Still Ignoring the Risks Inherent in Bank Deposits?

To paraphrase General Douglas MacArthur: Old investment policies never die; they just fade away.

It’s been nearly a decade since post-financial-crisis banking reforms attempted to end the era of “too big to fail.” And it’s been nearly five years since Dodd-Frank guarantees on unlimited deposit insurance expired. But according to the 2017 Liquidity Risk Survey of 130 treasury professionals, conducted by Capital Advisors Group and Strategic Treasurer, most companies’ investment policies ignore emerging exposures inherent in maintaining sizable bank deposit balances.

It’s been nearly a decade since post-financial-crisis banking reforms attempted to end the era of “too big to fail.” And it’s been nearly five years since Dodd-Frank guarantees on unlimited deposit insurance expired. But according to the 2017 Liquidity Risk Survey of 130 treasury professionals, conducted by Capital Advisors Group and Strategic Treasurer, most companies’ investment policies ignore emerging exposures inherent in maintaining sizable bank deposit balances.

The survey also found that corporate investment policies have been slow to adapt to the new landscape of investment alternatives that have emerged following last year’s reforms to prime money market funds (MMFs). Cash managers have had good reasons to hesitate before moving too much money from bank deposits into other short-term investments. Over the past year, many found themselves caught like a deer in the headlights over the uncertain status of the new floating net asset value (NAV) money market funds that replaced the old fixed-NAV prime funds. And the Fed’s slow pace of interest rate increases has minimized the pressure to pursue yield through alternative investment vehicles.

All told, it is not surprising that many respondents to this year’s survey said they’ve decided to stay with their familiar demand deposit accounts for the time being. However, the 2017 iteration of the Capital Advisors Group/Strategic Treasurer survey—which is now in its seventh year—does uncover some significant improvements in corporate liquidity risk management practices.

A significant proportion of respondents report more regular assessment and active updating of their investment policies. The survey also highlights moves by corporate treasurers toward counterparty risk management frameworks that accommodate a broader array of potential short-term investments. And it reveals treasury professionals’ enhanced focus on management of credit facilities to reduce risk while negotiating more favorable terms.

Slowly but surely, treasury professionals appear to be responding to the recent tumultuous changes in the cash management landscape with new policy limits and counterparty risk frameworks that reflect a more comprehensive and rigorous assessment of risk.

Investment Policies Are Still a Low Priority

A current, updated corporate investment policy provides guidelines that help protect institutional cash managers and the organizations they serve, especially during periods of disruptive regulatory and market-based change. The past two years have provided ample reason for every treasury team to implement annual investment policy updates. The return to a rising interest rate environment after a decade of zero rates has led many to start considering yield-bearing investments that may not currently be covered by their investment policies. Passing up opportunities for yield because of a restrictive policy creates potentially significant opportunity costs. Refreshing the investment policy every year is a discipline that ensures treasury teams examine new investment vehicles as they become available.

At the same time, reforms have completely recast the old prime money market funds that institutional investors bought for years. Over the past 18 months, an estimated trillion dollars has moved out of prime MMFs, which no longer offer fixed NAVs, and into bank deposits, government money market funds, Treasuries, and dozens of other short-term investment vehicles.

The new floating-NAV prime funds may not comply with investment policies crafted as recently as two years ago, so they may be off-limits even if treasury staff decide they have perfectly good reasons to invest in them. Conversely, treasury may be considering alternatives to prime funds—such as asset-backed securities, high-grade notes, or financial paper—that would meet their risk/reward requirements, but may be unable to consider them because they are not covered by current investment policies.

The new floating-NAV prime funds may not comply with investment policies crafted as recently as two years ago, so they may be off-limits even if treasury staff decide they have perfectly good reasons to invest in them. Conversely, treasury may be considering alternatives to prime funds—such as asset-backed securities, high-grade notes, or financial paper—that would meet their risk/reward requirements, but may be unable to consider them because they are not covered by current investment policies.

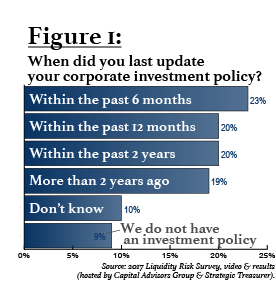

Any investment policy that hasn’t evolved to address the historically disruptive changes in money market funds is increasing the company’s liquidity risks, as cash managers’ short-term investment decisions may be based on guidance that is no longer relevant. Nevertheless, the Capital Advisors Group/Strategic Treasurer survey indicates that fewer than two-thirds of companies have updated their corporate investment policies within the past two years. Far too many survey respondents either do not have a formal investment policy (9 percent), don’t know whether they have one (10 percent), or have an investment policy that has not been updated for at least two years (19 percent—see Figure 1).

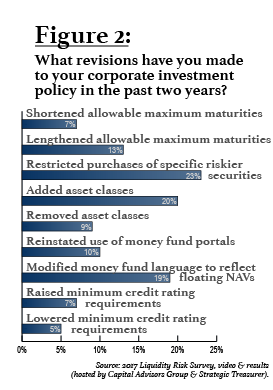

At the same time, however, there is evidence that some treasury teams are starting to pay closer attention to updating the fine print in their investment policies on a regular basis. More than a fifth of survey respondents have added restrictions on the purchase of securities that their organizations view as too risky (see Figure 2). For example, many treasury teams are currently imposing limits on investments in European financial institutions that have been buffeted by headwinds caused by Brexit uncertainties, ongoing sovereign debt problems, and other challenges.

At the same time, however, there is evidence that some treasury teams are starting to pay closer attention to updating the fine print in their investment policies on a regular basis. More than a fifth of survey respondents have added restrictions on the purchase of securities that their organizations view as too risky (see Figure 2). For example, many treasury teams are currently imposing limits on investments in European financial institutions that have been buffeted by headwinds caused by Brexit uncertainties, ongoing sovereign debt problems, and other challenges.

When an investment policy is updated every year, it is possible to impose—or remove—restrictions on specific investments and/or entire asset classes that have been impacted by current events. Such annual reviews of potentially problematic asset classes became more common after the financial crisis, when many investment policies were amended to disallow auction rate securities and other structured products that created so many unexpected problems.

At the same time, 20 percent of respondents said their company has amended its investment policy to allow new asset classes. For several years after the financial crisis, many treasury organizations put their heads in the sand, so to speak; they retreated to investment policies at the most conservative end of the policy spectrum, allowing little more than Treasuries and agency assets. Over the past several years, some have reversed that response. Some companies have been amending their policies to allow acquisition of additional assets that might positively impact portfolio performance, such as carefully vetted corporate notes and asset-backed securities.

Bank Deposits: Overexposed and Underinsured

Although nearly two-thirds of treasury departments have updated their investment policy to reflect market changes over the past two years, few are paying adequate attention to the potential liabilities associated with their bank deposits.

In many companies, bank deposits represent the organization’s single largest cash investment vehicle. And since the end of the temporary liquidity guarantee program in the United States, unlimited deposits have not been insured. Without FDIC coverage for uninsured deposits, all funds could be lost in the event of a bank failure.

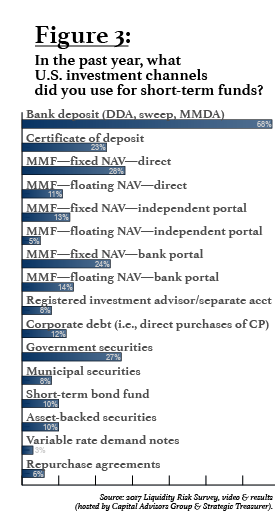

Still, institutional investors don’t seem to be losing sleep worrying about the safety of the cash they keep in deposit accounts. Perhaps that’s because since the end of the “too big to fail” regulatory era, there have been no major bank failures in the United States. Whatever the reason, corporate cash managers have been slow to abandon the investment channel which, for decades, has been regarded as one of the safest havens for corporate cash. In the 2017 Liquidity Risk Survey, 68 percent of respondents said they continue to depend on bank deposits to park at least some of their short-term cash investments (see Figure 3).

A bank failure would be troublesome, to say the least. No U.S.-based bank has yet gone through the orderly liquidation process set up by U.S. regulators to lessen the disruption of bank failures. In the European Union, where regulators set up a similar process known as the “single resolution mechanism,” corporate investors had a brush with default risk last year, when the near-collapse of troubled Spanish bank Banco Popular set the resolution mechanism in motion. The incident was a wakeup call for both banks and corporations that hold large reserves of uninsured cash in deposit accounts. It was also another step in the progression away from a “too-big-to-fail” mentality toward more awareness of the real risks depositors face with the possibility of future bank failures.

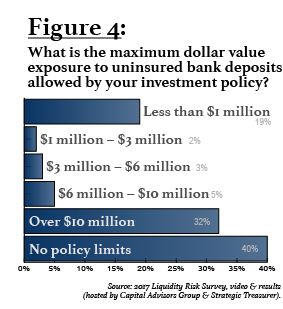

That growing awareness may be spurring companies that are updating their investment policy to limit the volume of corporate funds stored in bank accounts. In the 2016 Capital Advisors Group/Strategic Treasurer survey, 52 percent of respondents said their investment policies had no limits at all on uninsured bank deposits. But in the 2017 survey, that number fell sharply to 40 percent (see Figure 4, below).

Hopefully, this growing caution around bank deposits is reflective of an improving understanding of the counterparty exposures inherent in banking relationships. Currently, companies are less likely to track the overall credit exposure of banks that hold their deposits than they are to monitor other asset classes where they may also park cash.

But banks that hold deposits should be treated the same way as any other counterparty. Treasury professionals should have mechanisms in place for tracking the overall credit exposure of the bank, and if the bank’s credit deteriorates or degrades, they should have a plan to peel back their exposures. As with any other investment, diversifying risk by spreading deposits among multiple banking partners is a recommended practice.

More Robust Counterparty Risk Frameworks

Viewing banking partners’ exposures through the lens of counterparty credit risk management continues a trend among treasury professionals toward more of a focus on counterparty risk. A strong majority (78 percent) of respondents to the 2017 Liquidity Risk Survey indicated they are collecting and reviewing counterparty exposures in aggregate, and tracking many key indicators daily.

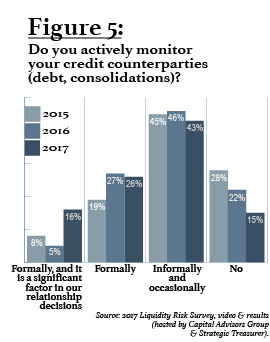

Over the past three years, respondents have reported substantial increases in vigilance around counterparty credit risk management. The proportion of respondents who said they “formally” monitor credit counterparties rose from 27 percent in 2015 to 42 percent in 2017. And the proportion who both “formally” monitor credit counterparties and make credit monitoring a “significant factor” in their relationship decisions doubled in that same time period, from 8 percent to 16 percent (see Figure 5).

Over the past three years, respondents have reported substantial increases in vigilance around counterparty credit risk management. The proportion of respondents who said they “formally” monitor credit counterparties rose from 27 percent in 2015 to 42 percent in 2017. And the proportion who both “formally” monitor credit counterparties and make credit monitoring a “significant factor” in their relationship decisions doubled in that same time period, from 8 percent to 16 percent (see Figure 5).

At the same time, the proportion of respondents who said they perform no active counterparty credit monitoring fell by nearly half, from 28 percent in 2015 to 15 percent this year. Overall, 85 percent of respondents to the 2017 survey actively monitor their credit counterparties, a significant increase from 2015’s 72 percent.

For treasury professionals tasked with navigating an increasingly complex and uncertain regulatory and market environment, increasing scrutiny of counterparty exposures is a step in the right direction. But while the trend appears to indicate positive movement toward more robust, comprehensive, and holistic counterparty risk frameworks, more work needs to be done. Companies still fail to include many exposures in their counterparty risk management programs. For example, only 27 percent of survey respondents monitor the creditworthiness of major customers, and only 22 percent monitor major suppliers.

A holistic and comprehensive counterparty risk management framework must monitor customers and suppliers. It should also include a laundry list of potential exposures to financial counterparties, including bank deposits and CDs, money market funds, all directly held investments, pension and retirement funds, investments in separately managed accounts, commercial paper, lines of credit, medium and long-term debt, and foreign exchange exposures, to name just a few.

Such a 360-degree view of risk is crucial in an interconnected global economy where “black swan” events are increasingly the norm. The 2011 earthquake and tsunami in Japan precipitated the worst nuclear crisis since Chernobyl. It also caught many institutional cash investors off-guard with the extent of disruption caused to global supply chains in vital industries such as semiconductors, computers, and electronics. How would a similar-scale event in San Francisco and Silicon Valley impact specific counterparty exposures in both the short and long terms? Or what impacts would there be from a possible conflict on the Korean peninsula?

Comprehensive risk management frameworks can better position treasury teams to anticipate and respond quickly to the possible impacts that a crisis event may have on all the counterparty exposures in their investment portfolios.

Given the many ongoing regulatory, market, and event-driven uncertainties in the new cash management landscape, treasury professionals are well-advised to take a comprehensive approach to counterparty risk management. New frameworks that encompass all known current and potential future exposures should become standard practice for the profession.

Credit Facilities Move Front and Center

Many treasury professionals today are working to bring their credit facilities into sharper focus. Even though most respondents to the 2017 Liquidity Risk Survey said they have not changed their investment policies in the past year, 59 percent have renegotiated their credit facilities—and 38 percent have done so within the past six months.

Respondents also reported a significant increase in the diversification of their credit facilities, with 50 percent reporting more than one maturity date in 2017, up from 39 percent in 2016. Additionally, 34 percent said that they intentionally staggered the maturity dates of their credit facilities, compared with 29 percent in 2016.

Respondents also reported a significant increase in the diversification of their credit facilities, with 50 percent reporting more than one maturity date in 2017, up from 39 percent in 2016. Additionally, 34 percent said that they intentionally staggered the maturity dates of their credit facilities, compared with 29 percent in 2016.

Renegotiating credit facilities, diversifying their credits, and staggering maturity dates are all activities that reflect the increased focus by treasury professionals on buffering potential liquidity risk.

Slow but Steady Progress

Compared with the first annual Liquidity Risk Survey by Capital Advisors Group and Strategic Treasurer in 2011, the 2017 survey demonstrates a slow but steady progression toward more comprehensive liquidity risk management following the crisis years of 2008 through 2010. It also provides a measure of treasury professionals’ response to the dramatic changes in the regulatory and market environment for cash investments over the past two years.

Still, the survey highlights the need for continued attention in three areas:

- First, uninsured bank deposits still represent an area of significant exposure for many businesses; maintaining a sharp focus on the credit of their banking partners and diversification among several partners is one way to help buffer risk.

- Second, although counterparty risks are gaining more attention than they used to, companies still need to expand the rigor of their exposure monitoring through comprehensive, holistic counterparty credit risk management frameworks.

- Third, an annual review and update of investment policies should be standard practice.

Seven years of liquidity surveys indicate that treasury professionals are starting to understand that eternal vigilance is the price of success in a cash management environment where constant market and regulatory disruption has become the norm.

————————————–

Ben Campbell is founder and CEO of Capital Advisors Group, Inc., an independent investment advisor based in Newton, Mass., that specializes in institutional cash investments, risk management, and debt finance consulting. In June 2011, Treasury & Risk named Campbell one of the “100 Most Influential People in Finance.”

Ben Campbell is founder and CEO of Capital Advisors Group, Inc., an independent investment advisor based in Newton, Mass., that specializes in institutional cash investments, risk management, and debt finance consulting. In June 2011, Treasury & Risk named Campbell one of the “100 Most Influential People in Finance.”