BofA, CAG Write on Repatriation: Funding Pressure, Offshore Reduced

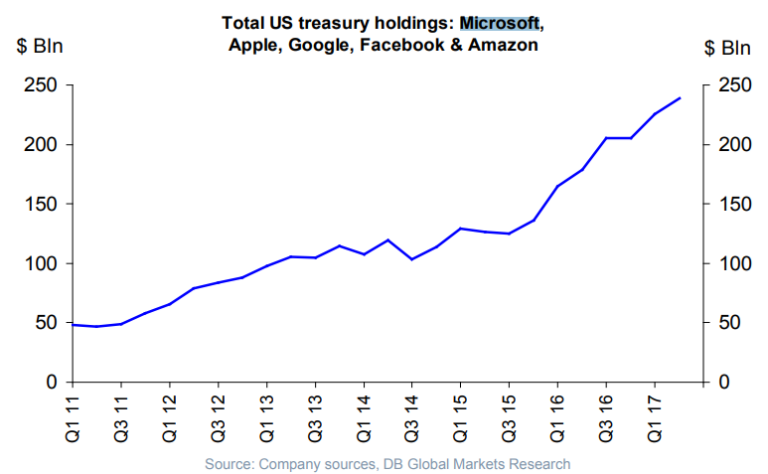

6 min readTwo new publications discuss the possibility of the “repatriation” of offshore corporate profits, its mechanics and the potential impact on the cash and money fund markets. The first, a “Liquid Insight” published by Bank of America Merrill Lynch, is entitled, “Repatriation Could Result in Modest USD Funding Pressure,” while the second, written by Capital Advisors Group, is…