October Month-End Portfolio Update

Resilient Consumer Continues to Spend – No Grinch Forecasted

Recent economic data highlights a resilient consumer ahead of the holiday season:

- Retail Sales: The September retail sales report rose +0.4% vs +0.3% expected while the Control Group rose +0.7% vs +0.3% expected, the strongest reading in 3 months. 10 of the 13 categories posted increases led by the “miscellaneous” category rising +1.5%. Eating and drinking establishments rebounded and rose +1%, the largest increase for that category this year. This is the only service-sector category and usually the area from which consumers pull back at the onset of a downturn, so September’s rebound was a good sign for the consumer.

- GDP Personal Consumption: The initial reading for Q3 GDP came in at +2.8% with consumer spending leading the way. The personal consumption component spiked +3.7%, which is up from the +2.8% reading in the second quarter and higher than expectations of +3.3%. This was the highest reading since early 2023 and was broad based with increases in autos, household furnishings and recreational items.

- Personal Spending: The September reading for personal spending came in higher than expected at +0.5% while the prior months reading was revised higher. The increase in spending was led by a reacceleration in goods spending while service spending was in line with expectations.

- Looking ahead, the National Retail Federation is forecasting spending this November and December to grow between 2.5% and 3.5% from last year.

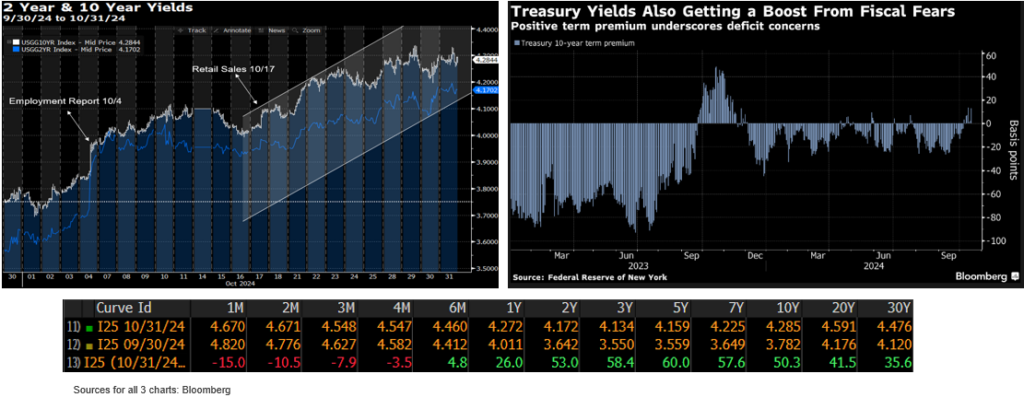

Yields Rise on Data and Election Outlook

October saw treasury yields rise approximately 40 to 60 basis points from 2 years to 30 years with several narratives behind the increase in yields:

- In the beginning of October, yields rose primarily on the solid labor market and retail sales reports which led to a repricing in the bond market. The rationale for the rise in rates is straightforward – you have a Fed that is cutting rates into a reasonably strong economy which leads to the market pricing in higher growth and inflation expectations.

- Since mid-September, the fed funds futures market has priced in fewer rate cuts over 2024 and 2025. Initially pricing in approximately ten to eleven 25 basis point cuts during this period, as of 10/31/24 futures are now pricing in only five.

- Later in October, the focus turned to the presidential election and deficit concerns. Both a Harris or Trump administration is forecasted to increase spending and deficits which would likely lead to increased bond issuance and ultimately higher bond yields. In addition, some recent polls are tilting towards a Republican sweep over Congress and the White House which could usher in more spending and tax cuts along with the potential for increased tariffs and higher inflation expectations.

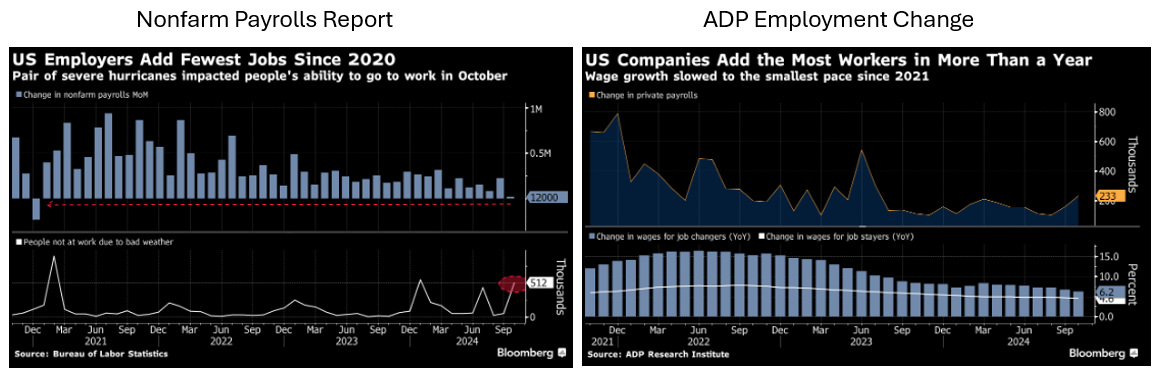

Mixed Labor Market Data

During the last week of October, we received mixed reports on the labor market, most notably from the October jobs report, but this was expected due to hurricanes Helene and Milton and the Boeing strike:

- First up was the October ADP Employment Change, which came in much higher than expectations at 233,000 vs 111,000 expected. This was the highest level in over a year, and did not see any impact from the hurricanes.

- Next up was the weekly initial jobless claims which declined to 216,000 from a 2024 high of 260,000 in early October, which was impacted by the hurricanes. This was the third consecutive decline and marked the lowest level in 5 months.

- On Friday November 1st, we saw a disappointing October jobs report. Although the unemployment rate remained unchanged at 4.1%, nonfarm payrolls came in much lower than expectations at 12,000, which was the lowest advance since 2020 and appears to be affected by both the hurricanes and the Boeing strike:

- The number of workers who reported they couldn’t work due to bad weather spiked to 512,000 vs the normal monthly average of 55,000. This is similar to the 436,000 spike in July from hurricane Beryl (see chart below).

- The response rate for the jobs survey was the lowest since 1991.

- The transportation equipment manufacturing sector saw a decline of -44,000 jobs which was largely due to strike activity.

- Away from hurricanes and strikes, there were -112,000 in revisions for the August and September readings with August accounting for 81,000 of the downward revisions, declining from 159,000 to 78,000. This will likely be a concern for the Fed at this week’s upcoming FOMC meeting.

Markets looked through the disappointing nonfarm payrolls report as Treasury yields rose and equity markets rallied after the release. Looking ahead, the FOMC is expected to cut rates by 25 basis points at the November 7th meeting, bringing the Fed Funds target range down to 4.50%-4.75%.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.