November Month-End Portfolio Update

November – The Everything Rally

It was truly a November to remember as equities, Treasuries, investment grade & high yield corporate bonds, and commodities all posted solid gains. The primary drivers were a dovish pivot from Fed members and expectations of a soft landing for the U.S. economy, which translated into the markets eliminating odds of more rate hikes from the Fed and accelerating the timing of the first rate cut to the May 2024 FOMC meeting. Here are some of the highlights from November:

- The Bloomberg Aggregate Index rose +4.53% in November, which is the 2nd largest gain since 1985.

- The Bloomberg Treasury Index gained +3.47%, the largest gain since 2008 and the market’s first gain since April.

- The Bloomberg Corporate index spread tightened 25 basis points while the High Yield index spread tightened 57 basis points.

- The S&P 500 rose +8.92% in November, which is the 2nd best November since 1980.

- The Dow rose over +8% while the Nasdaq rose over +10%, which are both among the best monthly returns since 2022.

November Treasury Yield Changes

Source: Bloomberg

Dovish Fed Speak

Although most Fed speeches of late have tilted into dovish territory, it was recent comments from usually-hawkish Fed Governor Waller which caught the markets’ attention. Waller said he was “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%”, which implies no more rate hikes. The comment represented a reversal from the summer months when Waller was vocal about his views in favor of additional hikes. Further, in the Q&A section of his speech, some of his responses suggested cuts were potentially possible in the first half of 2024 if inflation behaves as he thinks it could.

In hawkish commentary, Fed Governor Bowman said that her baseline outlook “continues to expect that we will need to increase the federal funds rate further” while Richmond Fed President Barkin said the central bank should keep the option to hike.

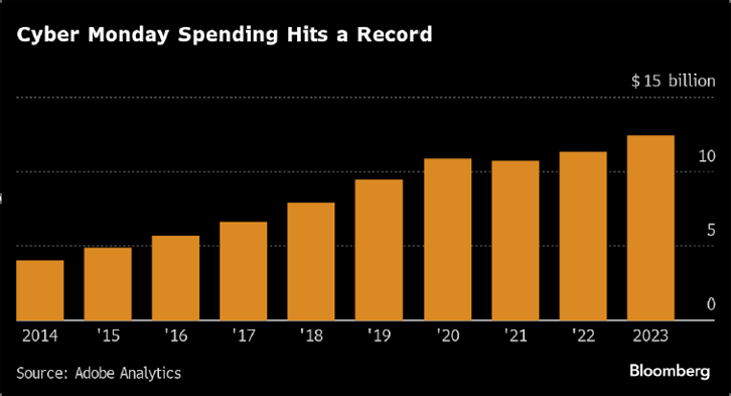

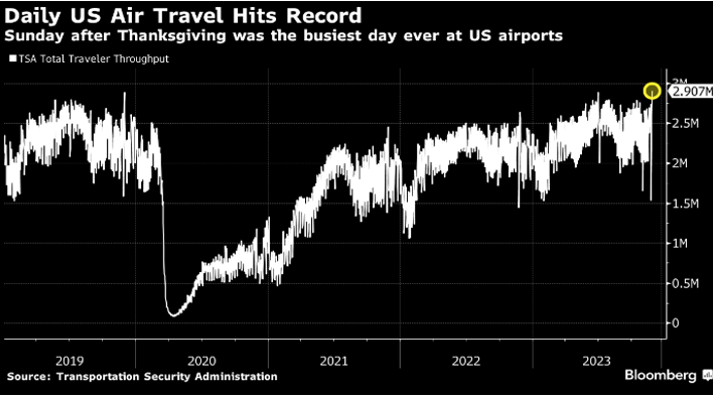

Record Shopping and Traveling Thanksgiving Weekend

Americans kicked off the holiday season with a bang, signaling a healthy consumer sector and supporting the soft-landing narrative. A record 200.4 million people hit the stores and online sites from Thanksgiving Day through Cyber Monday, according to a survey by the National Retail Federation. The turnout marks an all-time high since the major trade group and Prosper Insights & Analytics began tracking total in-store and online traffic in 2017. On Black Friday, consumers spent $9.8 billion in U.S. online sales, according to Adobe, up 7.5% from a year ago. Cyber Monday sales hit a new record, with $12.4 billion in sales. Thanksgiving travel also broke records, with the highest number of daily passengers screened the Sunday of Thanksgiving, at 2,907,378 according to the TSA.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.