Weighing Your Next Move

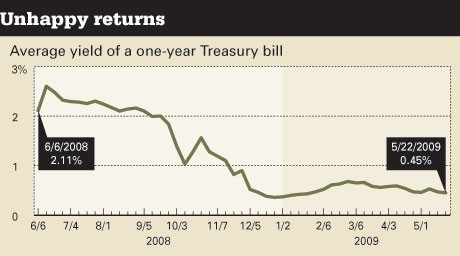

8 min readMoving corporate cash to boost returns by a basis point or two could earn a CFO or treasurer a well-deserved dressing-down. But that doesn’t mean that finance executives who manage growing pools of idle cash can stand pat with their current investing strategies. Safety and liquidity require constant vigilance — maybe even more so this…