Powell’s Got the Power: How the Fed Brought Funding Markets Back from the Dead

Funding markets are back from the dead. A little over two months ago, liquidity in short-term markets all but dissipated amidst a broader market panic in reaction to COVID-19. But fast action by the Fed prevented what might have turned into a full-blown liquidity freeze reminiscent of the one that helped precipitate the 2008 financial crisis. Promising trillions of dollars of potential support with an array of new programs, the Fed quickly restored investor confidence and stabilized liquidity markets. In the process, it established a “new normal” in the corporate cash management landscape.

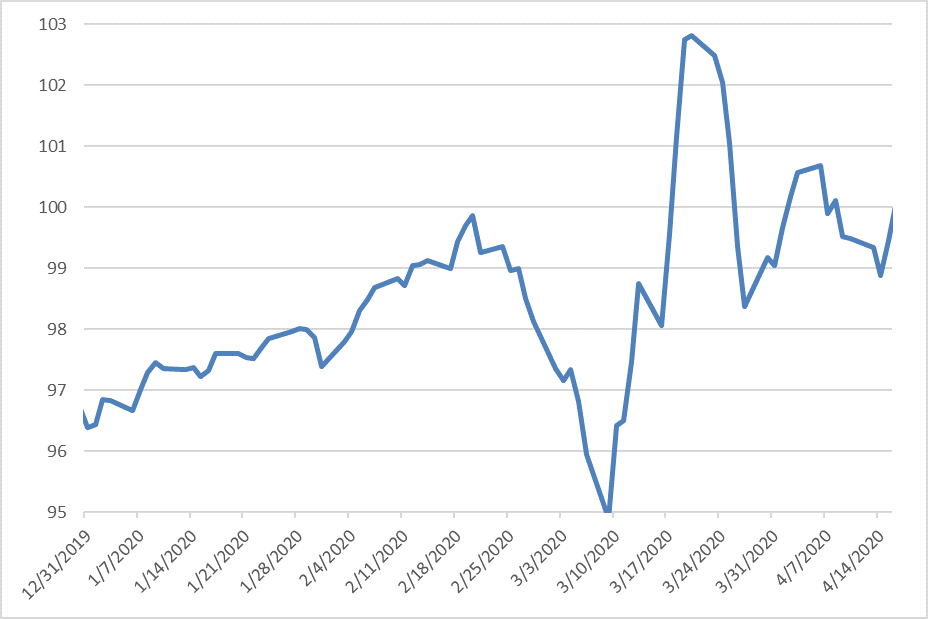

The mid-March sell-off in equities that sent stock market indexes into free-fall was widely reported in the media. Less noticed, but equally important, were the strange things happening in money markets at the same time. In the week prior to March 16, prime money market funds experienced a shocking outflow of $60 billion, and tens of billions more drained from corporate bond funds as investors flocked to safety and liquidity. The only in-demand asset was US dollars, which soared over the back half of March (Figure 1).

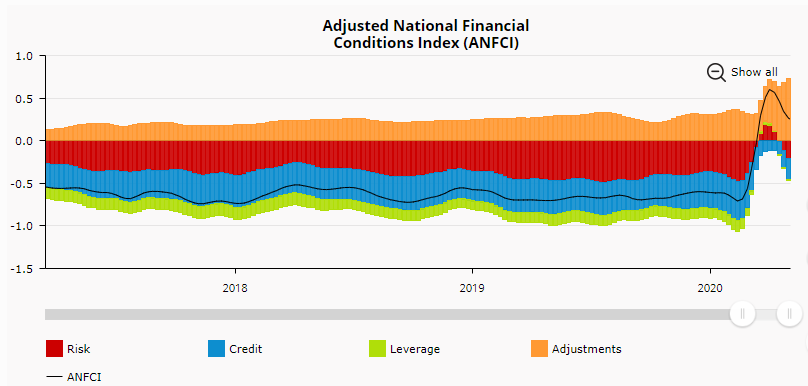

This led to a shortage of dollars in foreign exchange markets, a shortage of dollars for corporates seeking funding, and perhaps most oddly, a temporary rise in the yields on long-dated Treasury bonds. In short, nothing was working as it normally would, resulting in a severe tightening in credit conditions that threatened to send the entire global financial system in a downward spiral (Figure 2).

Figure 1: US Dollar Index

Source: Bloomberg

Figure 2: Chicago Fed Financial Conditions Index

Source: Chicago Fed

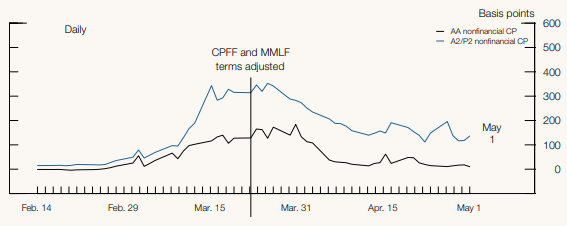

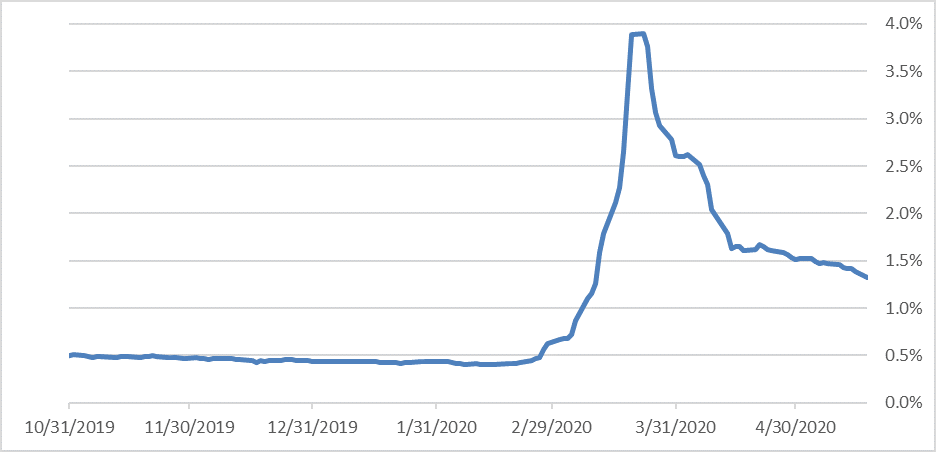

Fast-forward to May and, lo and behold, markets are working normally again. Most importantly, from our perspective, USD funding markets look relatively healthy, with active participants and healthy liquidity levels. Commercial paper spreads have come down significantly (Figure 3), to the point where the highest rated issuers are below the upper end of the Fed’s 0-0.25% interest rate target. And OAS levels on short-to-intermediate term corporate bonds have rallied to more reasonable levels (Figure 4).

Figure 3: 30-Day Commercial Paper Spreads to Treasuries

Source: Federal Reserve Financial Stability Report

Figure 4: Bloomberg Barclays 1-3 Year US Corporate Index- OAS to Government

Source: Bloomberg

How could this have happened, even as the COVID-19 economy remains highly uncertain? The unemployment rate is now 14.7% and headed upwards, yet at the same time short-term market spreads keep narrowing. The answer is partially due to the nature of the shock (which is abnormal), but even more so to the actions taken by the Federal Reserve. The Fed has established a litany of programs in the wake of the crisis, most notably the Money Market Liquidity Facility (MMLF), the Commercial Paper Funding Facility (CPFF), and the Primary & Secondary Corporate Credit Facilities (PMCCF & SMCCF). These programs either explicitly provide funding or support funding for investment grade companies, along with so-called “fallen angels.” (For more on the new Fed programs, see our May research report).

The fascinating thing about these programs is that, so far, they have hardly been used. Analysis of the Fed’s most recent Balance Sheet release indicates that as of 5/28/20, uptake on the MMLF and CPFF has been just $34.3B and $11.6B, respectively. For comparison, total money fund assets are $4.8 trillion1, and Tier-1 commercial paper outstanding is north of $400 billion2. Furthermore, the Fed’s corporate bond buying facilities have yet to get off the ground. It has only just now started purchasing bond ETFs (and is not even lending directly to companies). All-in-all, the total amount of actual lending the Fed has done through these programs is negligible.

It may seem counterintuitive, but the lack of activity in these programs is a positive. The Fed moved remarkably quickly over the latter half of March, making clear its intention to backstop liquidity in short-term markets. Because market participants viewed the Fed’s programs as credible, this had the effect of increasing their willingness to extend credit to borrowers. Chair Powell noted this phenomenon explicitly during his April 29th press conference, stating “many companies that would’ve had to come to the Fed have now been able to finance themselves privately since we announced the initial term sheet on these facilities.” Most emblematic of this was Boeing, who after seeking a bail-out from the government was able to raise $25 billion, in what was its largest bond offering ever, at the end of April.

There are a couple of takeaways here. The most obvious is that the impact of the Fed’s programs extend far beyond its balance sheet, into the confidence they instill in market participants. Furthermore, the Fed’s assertiveness in supporting the functioning of short-term markets so far is indicative of its capacity and willingness to do so going forward.

In both this crisis and 2008, the Fed focused explicitly on maintaining short-term liquidity markets because it views their functioning as essential to supporting broader credit conditions. And during today’s COVID-19 lockdown, where the Fed has less control over hitting its macroeconomic targets (e.g. full employment and 2% inflation), it stands to reason that the Fed will be even more diligent in providing ample liquidity to the financial system. For institutional cash investors, this should provide comfort that current conditions, rather than what we saw two months ago, are the new normal.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

1According to the Investment Company Institute as of 5/27/20

2Federal Reserve as of end of May

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.