation, and labor markets. As such, it’s unlikely that the interest rate path will remain consistent over the course of the year. More likely, the Fed will adjust the timing and frequency of policy tightening as the outlook becomes less cloudy.

Supply Chain Not a Major Concern for Corporate Credits

By Andrew Tong, CFA®, and Alex Goldman

Ongoing supply chain challenges that made headlines in 2021 will continue in 2022 but will not have material impact on corporate profitability or credit strength. The post-pandemic surge in demand for products and the ongoing spread of Covid have caused product shortages, backlogs at the ports, truck driver shortages, and extended shipment times for most products. Transportation companies responded by raising prices, while large retailers and product companies combat shipment delays and cost inflation to protect profitability.

Larger corporations have been able to use their scale, creativity, and previous experiences to combat some of the headwinds. On the logistics front, some firms acquired transportation companies or enhanced the shipping segment through truck and van purchases, while companies like Wal-Mart purchased warehouses near the ports to smooth out unloading of cargo. Cost inflation has generally been passed through to the consumers through higher prices, lower or non-existent discounts, and smaller product sizes. So far, consumers have been willing to accept the price hikes due to the extraordinary stimulus and unemployment benefits throughout the pandemic. For those companies unwilling to increase prices, the hope is to garner higher product sales, offsetting any increases to input cost, and outmaneuver competitors for market share.

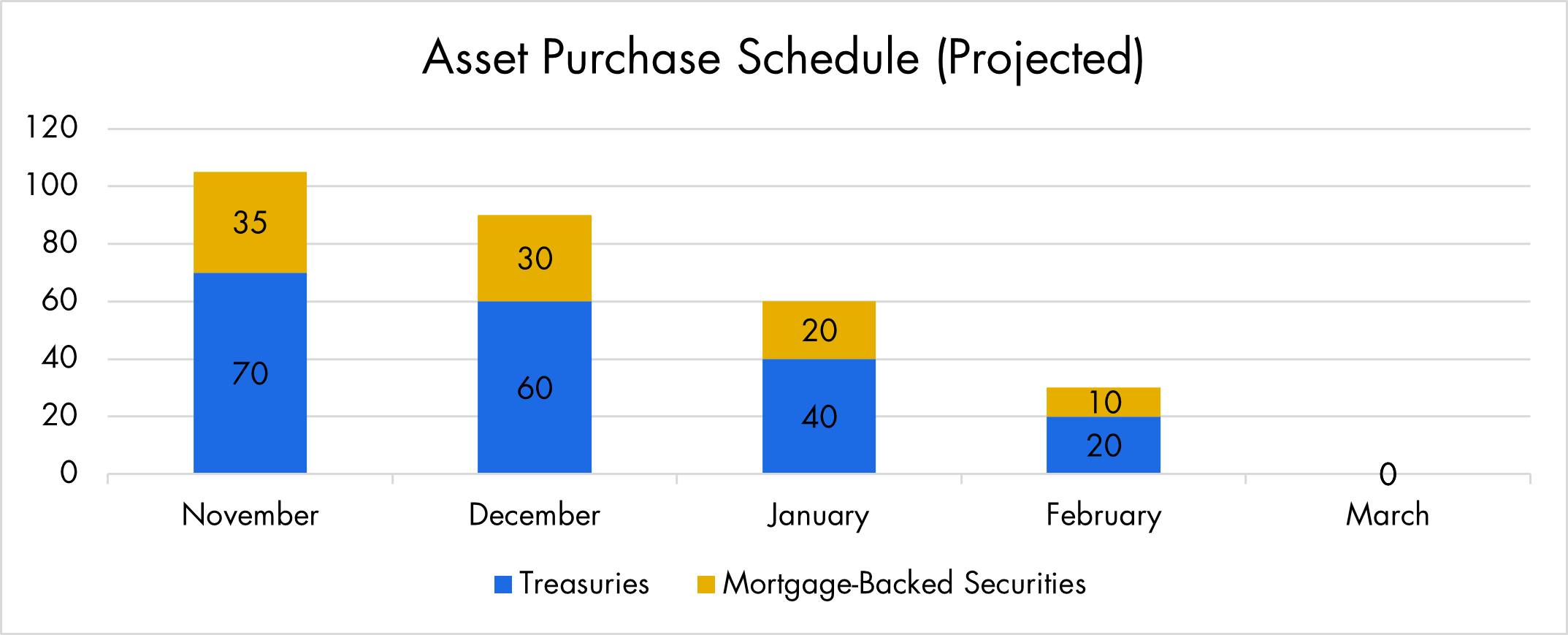

Exhibit 2: Profit Margin for Non-financial Business

Source: Bloomberg and the Bureau of Economic Analysis

Note: Margin = seasonally adjusted profits as share of gross value added by non-financial corporate business.

For the balance of 2022, we expect non-financial corporate credits to maintain healthy margins by passing through costs and driving higher sales from strong overall demand. The companies that make up the S&P 500 have kept margins strong throughout 2021 and have booked the largest profit margins since 1950. The profit margin in the third quarter 2021 was historically strong at 14.8%, down from 15.3% in the second quarter. Although some margin compression should be expected as we move into the new year due to labor, commodity and cost inflation, a relatively strong economy in 2022 will support the non-financial sectors’ profitability.

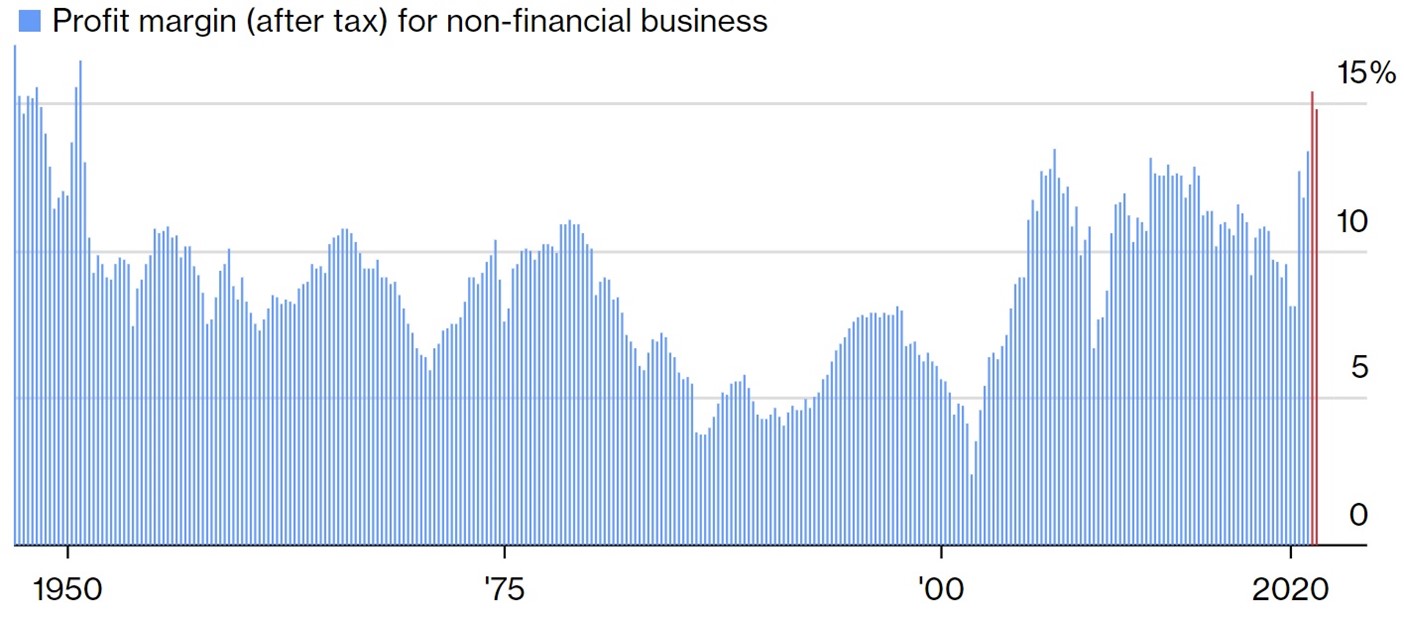

Exhibit 3: High-frequency Supply Chain Indexes

Source: Moody’s Investor Services and Capital Advisors Group

Analysis of high-frequency data regarding manufacturing and supply chains suggests that supply chain issues, while elevated, may have reached their peak. Each measurement is based off representative indexes and scored on a scale of 1 to 10, with a higher score reflecting better conditions.

Supply chain indicators remain at elevated levels, but most appear to have peaked towards the end of 2021. Manufacturing and production indicators have improved, with Asian manufacturing hubs able to bring production back online. Volume levels are expected to remain high, but port backlogs may ease following the rush of winter deliveries to meet holiday demand. Industry analysts1,2, believe that we should reach a peak in supply backups by mid-year 2022 and then see gradual recovery to normal levels in 2023. The pace of improvement will depend on relieving some of the roadblocks in the shipping and transportation industry. Previous logistical solutions should provide the infrastructure and learning experience to prevent bottlenecks from surging. However, continuing Covid outbreaks from new variants could prolong the supply chain problems. Lastly, any tempering of demand for products and a shift towards greater spending on services should relieve the added pressure to inventory shortages. We think that by year-end 2022, the supply chain problems will largely be behind us.

A Winding Road to ESG Integration

By Pate Campbell

The meteoric rise of ESG principles over the previous few years has led to an undomesticated ecosystem of solutions, principles and standards that leaves significant unanswered questions about what ESG’s contributions to society’s sustainability goals will look like. As ESG implementation spreads, the race to tame the industry has quickly advanced, forcing us to reassess how we view and utilize ESG factors that will affect all assets, including cash portfolios. We should get more clarity on these efforts in 2022.

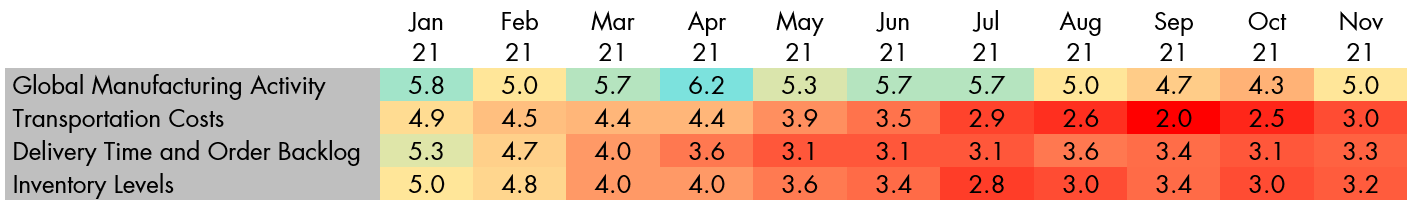

ESG Has the Wind at Its Back… Most Times: For the third year in a row, we have identified ESG as a trend to watch. The growth of ESG investing and focus on sustainability topics accelerated in 2021 with the horrific social impact of the pandemic, increasing instances of severe weather, and the COP26 climate change convention in Glasgow. One thing the spotlight on ESG has made certain is that the road to widespread integration of ESG factors into the financial system and society is neither clear nor linear. Perhaps best highlighting this was the U.K.’s 2021 wind shortage, which caused the nation to turn on coal power plants to meet energy demand weeks before COP263 demonstrating how difficult proper ESG integration will be.

Everyone Wants to Drive: As companies in all industries grapple with how to implement ESG factors into their business models, they are hearing increasing criticism from back-seat drivers. Despite being an ESG outperformer in the oil and gas industry, Royal Dutch Shell has fielded calls from activist investor Third Point LLC to separate its legacy oil and gas business from its renewable business to boost returns.4 An even louder voice came from the Hague District Court, which ordered the company to reduce its CO2 emissions by 45% compared to 2019 levels by 2030.5 In 2022, ESG factors will likely only become more prominent in corporate board rooms as stakeholders, governments and organizations drive change, making understanding them of growing importance to credit and portfolio analysis.

Exhibit 4: Percentage of PIMCO’s Portfolio Companies that Mentioned ESG in Earnings Calls6

Macroprudential Incorporation: A good roadmap and careful preparations can help to avoid an uncertain road that leads to uncertain risks. The Financial Stability Oversight Council identified climate risks as an increasing threat to U.S. financial stability in 20217, while the Fed created two committees to identify and address the financial risks that climate change poses.8 Continued identification of ESG risks to the financial system, particularly environmental risks, will be a focus point in 2022. Once identified, they can be incorporated into preventative regulatory measures. The Bank of Canada and OSFI, for example, are expected to soon release a years-long study setting the foundation for mandatory ESG risk disclosures and climate related regulation.9 As the drive to account for ESG risks in the markets accelerates, it will have an increasingly direct impact on issuers and the financial system as a whole.

Understanding the Road Signs: The increasing impact that ESG will have on corporate strategy, financial system regulation and compliance standards is exponentially more difficult to navigate when there is no consensus on its meaning. To this end, standard setting bodies have been working to homogenize ESG disclosures and accounting. It is anticipated that the SEC will soon release updated climate-related disclosure regulations to enhance their scope and comparability across companies.10 Additionally, the IFRS Foundation announced the launch of the International Sustainability Standards Board, which is expected to develop a baseline for corporate sustainability disclosures through the coming year.11 In 2022, the EU is set to further enhance disclosure regulation through the continued development of their Environmental and Social Taxonomies as well as the Corporate Sustainability Reporting Directive, making the process of ESG integration more straightforward for investors and asset managers12.

Enforcement: The financial industry’s scramble over the past few years to meet rising demand for ESG products while lacking clearly defined standards has led to massive confusion in the nature and purpose of ESG products. Regulators are beginning to pull back on the reigns. The SEC issued a risk alert following a review of ESG investing in April, highlighting the risks investor confusion produces, and in some cases, insufficient internal controls in applying ESG principals13. To combat this, the SEC has created a climate and ESG task force. In 2022, we should expect increased disclosure requirements and subsequent enforcement that will charter a clear path to ESG integration. This will make ESG more useful to a broader set of applications, including cash portfolios, integrating it deeper in markets and making it more critical to investment decisions.

Stablecoins and Liquidity Market (In)stability

By Lance Pan, CFA®

In recent months, a class of crypto (or digital) currencies received increasing regulatory attention for their potential to cause unknown harm to short-term market stability. Governmental bodies including the Fed, the Treasury Department, the Securities and Exchange Committee (SEC), and the President’s Working Group on Financial Markets have taken notice of stablecoins, previously an obscure corner of crypto space.

What’s all this got to do with me, the boring cash investor, you may ask? Well, plenty. Think of stablecoins as unregulated shadow cash pools competing with the largest prime market funds for deposits and short-term investments, especially in commercial paper and similar credit instruments. With rapid growth and their association with the highly volatile crypto market, one or more of these collateral portfolios may need to be unwound quickly, leading to a liquidity crunch that could take investors of commercial paper and other liquid investments by surprise. How stablecoins evolve and how soon the regulators can catch up to them may be a meaningful risk concern in 2022.

Unlike well-known but volatile crypto assets like Bitcoin and Ethereum, stablecoins are so named because they are designed to provide price stability by pegging values to real financial assets as collateral, including dollar-denominated bank deposits and commercial paper and commodities. The practical purpose of a stablecoin is to serve as a medium of exchange between real money and crypto assets, facilitating the conversion and storage of funds on coin exchanges or in virtual wallets. In essence, stablecoins are to crypto traders what checking and money market accounts are to stock traders. If virtual and real money flow in their respective streams, cash investors need not be concerned with the crypto goings-on. But recent data shows that is not the case: stablecoins are gobbling up a lot of real liquid assets as collateral, essentially turning into large shadow money market funds without regulatory oversight.

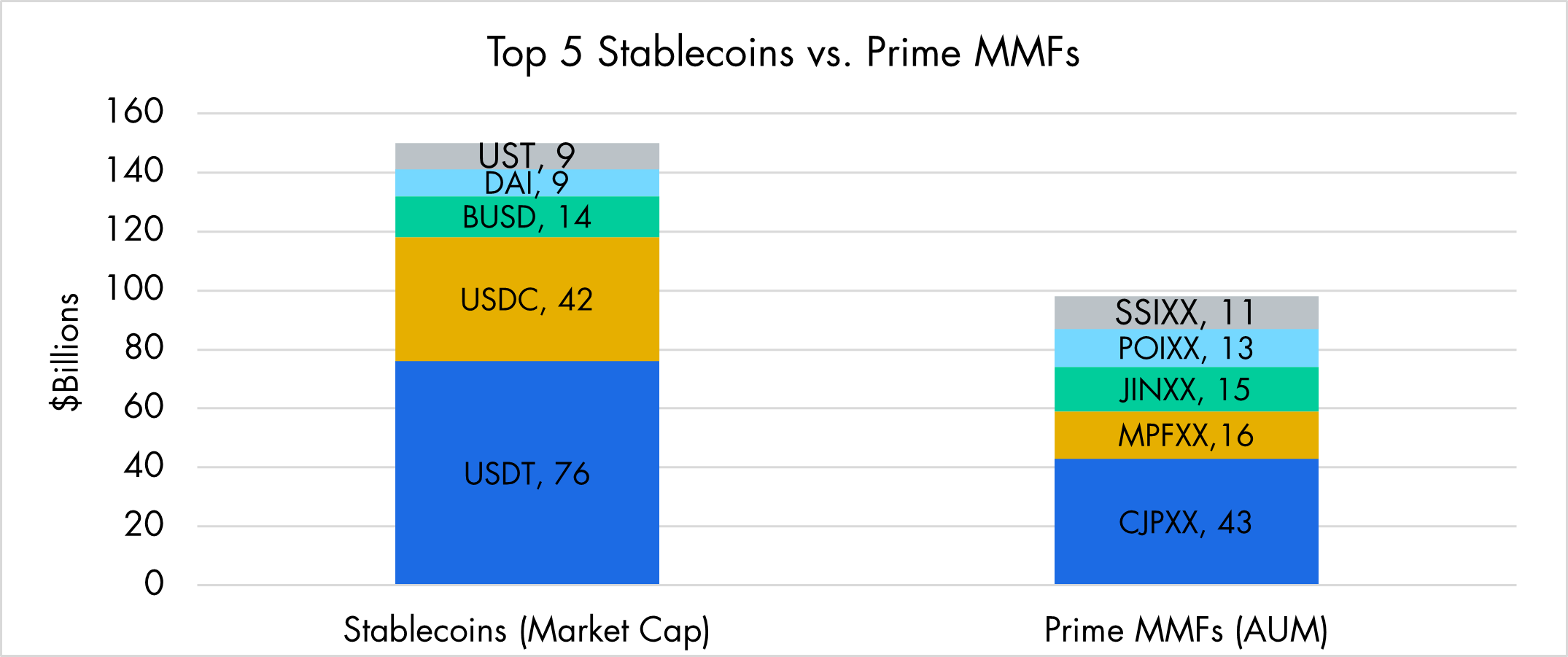

According to CoinmarketCap.com, the top five stablecoins command a market cap of $151 billion.14 This compares to the combined balance of the five largest prime institutional money market funds of $97 billion.15 Considering that stablecoin supply was merely $21 billion a year ago16, their meteoric rise indicates that the gap between the two will grow wider, and quickly. For context, total US commercial paper outstanding is $1.1 trillion, and Treasury bills held by the public amount to $3.7 trillion.17 A rapid unwinding of a stablecoin portfolio may not pose a significant threat to the T-bills market, but the same cannot be said about CP market participants or money market fund investors.

Exhibit 5: Asset Values of Stablecoins vs. Prime MMFs

Source: Crane Data’s Money Fund Intelligence XLS as of November 30, 2021 and the President’s Working Group on Financial Markets’ Report on Stablecoins, dated November 2021

While cash investors are still focused on how to fix prime funds’ run risk, the crypto coins, which dabble in the same liquid assets but loom larger by the day, can be a greater harm due to the lack of transparency in their holdings and lack of regulatory oversight. For example, Tether, the largest stablecoin, discloses its collateral portfolio valuation only quarterly.18 Of the $62.8 billion in assets it held as of June 30th, 2021, roughly 50% was in commercial paper and certificates of deposit, 24% in T-bills, 10% in cash and bank deposits, and the rest in other instruments. Of its CP and CD holdings, less than 48% were rated A-1 or better. USD Coin, the second largest coin, discloses its holdings monthly, which are said to be cash and cash equivalents in US dollar deposits and short-term liquid investments, but with no details offered.19

US financial authorities including the Fed, Treasury and the SEC have taken notice of this potential threat to financial stability. Congress also held hearings on related subjects. We are, however, skeptical of an immediate and effective safety measure forthcoming. Investors wary of unexpected sources of instability in the cash investment world should keep an eye on the crypto space, particularly stablecoins’ collateral values and their portfolio turnovers.

1Bokil, M. et al. High-frequency data indicate supply chain stress in the US and Europe is at its peak. Moody’s Investors Services. https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1311212

2Williams, G. et al. Supply Chain Strains and Rising Costs Will Pressure Profitability in 2022. S&P Global Ratings. https://www.spglobal.com/_assets/documents/ratings/research/100702592.pdf

3See Rachel Morison’s and Anna Shiryaevskaya’s article ‘U.K. Power Surges to Record 400 Pounds as Wind Fails to Blow’ published by Bloomberg on September 13th. https://www.bloombergquint.com/business/u-k-power-prices-hit-record-as-outages-low-winds-cut-supply

4See Ben Dummett’s article ‘While Shell Resists Breakup, Rivals See Opportunity From Spinoffs’ published by the Wall Street Journal on December 3rd. https://www.wsj.com/articles/while-shell-resists-breakup-rivals-see-opportunity-from-spinoffs-11638527400

5See Stanley Reed’s and Claire Moses’ New York Times Article ‘A Dutch Court Rules that Shell Must Step Up its Climate Change Efforts’ published on October 28th. https://www.nytimes.com/2021/05/26/business/royal-dutch-shell-climate-change.html

6See PIMCO’s Asset Allocation Outlook published on July 14th written by Erin Browne and Geraldine Sundstorm. https://www.pimco.com/en-us/insights/economic-and-market-commentary/global-markets/asset-allocation-outlook/mid-cycle-investing-time-to-get-selective/

7See the Treasury’s press release on FSOC’s recommendation on climate-related financial risk, published on October 21st. https://home.treasury.gov/news/press-releases/jy0426

8See the Fed’s October 21st press release pertaining to FSOC’s report on climate related financial risk and what the Fed is doing to combat these risks. https://www.federalreserve.gov/newsevents/pressreleases/other20211021c.htm

9See Fitch Ratings’ October 12th report ‘Canada Banks Face New Climate Regulation, Capital Requirements’. https://www.fitchratings.com/research/banks/canada-banks-face-new-climate-regulation-capital-requirements-12-10-2021

10Ibid

11Ibid

12See S&P Global’s May 12th report ‘A Short Guide to the EU’s Taxonomy Regulation.’ https://www.spglobal.com/esg/insights/a-short-guide-to-the-eu-s-taxonomy-regulation

13See the SEC’s April 9th risk alert, ‘The Division of Examinations’ Review of ESG Investing’ https://www.sec.gov/files/esg-risk-alert.pdf

14As of December 20, 2021: Tether, $76 billion, USD Coin, $42 billion, Binance USD, $14 billion, Dai, $9 billion, and TerraUSD, $9 billion. Source: https://coinmarketcap.com/view/stablecoin/

15The five largest prime institutional money market funds (excluding internal portfolios) are: JPMorgan Prime ($43 billion), Morgan Stanley Institutional Liquidity Prime Institutional ($16 billion), JPMorgan Prime MM I ($15 billion), Federated Hermes Inst Prime Obligations IS ($12 billion) and State Street Inst Liquid Res Prem ($11 billion). Source: Crane Data’s Money Fund Intelligence XLS as of November 30, 2021. https://cranedata.com/. Access requires subscription.

16See the President’s Working Group on Financial Markets’ Report on Stablecoins, dated November 2021. https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf

17Federal Reserve data as of as of December 15, 2021. https://www.federalreserve.gov/releases/cp/. Treasury Department’s monthly statement of public debt website as of November 30, 2021. https://www.treasurydirect.gov/govt/reports/pd/mspd/mspd.htm

18See Tether’s latest “Assurance Opinion” by Moore Cayman as of June 30, 2021. https://tether.to/latest-assurance-opinion-confirms-tether-fully-backed/

19See USD Coin’s October 2021 Examination Report by Grant Thornton. https://www.centre.io/usdc-transparency

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.