November Month-End Portfolio Update

Fed Speakers Convey Caution on Pace of Rate Cuts

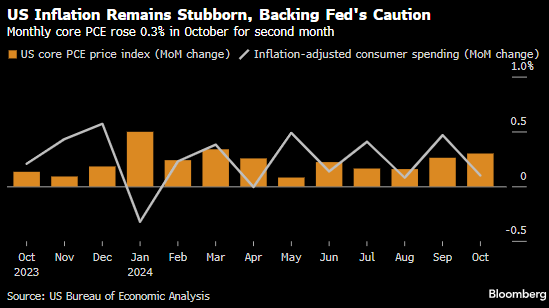

Several Federal Reserve officials have echoed a theme conveyed by Fed Chair Powell that the FOMC is in “no hurry to lower rates” and the central bank could slow its easing pace given stronger than expected economic data. For example, year-over-year inflation readings for both CPI and PCE (the Fed’s preferred inflation measure) have risen, and overall, inflation appears to be sticky. This provides support for those Fed members that want to approach rate cuts with some caution.

- Fed Governor Michelle Bowman: “I would prefer to proceed cautiously in bringing the policy rate down to better assess how far we are from the end point, while recognizing that we have not yet achieved our inflation goal and closely watching the evolution of the labor market.”

- Fed Governor Lisa Cook: “If inflation progress slows and the labor market remains solid, I could see a scenario where we pause along the downward path.”

- Minneapolis Fed President Kashkari: “Right now, knowing what I know today, still considering a 25-basis-point cut in December — it’s a reasonable debate for us to have.”

While members above are signaling caution or are at least willing to have a debate about up-coming rate cuts, others have taken a different view. For example, Chicago Fed President Austan Goolsbee recently said that “Barring some convincing evidence of overheating, I don’t see the case for not continuing to have the fed funds rate decline.” Fed Governor Christopher Waller added that “policy is still restrictive enough that an additional cut at our next meeting will allow ample scope to later slow the pace of rate cuts.

Source: Bloomberg

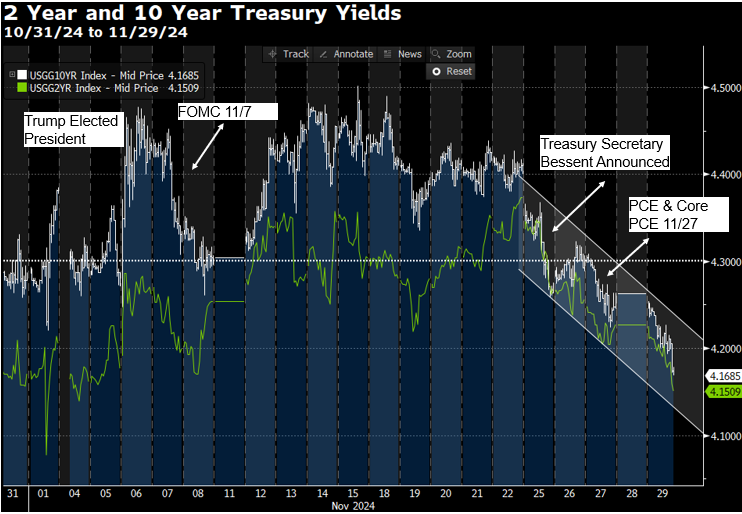

Bond Market Approves of Bessent as Treasury Secretary

One of the most important appointments by President-elect Trump (and especially for the bond market) was the announcement of Scott Bessent as Treasury Secretary. Treasury yields rallied on the announcement as he is viewed as someone more likely to keep a lid on deficits (which would mean less Treasury issuance) while taking a more measured approach on tariffs (which would likely help to suppress inflation). Regarding tariffs, Trump has announced plans for an additional 10% tariff on goods from China and a 25% tariff on products from Mexico and Canada. Imports from Canada and Mexico represent approximately 4.7% of headline PCE inflation and 5.4% of core-PCE. Early estimates from economists show that tariffs could add anywhere from 0.8% to 1.4% to core-PCE, depending on how they are applied.

Source: Bloomberg

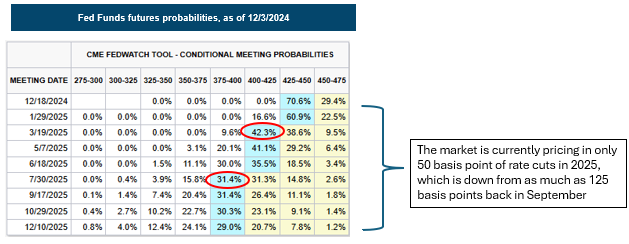

Fed Updated Economic Projections: Likely to Show Reduced Cuts in 2025

At the December 18th FOMC meeting, the Fed will be updating their summary of economic projections for the fourth and final time this year. With the underlying economy showing a resilient consumer, a stable labor market, and sticky inflation, the Fed is likely to reduce the amount of projected rate cuts for 2025. Their last update was in September, and it showed a median estimate of 100 basis points of rate cuts for all of 2025. Currently, the fed funds futures market is pricing in just two 25 basis point rate cuts in 2025.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.