Rates, Liquidity, and Tariffs: Three Questions to Answer in 2025

Introduction

2024 was a remarkable year for financial markets in many respects.

The estimated 2.7% growth in real gross domestic product (GDP) nearly doubled the Federal Reserve’s median projection of 1.4% a year earlier.[1] The S&P 500 stock index rose 23.3% on the heels of an equally impressive gain of 24.2% in 2023. Core Consumer Price Index (CPI) inflation improved from 3.9% at year-end 2023 to 3.3% through November 2024. The Fed made three consecutive interest rate cuts totaling 100 basis points (bps), reducing the federal funds rate to a range of 4.25% to 4.5%.

The strength of the US economy was even more remarkable when factoring in the long list of political headwinds, primarily the consequential presidential election cycle. A sudden change at the top of the Democratic ticket late in the race and two assassination attempts on the Republican nominee failed to rain on the parade. Nor did other events, including the widened war in the Middle East that saw direct military conflicts between Israel and Iran, and a ban on TikTok.

Looking back at the three themes our credit team identified in January 2024, we discussed: (1) Ghost of the great inflation haunting the Fed in rate cuts; (2) Corporate credit staring down the great (maturity) wall; and (3) Known unknowns in deglobalization threatening growth and inflation. On the first point, the Fed’s path to a 100 bps-reduction was not without drama and ended the year with uncertain rate outcomes for 2025. Our second concern regarding corporate issuers facing an ever-growing wall of maturing debt was alleviated by an accommodative Fed and rising equity valuation. Nevertheless, we believe the wall remains menacing in the new year, especially for speculative grade credits and commercial property owners/developers. Lastly, on the megatrend of deglobalization, little needs to be said about what flooded the news waves in an election year—the real and rhetorical threats of tariffs, restrictions of trade, banned technology transfers, and a competing arms race of commodity and infrastructure deals with the developing world between a US-led Western alliance and the BRICS nations (Brazil, Russia, India, China, and South Africa). The trends we expected for 2024 may well continue into 2025 and beyond.

But it will not do to say that 2025 is a supersized version of 2024. The credit team at Capital Advisors Group identified additional trends and themes that may shape the short-term debt market in interest rates, liquidity and credit. Out of the conversation came not three trends to watch but three questions to answer in 2025.

Our analysts present their cases on these questions for 2025:

- Is Goldilocks here to stay?

- Are reserves reaching a critical threshold?

- Will tariffs “seriously, but not literally” impact growth and inflation?

Is Goldilocks Here to Stay?

2024 played out about as well as the Fed could have asked for. Coming into 2024, the Federal Open Market Committee (FOMC) had already done the hard work of raising interest rates from 0% to 5.5%. However, there were concerns that after six months of holding rates steady, the Fed would be forced to restart its hiking cycle to deal with a nascent retrenchment of inflation. Equally unclear was whether higher rates would lead to an unmooring of the labor market, if not an outright recession.

In the end, the economy outperformed on every front. The labor market remained strong, progress on the inflation front continued, and growth is set to exceed 2.5%. The Fed engaged in a relatively orderly 100 bps in cuts in 2024. As things stand, the Fed’s dual mandate seems to be roughly in balance.

The questions for 2025 then are two-fold:

- Can the Fed continue to proceed in an orderly manner?

- Where is the terminal level?

The market and private forecasters agree on the first question. In their economic outlook for 2025, J.P. Morgan stated the Fed is “one area where policy uncertainty does not appear exceptionally high” (in contrast to, say, fiscal policy).[2] The market expects one to two cuts next year and the Fed’s December SEP projected two cuts.

This analyst wonders, however, if the market isn’t putting the cart before the horse. Despite progress made, inflation remains stubbornly above target, particularly on the core side. Fed Governor Christopher Waller described the process of trying to rein in inflation as akin to an MMA fighter who keeps getting his opponent in a chokehold only for them to “slip out of (their) grasp at the last minute.”[3] This lack of predictability suggests some upside risk to inflation, particularly in the context of greater uncertainty around fiscal, trade, and immigration policies.

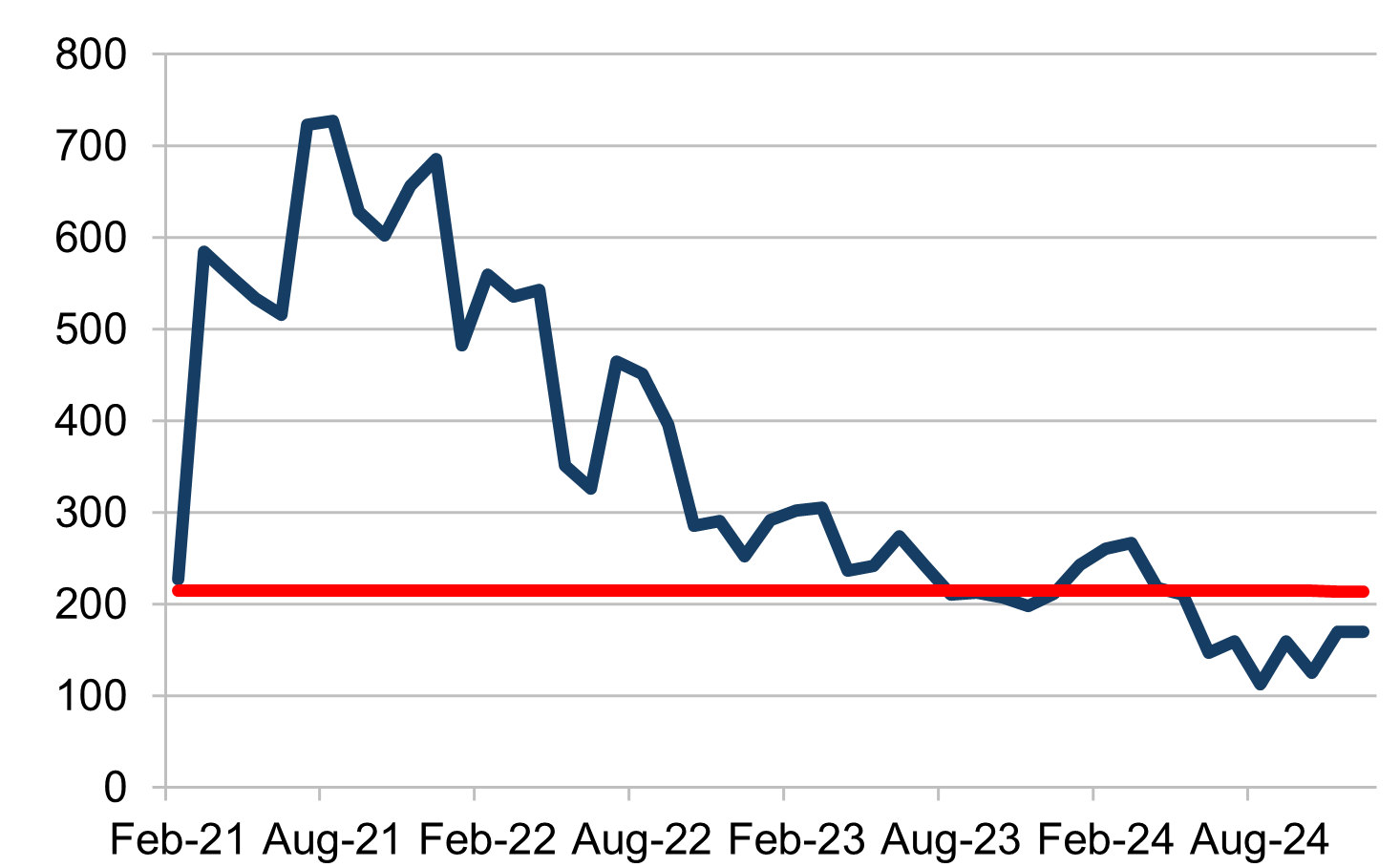

Moreover, concerns over a potential downturn in labor conditions have receded, at least in the near-term. Payroll growth has rebounded over the past few months, while unemployment has stabilized in the low 4% range following a rise in the first half 2024. There are some signs of a reduction in labor velocity, namely a falling quits rate, lower nominal wage growth, and a reduction in job openings relative to unemployed persons. However, these developments seem consistent with a “normalization” of labor conditions rather than an outright deterioration.

3M Rolling Average Nonfarm Payrolls (K)

Source: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, FRED.

Some Fed officials have already suggested that given this backdrop the FOMC can adopt a “wait and see” approach in the coming meetings, particularly now that policy has come down from its most restrictive level. It seems that something unexpected would be needed to jolt the Fed out of this comfortable state.

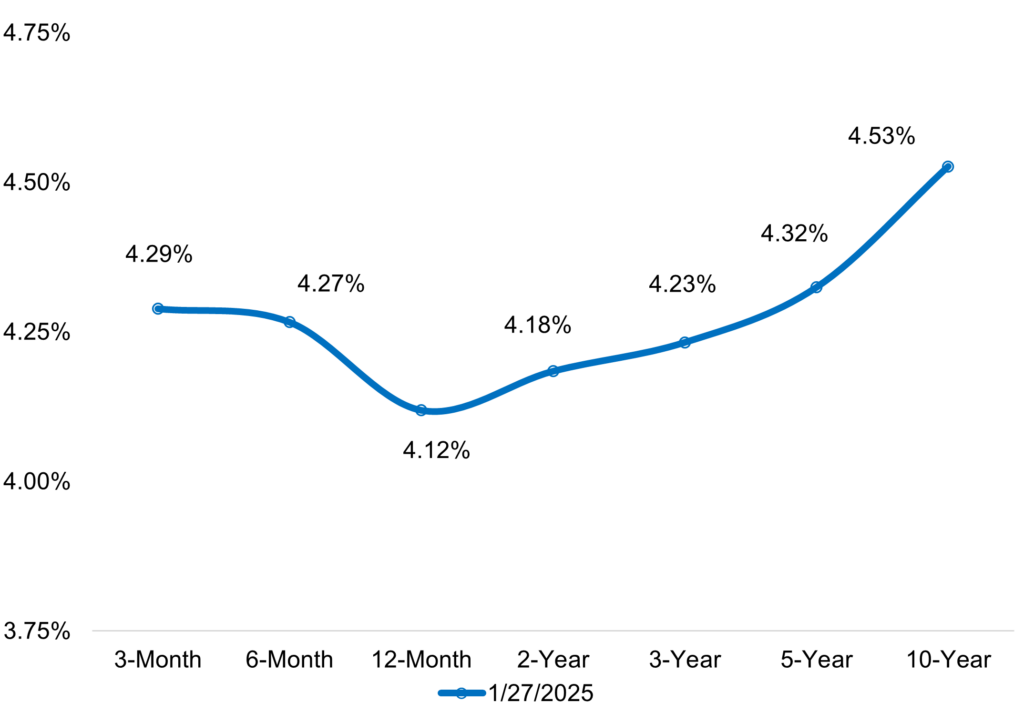

The second question refers to something we first addressed back in October 2023, namely whether the neutral policy rate has risen. This debate is by no means settled; however, the current yield curve is a big check mark for the higher neutral rate column. The market appears to believe that higher rates are here to stay.

Treasury Curve

Source: Bloomberg

There are a few reasons to be wary of putting too much stock into what the curve is forecasting. First off, rate volatility has been elevated, suggesting that the long end of the curve may shift significantly from here. Secondly, it’s difficult to point to any specific fundamental reason that rates should be so much higher than they were pre-pandemic. Inflation is now below 3%, productivity has risen but is still low by historical standards, immigration surged but is set to subside.

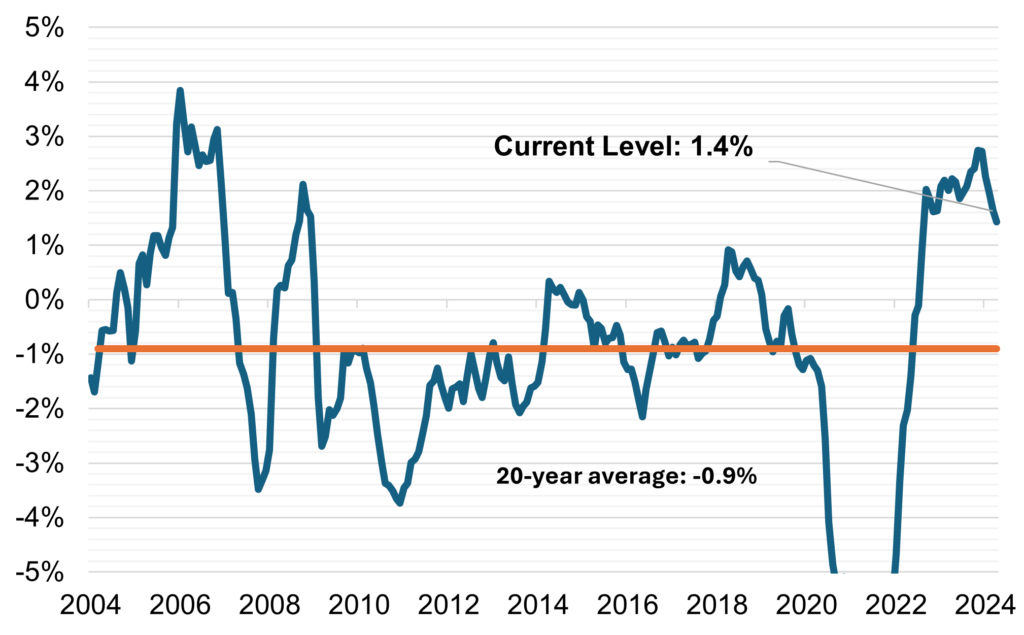

From a historical perspective, 3-4% interest rates are hardly unusual for an economy where nominal GDP growth is running above 4% (as is currently the case as of January 2025). It’s possible the economy is simply returning to a more normalized state, one where businesses don’t need deeply negative real interest rates to function. To that end, J.P. Morgan forecasts that business investment will expand by 3% in 2025 despite the real fed funds rate (shown below as the fed funds rate less 12-month CPI inflation) being north of 1%.

Real Fed Funds Rate

Source: Federal Reserve Bank of St. Louis, FRED, Bureau of Labor Statistics

Taken as a whole, this supports the view that the terminal rate may be meaningfully higher than in recent cycles. The market is projecting ~4.0%, while the Fed’s estimate is currently 3.0%. Take the Fed’s estimate with a grain of salt however, as they have been revising it up systematically for the better part of a year. In summation, it’s difficult to pinpoint a single number, but as Wall Street Journal reporter Nick Timiraos noted, most estimates place the neutral fed funds rate somewhere between 2.5% and 4%.[4]

Are Reserves Reaching a Critical Threshold?

By Keren Luo

As we move into 2025, the Federal Reserve finds itself navigating an unclear path as it shrinks its balance sheet, reducing banking system liquidity without knowing exactly how low reserves should fall. Over the past few years, quantitative tightening (QT) has steadily drained reserves from the banking system, which has been partially offset by falling Overnight Reverse Repo Program (ONRRP) balances as money market funds (MMFs) purchased Treasury securities to extend duration and replenish reserves in 2024. With ONRRP levels now nearing zero, there is renewed interest in a perennial question: How low can reserves go before the system begins to become strained? The Fed, for its part, continues to emphasize its “ample reserves” regime, but lack of a clear definition of “ample” has left analysts and market participants guessing where the tipping point might lie.

The Fed’s challenge is twofold: (1) identifying the signals that reserves are nearing critically low levels, and (2) determining how the Fed might respond. The former is less about setting an arbitrary reserve level and more about interpreting real-time indicators of stress. The latter will likely depend on how well the Fed can maintain flexibility in its policy toolkit.

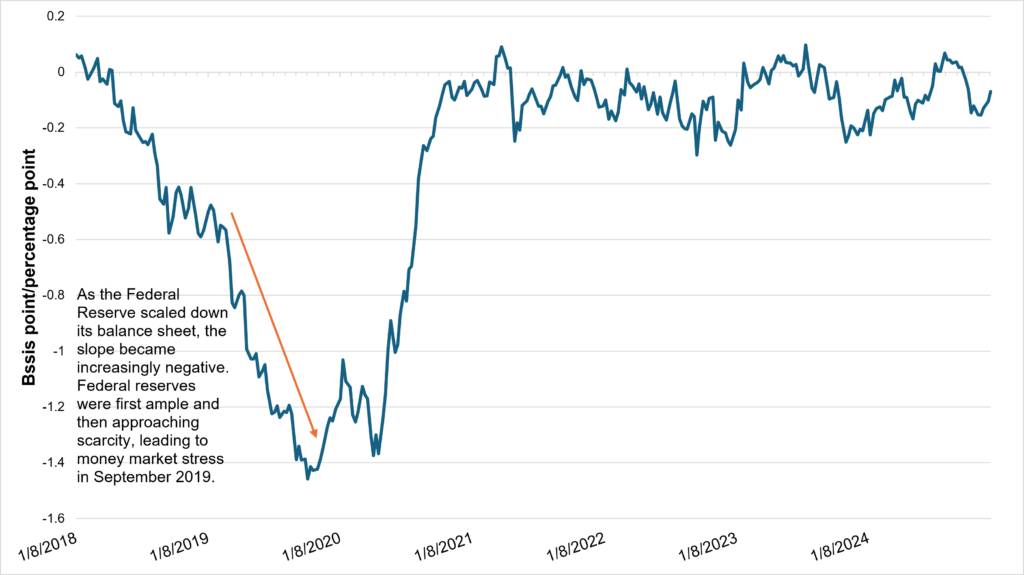

Early Warning Signs of Reserve Scarcity

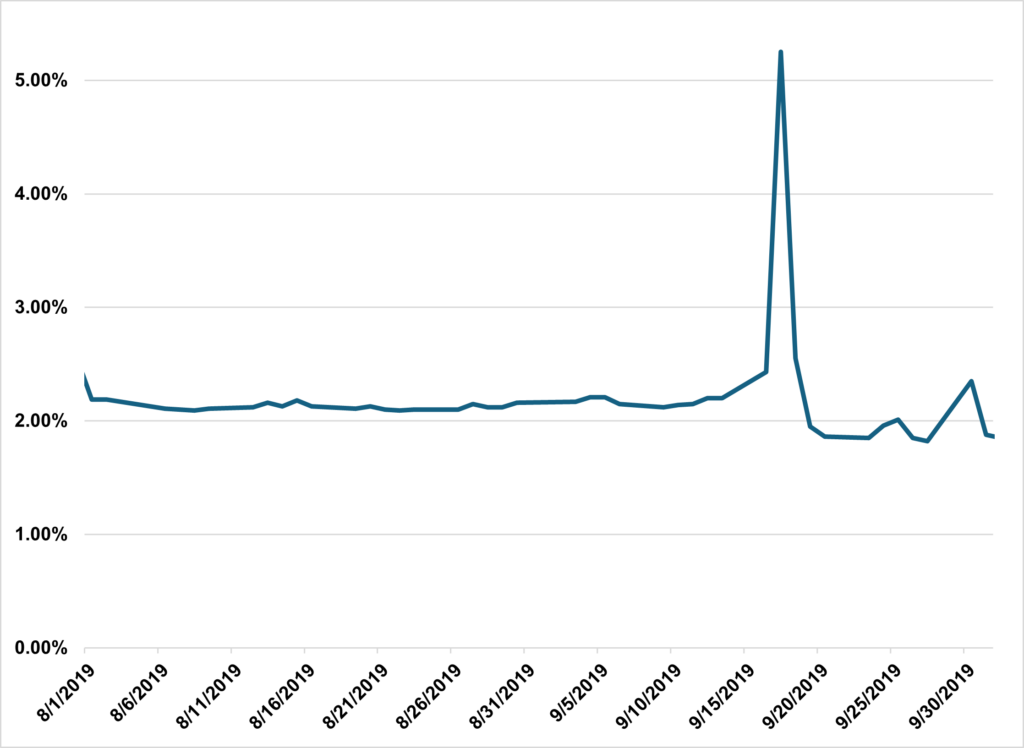

One of the most compelling real time indicators of reserve scarcity is the elasticity of the federal funds rate to changes in reserve supply. When reserves are ample, the federal funds rate remains largely insensitive to small fluctuations in reserves. But as reserves decline, the slope of the reserve demand curve becomes increasingly negative, as rates become more responsive to even minor shifts in reserve supply.[5] We saw this dynamic play out during the 2018-2019 QT cycle. By mid-2019, the elasticity of the federal funds rate had turned sharply negative, signaling that the banking system was approaching a tipping point.[6] In September of 2019, Secured Overnight Financing Rate (SOFR) rates jumped over 3 percentage points, as banks clamored for liquidity.

Reserve Demand Elasticity

SOFR August 2019-Setermber 2019

Sources: Federal Reserve Bank of St. Louis, FRED, Federal Reserve Bank of New York[7]

The 2019 “repo ruckus” was a stark reminder of how quickly conditions can deteriorate when reserves become scarce. Since then, real-time estimates of the reserve demand curve have become a cornerstone of the Fed’s monitoring efforts, allowing policymakers to detect when the system transitions from ample to abundant or even scarce. Analysts may watch for signs of a steepening elasticity curve, which could foreshadow increased rate volatility and funding market stress.

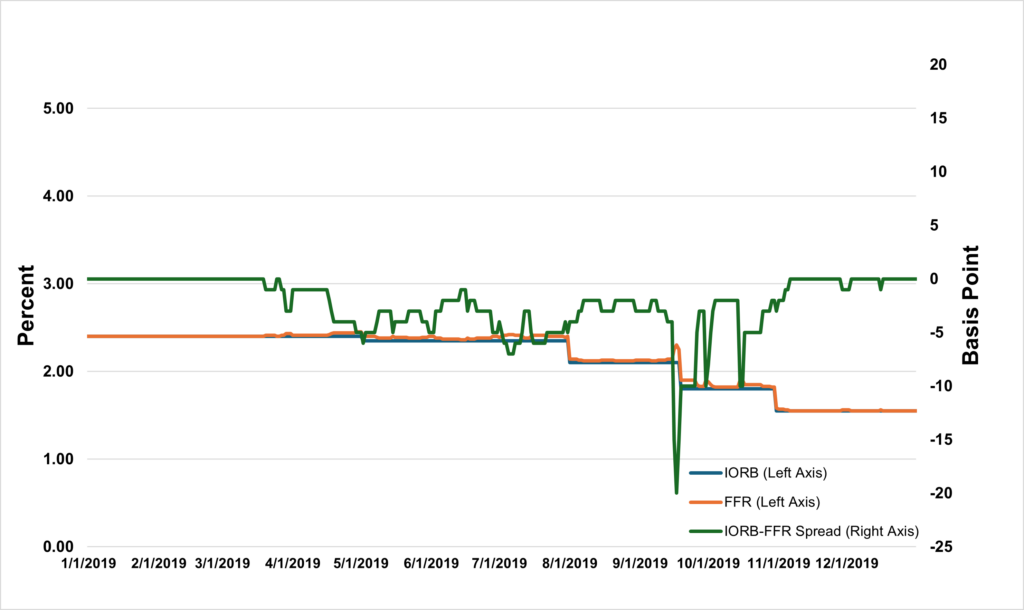

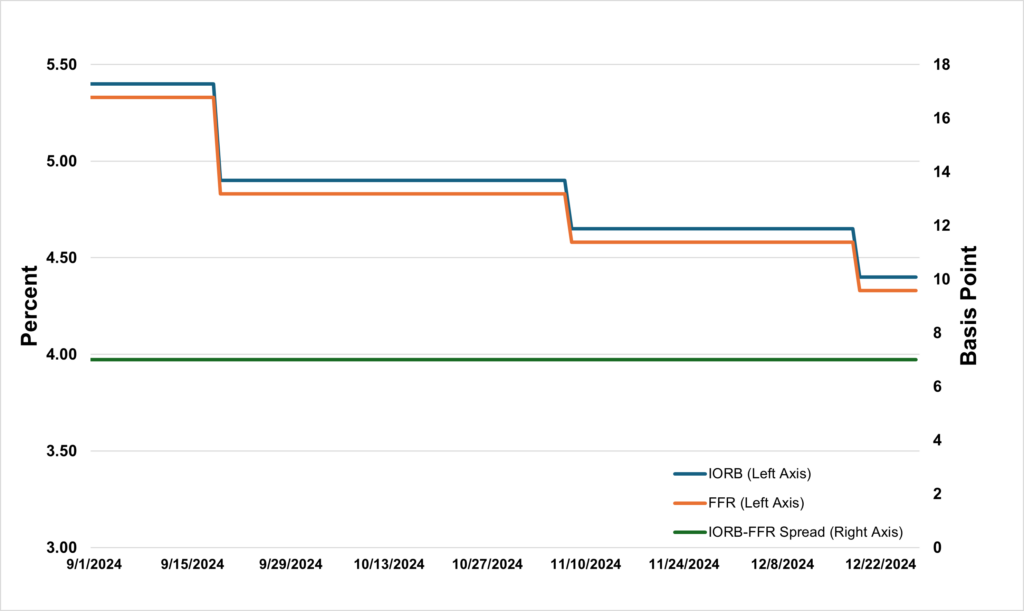

Another key indicator of reserve scarcity is the spread between the Effective Federal Funds Rate (EFFR), which is set by the market, and the interest on reserve balances (IORB), which is administered at a set level by the Fed. The FFR is usually slightly below IORB, as banks are largely indifferent when they can earn a positive interest spread between the two rates.[8] As reserves decline, demand for liquidity may cause the spread to invert, even to the point of moving the EFFR above the IORB, which was observed in 2019.[9] If reserve levels continue to decline under QT, a similar dynamic may emerge in 2025. The Federal Reserve’s balance sheet runoff is projected to bring reserves to approximately 12%–13% of bank assets by 1Q 2025, down from 14% as of 4Q 2023. At these levels, short-term interest rates may become more sensitive to changes in reserves, compressing the spread, which averaged 7-bps in 4Q 2024, and reflecting growing liquidity constraints in the banking system.

IORB-FFR Spread During 2019 Repo Market Crisis

IORB-FFR Spread in 4Q2024

Source: Federal Reserve Bank of St. Louis, FRED.

Glaring Red Lights of Reserve Scarcity

Market-based indicators are real-time stress gauges for reserve scarcity. Often when these signals appear, reserves have already dipped too low, leading to a scramble for reserves.

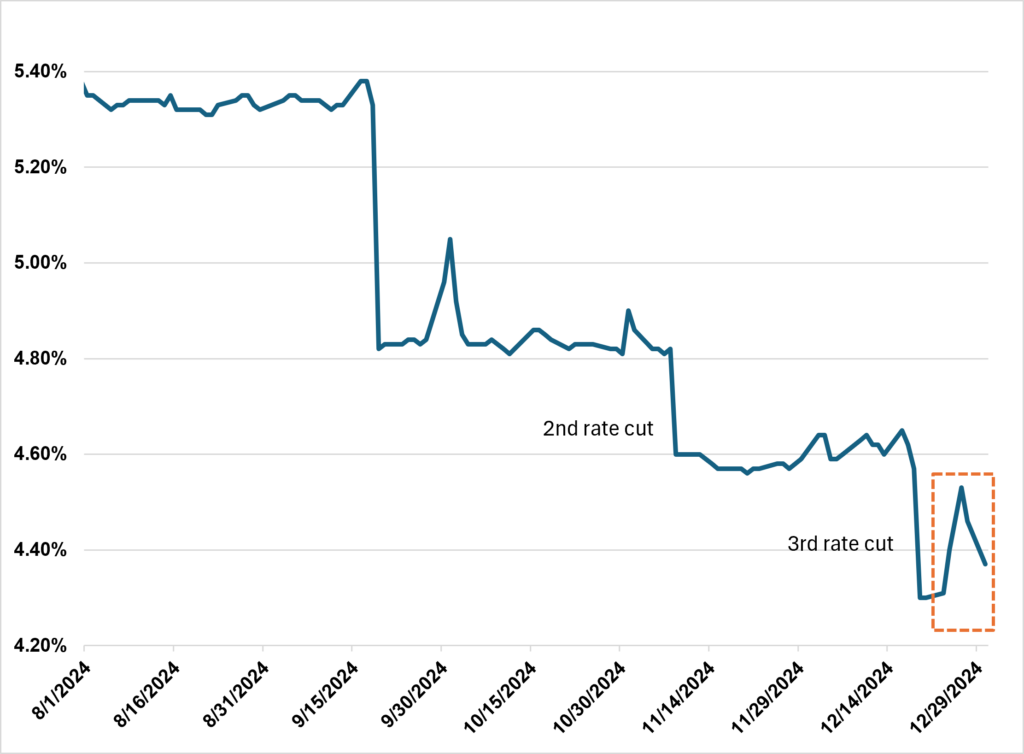

SOFR August 2024 – December 2024

Source: Federal Reserve Bank of St. Louis, FRED

SOFR, a market-based composite rate for repurchase agreements (repos) backed by Treasury securities as collateral, is highly sensitive to fluctuations in reserve levels. When reserves are abundant, SOFR tends to remain largely stable. As reserves decline, even a small change in funding demand may lead to abrupt spikes in SOFR, signaling heightened competition for liquidity.[10] The Fed responded to the sharp and unexpected increase in repo rates in 2019 with temporary liquidity injections.[11] Subsequently, it established the Standing Repo Facility (SRF) in 2021 to mitigate liquidity stress from depleted reserves or other causes before it spirals out of control.

Operating at a rate slightly above prevailing market levels, the SRF deters routine use during normal conditions while ensuring a reliable and immediate liquidity backstop during stress. The program’s emergency response nature makes its balances a key barometer for the liquidity health of the banking system.

Interpreting Stress Signals and Policy Implications

Together, early warning signs and market indicators formed a comprehensive framework for assessing how declining reserves may impact financial stability. By closely monitoring these signals, the Fed can adapt its approach to QT and deploy tools like the Standing Repo Facility or adjustments to administered rates to help maintain stability.

The path forward requires a delicate balance. While declining reserves are a natural consequence of balance sheet normalization, understanding the thresholds at which liquidity stress emerges is critical to preserving financial market functionality. The lessons of 2019 remain relevant, serving as both a warning and a case study for navigating the complexities of reserve dynamics in the year ahead.

Will Tariffs “Seriously, but not Literally” Impact Growth and Inflation?

Since Donald Trump was re-elected in November 2024, there has been significant speculation as to how the President’s policies will impact the global economy. There is a broad spectrum of proposals and potential impact, but the cornerstone of Trump’s economic policies center around three things: tariffs, taxes, and deregulation.

While de-regulation and tax cuts could impact profitability, deficit spending, and inflation, it is more likely that tariffs may have the most immediate economic impact in 2025 among the three. Should the Tax Cuts and Jobs Act of 2017 be extended, its impacts will likely not be felt until 2026, when the law is set to expire. Likewise, while a more pro-business regulatory environment will be a tailwind for some industries, it is unlikely to provide any “silver bullet” to a particular sector or group of sectors.

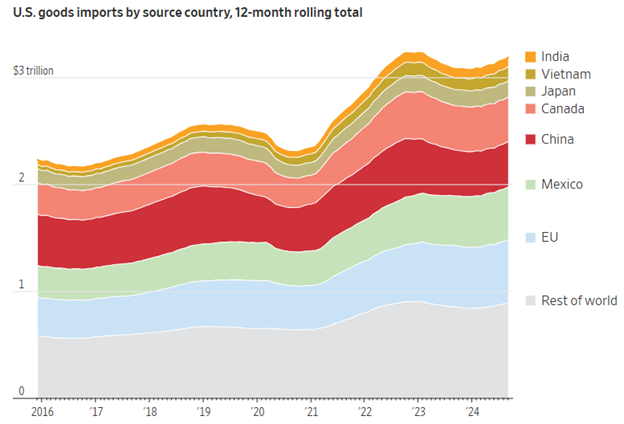

Tariffs are a particularly noteworthy risk in 2025 due to the ramifications on inflation and Fed policy. President Trump has suggested he will implement tariffs of up to 60% on goods from China, 25% on goods from Mexico and Canada, and baseline tariffs of 10%-20% on everything else. Motivation for these tariffs varies, from promotion of domestic manufacturing to increasing federal revenues. Most of all, the threat of tariffs has been perceived as a starting point to negotiate with other nations. For example, Trump cited lack of border security as a factor for tariffs on Mexico and Canada, suggesting a promise of stronger border enforcement could see these tariffs halted. The widespread belief is that tariffs will evolve to be less severe than initially promised. Many are taking the threats “seriously, but not literally.”[12]

However, tariffs of any kind would ultimately be incorporated into the final price of goods, risking a potential rebound in inflation. It is difficult to forecast the impact given the variables, including the extent to which prices are passed on to the consumer, which countries realize tariffs, and the duration of tariffs. J.P. Morgan estimates that a 60% tariff on China, if fully passed through to the consumer, would raise core inflation by 0.2%, while Barclays estimates a 25% tariff on Mexico and Canada would raise prices by 0.35-0.40%.[13],[14] While these increases are somewhat modest, the US consumer could be more susceptible to price increases after a prolonged period of high inflation, meaning additional price increases could deter consumption and negatively impact GDP growth. However, if tariffs had a considerable impact on growth, the US would likely negotiate with other countries to ease restrictions and mitigate damage to the economy.

Moreover, tariffs are usually a short-lived change in the price level, meaning it is less likely to impact short-term decision-making at the Fed. But given that the last leg of inflation reduction has proven trickier than expected, failure to bring inflation closer to 2% may reduce the number of times the Fed plans to cut rates in 2025. Already, the Fed has reduced the number of projected interest rates cuts in 2025 to two from four, according to the Fed’s December 2024 Summary of Economic Projections report.

Some tariffs appear more likely to become a reality than others. Trump may be more likely to adhere to proposed tariffs on China given geopolitical tensions. The trend of nearshoring may partially mitigate tariffs on China. Alternatively, tariffs against more amicable trade partners may be less likely to stick around or to materialize at all. Mexico and Canada are important trade partners to the US, with Mexico manufacturing roughly 16% of cars sold in the US and Canada providing 60% of all oil imports.[15] A trade war among partners ultimately hurts all parties involved, and as a result negotiations look more probable than tariffs.

Source: Wall Street Journal, Trade Partnership Worldwide, Census Bureau

To summarize, tariffs may provide upside risks to inflation and downside risk to growth, but there is significant uncertainty over the magnitude and timing. However, some things are easier to predict, such as which countries are more likely to realize the threat of tariffs. Looking into 2025, investors should monitor the impact of tariffs on core inflation, particularly if headline inflation remains stubbornly above 2%. Persistently high inflation may lead the Fed to be more patient with rate cuts or to stop cutting altogether. But if tariffs do not materialize as planned, or if they have a minimal impact on the overall price level, the Fed may continue to lower rates as planned.

Conclusion: Maintain Ample Flexibility in 2025

There you have it. As our analysts pose their observations and analysis in question format, it is fair to say that we see multiple paths forward for the economy, inflation, interest rates, as well as liquidity and credit performance. 2025 will also be a year when investors take on the additional role of onlookers as a new administration embarks on an “unprecedented mandate” to reform a large swath of the federal government. Economic and market consequences may be far-reaching. We caution, more than ever, to maintain adequate liquidity and ample flexibility in cash investment portfolio construction.

[1] The Conference Board’s forecast as of December 17, 2024: https://www.conference-board.org/publications/pdf/index.cfm?brandingURL=us-forecast.

[2] Feroli, M., Hanson, M., Reinhart, A., & Tasci, M. (2024, November 21). 2025 US Economic Outlook: Yes, There Are Two Paths. In J.P. Morgan Economic Research. https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4846376-0

[3] Waller, C. (2024, December 2). Cut or Skip? Building a Better Fed Framework. https://www.federalreserve.gov/newsevents/speech/waller20241202a.htm

[4] Timiraos, Nick. “Will the Fed Keep Cutting in 2025?” Wall Street Journal, 16 Dec. 2024, www.wsj.com/economy/central-banking/federal-reserve-interest-rates-2025-1c5cc687?mod=djem10point.

[5] Federal Reserve Bank of New York. (2024, August). When are central bank reserves ample? Liberty Street Economics. https://libertystreeteconomics.newyorkfed.org/2024/08/when-are-central-bank-reserves-ample/

[6] Federal Reserve Bank of New York. (n.d.). SOFR (Secured Overnight Financing Rate). https://www.newyorkfed.org/markets/reference-rates/sofr

[7] The slope represents the elasticity of the federal funds rate to shocks in the supply of reserves: it shows by how many basis points the spread between the federal funds and IORB rates would move for an increase in aggregate reserves equal to 1 percent of banks’ total assets.

[8] Federal Reserve Bank of New York. (2022, October). Measuring the ampleness of reserves. Liberty Street Economics. https://libertystreeteconomics.newyorkfed.org/2022/10/measuring-the-ampleness-of-reserves/

[9] Federal Reserve Bank of New York. (2022, October). Measuring the ampleness of reserves. Liberty Street Economics. https://libertystreeteconomics.newyorkfed.org/2022/10/measuring-the-ampleness-of-reserves/

[10] Williams, J. C. (2024, September 26). Speech at the Economic Club of New York. Federal Reserve Bank of New York. https://www.newyorkfed.org/newsevents/speeches/2024/per240926

[11] Federal Reserve Bank of Richmond. (2023, July). The role of reserves in monetary policy (Economic Brief No. 23-07). https://www.richmondfed.org/publications/research/economic_brief/2023/eb_23-07

[12] Josep M. Colomer, “To Understand Trump, Take Him Seriously, but Not Literally,” Fair Observer, November 24, 2024, https://www.fairobserver.com/politics/to-understand-trump-take-him-seriously-but-not-literally/.

[13] Feroli, M., Hanson, M., Reinhart, A., & Tasci, M. (2024, November 21). 2025 US Economic Outlook: Yes, There Are Two Paths. J.P. Morgan Economic Research. https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4846376-0

[14] Millar, J., Giannoni, M., Sriram, P., & Johanson, C. (2024, November 29). The Return of the Tariff: Warning Shots Fired. Barclays FICC Research. https://live.barcap.com/PRC/publication/CL_TEJ-IH4gfiB-IH4g_674a31adf345ad36ede5a2e8

[15] Douglas, J., Harrup, A., & José de Córdoba. (2024, November 26). Trump’s Proposed Mexico, Canada Tariffs Would Upend North American Trade Pact. The Wall Street Journal. https://www.wsj.com/economy/trade/trump-fires-salvo-on-north-american-trade-pact-eded4fca?mod=hp_lead_pos1

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.