October Month-End Portfolio Update

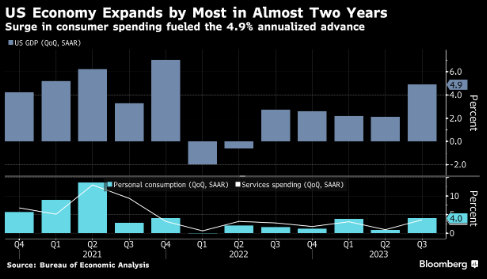

GDP Doubled in Q3 2023

The first reading for 3rd quarter GDP came in at +4.9%, more than double the +2.1% reading in the 2nd quarter and the most in nearly two years. The US consumer continues to drive the economy forward with personal consumption rising +4%. Spending on services rose by the most in two years, while outlays on durable goods, such as automobiles, also accelerated. We saw the same trend earlier in the month as the retail sales report came in double the consensus at +0.7%. Government spending was also strong at +4.6% and inventories added +1.3% to the reading. However, there was some disappointing underlying data as business investment fell for the first time in 2 years on a decline in spending on equipment.

Looking ahead, the market expects growth to slow in the 4th quarter due to headwinds from higher long-term rates, a potential government shutdown, the UAW strike, the return of student-loan payments, and the threat of a wider war in the Middle East.

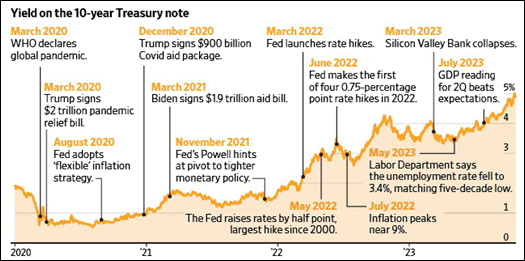

10-Year Treasury: 5% Yield Milestone Reached, But Short Lived (as of 11/02/2023)

The 10-year Treasury recently climbed to 5% in late October for the first time since 2007, likely due to a variety of forces: stronger-than-expected economic data, rising Treasury issuance, increasing Treasury term premium, higher energy prices, and less overseas demand from central banks. The employment report, CPI, and retail sales all surprised to the upside for September and we even saw the weekly jobless initial claims fall below 200,000 for the first time since January. On the supply front, the breakout on the 10-year yield can be traced back to July when the Treasury Department said it would need to borrow more than expected. The Fitch downgrade of the U.S. sovereign rating also contributed to the rise. As of October month-end, the 10-year yield rallied back below 5% to 4.93%,and has further declined to 4.63% as of the morning of November 2nd.

While the 10-year breaching 5% was interesting news, a 5% yield has been consistent across the front-end of the curve since April as the Fed’s overnight rate target has been forecasted to stay higher-for-longer.

Source: Wall Street Journal

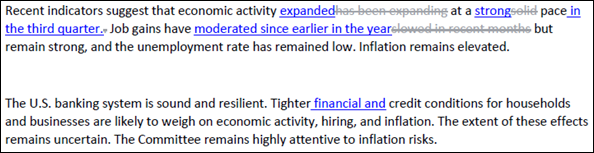

FOMC Meeting – Tightening Financial Conditions

The FOMC met this week, and although their official statement contained only minor changes, they addressed the recent rise in long-term bond yields by adding one significant word – “financial” – referring to tighter credit conditions. During his press conference, Fed Chair Powell elaborated on the change, saying persistent changes in financial conditions can have implications for the path of monetary policy. He also confirmed that the Committee will be proceeding carefully, will make decisions meeting by meeting, and left the door open for more hikes. He also made some dovish-leaning remarks, saying the dot-plot efficacy of forecasts erodes over time which might suggest that a remaining rate hike forecasted by the Fed in September might be in question.

The market reaction took a ‘risk-on’ tone with equity indexes rallying, credit spreads tightening and Treasury yields declining. Fed funds futures are pricing in no additional rate hikes this year and for rate cuts to begin in June 2024. Treasury yields were already rallying prior to the FOMC meeting as a result of the Treasury Department’s refunding amount coming in smaller than expected, paring back the pace of increases in the 10-30 year sector, alongside disappointing economic data releases.

FOMC Statement Changes

Source: Federal Reserve

Treasury Yield Changes 11/1/2023

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.