Finance Turns Overtly Cautious

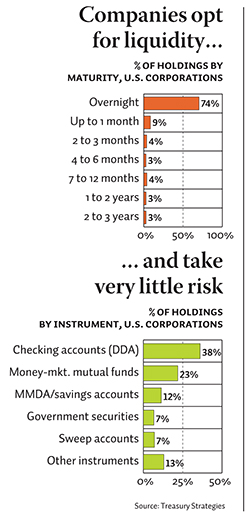

3 min readThe financial meltdown in the fall of 2008 prompted many large companies to prep for future calamities, but recent events are pushing them to accelerate the implementation of those defensive moves. Corporate giants including Coca-Cola, Hyatt Corp., Kinder Morgan and J.P. Morgan have issued upwards of $5 billion in long-term debt over the last week,…