October Mid-Month Portfolio Update

Fed Pivot

Recent speeches from Fed members have signaled that the FOMC may be finished raising rates, due in part to the rise in long-term bond yields over the past month. The rise in Treasury yields has increased borrowing costs by an amount equal to or even more than a 25-bp rate hike.

- Dallas Fed President Logan: “If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed-funds rate.”

- Fed Vice Chair Jefferson: Fed officials would “remain cognizant of the tightening in financial conditions through higher bond yields” when determining whether to raise rates again this year.

- Boston Fed President Collins: “If it persists, it likely reduces the need for further monetary-policy tightening in the near term.”

- Fed Governor Waller: “The rising bond yields are ‘doing some of the work for us’ and ‘we’re in a position where we can watch and see what’s going on with rates.’”

- Atlanta Fed President Bostic: “I don’t think we need to increase rates anymore.

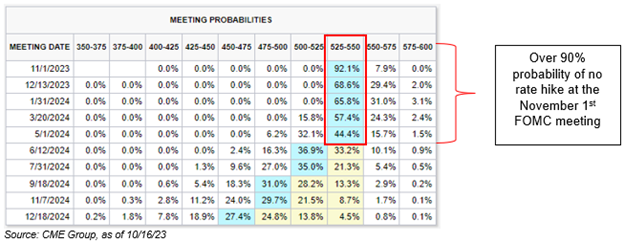

The Fed Funds Futures market reflects a similar sentiment, suggesting low odds of additional rate hikes, and for rate cuts to begin in the second quarter of 2024.

Solid Labor Market

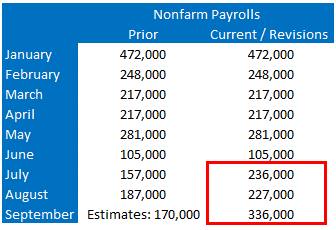

Heading into the latest employment report at the beginning of October, consensus was for a continued decline in job creation with expectations for 170,000 new payrolls, which would have been the 4th consecutive release with a 100-handle level reading. Instead, employers added 336,000 jobs in September, the most since January. Furthermore, the prior two months saw a combined 119,000 in upward revisions. The unemployment rate held at 3.8% due to a surge of re-entrants into the labor force. Hospitality-leisure and education-healthcare sectors led the gains, and employment levels for restaurants and bars are now back to pre-pandemic levels.

Source: Bloomberg

Source: Bloomberg

Treasury Yield Selloff Eases (as of 10/17/2023)

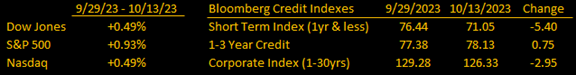

Although yields have climbed through the middle of October, the sell-off has been contained to single-digit basis point moves. There are two primary reasons for this: the first being the less-hawkish Fed talk referenced above. The second is an effect of the Israel-Hamas conflict. Nevertheless, the 2 year Treasury yield remains seems well-anchored around 5% due to its tie to monetary policy expectations and the recent higher-for-longer Fed narrative. Away from Treasuries, we have seen gains in risk assets with all three equity indexes increasing in October while investment grade credit spreads are slightly tighter.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.