New CHOICE For Financial Reform

Amongst the numerous debates happening up on Capitol Hill, one that’s slipped under the radar is related to financial regulatory reform. On June 8th, with the whole of the country’s attention fixated on former FBI Director James Comey, the House of Representative passed the Financial CHOICE Act along party lines. The bill aims to rollback much of the banking regulations that were put into place by the Dodd-Frank Act in the wake of the financial crisis including provisions to: curtail the power of the Consumer Financial Protection Bureau (CFPB), reduce the Federal Reserve’s role in overseeing banks, and adjust bank capital requirements. While the CHOICE Act has very little chance of making it past the Senate in its current form, it makes sense to do a deeper dive of what is actually being proposed, and what effect it might have if implemented.

To start, let’s take a look at what initially brought about financial reform. Up until the financial crisis, banks suffered from serial undercapitalization. Lehman Brothers, whose failure triggered the worst part of the downturn, was at various points levered by nearly 30:1. Bear Stearns and Washington Mutual were similarly leveraged, and as a result required a relatively small drop in the value of their assets before they became insolvent. In and of itself, this is not a bad thing. Normally, firms who make bad bets and lose simply fall by the wayside. However, as the failure of Lehman exemplified, these banks became so important to the global economy that this could not be allowed to happen without unleashing the potential for outright collapse. So the Federal Reserve and the U.S. government chose to “bail-out” the banks, essentially nationalizing the banks’ losses. And while this eventually stabilized the financial system it created a moral hazard problem; the banks took risks they weren’t ultimately on the hook for.

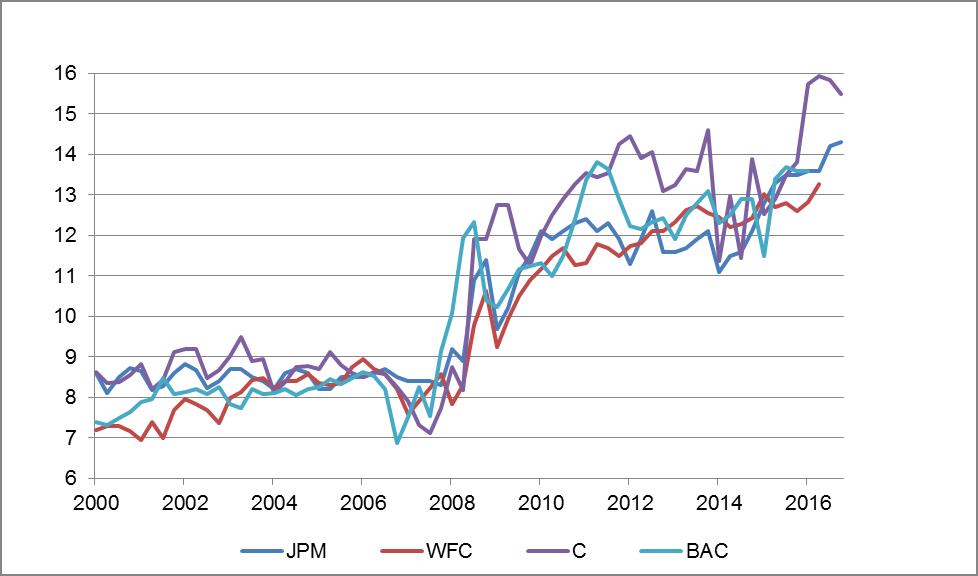

Amidst these realities, the goal of financial reform was two-fold, to make the banks safer while also planning for their demise. And by almost all accounts the Dodd-Frank Act has succeeded at these two goals. According to the Federal Reserve, high-quality common equity amongst institutions subject to its annual stress tests has increased by more than $700 billion since 2009. And as shown in Figure 1, Tier 1 Capital Ratios (one of the myriad ways to measure bank capitalization) have improved markedly over the last decade1. It is now almost universally accepted that the banks have significantly more loss-absorbing capacity than before the crisis, and while it cannot be assumed that this will prevent another banking crisis, it does reduce the outright probability of one.

Figure 1: Tier 1 Capital Ratios

Source: Bloomberg

Source: Bloomberg

The CHOICE Act could potentially undermine some of this progress. For starters, it would reduce the frequency of regulatory stress tests, which examine how banks’ balance sheets would hold up in a time of crisis, from annual to biannual occurrences. Furthermore, it would exempt all institutions which maintain a leverage ratio of at least 10% from having to undergo stress testing at all. This is mistaken on two levels.

- First of all, these stress tests are the only gauge the public has on how the banks would hold up in the case of another crisis. They are obviously imperfect, but almost certainly better than nothing.

- Secondly, as Mike Knoczal points out, the use of leverage ratios work better in concert with more sophisticated measures of bank capitalization, rather than as a standalone measure. This is because leverage ratios do not take into account the make-up of a bank’s balance sheet. This makes them hard to game, but provides an incentive for banks to seek out risk. After all, if a bank is required to hold the same amount of capital against any asset it will likely seek to maximize its returns by loading up on the riskiest assets. Measures that use risk-weighted assets in their denominator (such as the Tier-1 Capital ratio) help rectify this situation. Banks whose balance sheets are loaded with high-risk assets will also need to hold more capital against those assets, thus reducing their effective return.

Another important piece of the legislation is that it would seek to get rid of Title II of Dodd-Frank; aka the Orderly Liquidation Authority (OLA). The OLA was put into place to provide a guideline for how a bank would be wound down in the case of its failure. It allows the FDIC to take control of a failing institution in a time of crisis and to liquidate it over a period of time. There are two main criticisms of the this mechanism, which I will address here:

1. The OLA codifies “Too Big To Fail”

The main argument against the OLA is that it is essentially a thinly-vailed bailout, one which only further ingrains the moral hazard problem. There is some merit to this argument, as the OLA does give the FDIC authority to step-in and provide short-term liquidity to a failing bank. Crucially though, this injection is not designed to offset losses of equity/bondholders (à la TARP), but rather to see the bank through a safe and orderly liquidation. In that sense it has many characteristics of the “bail-in” programs set forth by the ECB. As an alternative, if the OLA were to simply go away without a replacement framework it would become more (not less) likely that policymakers would conclude that an out-and-out bailout was necessary to prevent the economy from collapsing.

Moreover, if the OLA really did codify “Too Big To Fail,” firms would be incentivized to reach a point where they would qualify as a SIFI (systemically important financial institution) since it would reduce their cost of capital. But in reality the exact opposite has occurred; firms such as GE and Met Life have actively looked to escape the designation because of the increased regulatory burdens it brings about.

2. It gives too much power to regulators

Another argument is that the OLA cedes too much power to regulators. The FDIC has outlined a plan of how it would resolve failing institutions1; however there is no requirement under the OLA that the plan be implemented in the case of a bank failure. This is obviously not ideal and, given the lack of precedent, would certainly invoke a great amount of uncertainty amongst the banks’ creditors. However, consider the alternative of bankruptcy court. As former FOMC Chair Ben Bernanke pointed out in a blog post from February, bankruptcy courts were woefully unprepared to deal with the dismantling of Lehman Brothers back in 2008. Looking forward, there is no reason to think that bankruptcy courts would do any better in winding down a large financial institution now. Doing so requires international coordination along with expertise on the institution’s balance sheet and sectorial/geographic exposure, something which is far outside the realm of expertise of bankruptcy judges. The FDIC, on the other hand, could draw upon its vast network of connections with other regulatory agencies and central banks, as well as its own history of resolving failed commercial banks here domestically. This would likely produce a more optimal outcome in terms of financial stability.

The third part of the legislation involves the general rollback of bank regulation. Amongst other things, the CHOICE Act would reduce funding to the CFPB, roll back the oversight powers of FSOC2, and eliminate the Volker Rule, which banned proprietary trading. Proponents of the bill argue that these moves will help ease unnecessary and over complicated burdens on banks, and thereby unleash stronger economic growth. Once again, there is some merit to these arguments. The banking regulatory web is needlessly complicated; there are a seemingly endless number of organizations which perform a substantial number of overlapping tasks. Furthermore, many of the rules can be difficult to follow. For example, the line between banks’ market making activities and proprietary trading is incredibly thin, and arguably up to personal interpretation. And finally, rules banning specific consumer lending products, such as payday loans, disproportionately affect smaller institutions. A recent report issued by the U.S. Treasury Department echoes these sentiments, saying that Dodd-Frank has an especially hard impact on the lending of credit unions and regional banks.

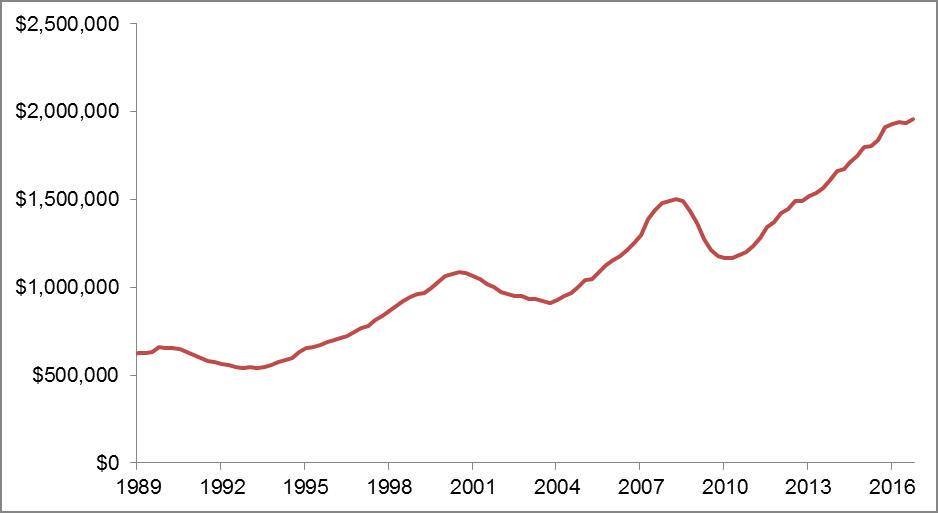

Even so, the assertion that a sudden easing of these regulatory burdens will unleash economic growth is highly questionable. As Figure 2 exemplifies, commercial and industrial lending is currently at an all-time high, and growing at a pace not too dissimilar to that of past recoveries. Furthermore, even as banks have had to adapt to more stringent capital and regulatory requirements, they remain highly profitable3. So while a decrease in regulatory burden might increase lending at the margin, it would not likely overcome the structural factors holding back economic growth (namely stagnant productivity and a shortage of labor).

Figure 2: Total Commercial & Industrial Loans

Source: Bloomberg

Source: Bloomberg

In short, the Financial CHOICE Act (as currently constructed) may swing the pendulum too far in the way of deregulation. Specifically, loosening bank capital requirements and getting rid of the OLA without a detailed replacement may put the U.S. economy at a greater risk of another financial crisis. And while there are ways to improve the efficiency of the current regulatory structure, there is little evidence that this sort of regulatory reform will have a meaningful impact on economic growth. Fortunately, as currently constructed the bill has little chance of getting past a filibuster in the Senate, but amidst all the other things happening on Capitol Hill, it’s worth keeping an eye on.

1A detailed outline of the strategy (called Single Point of Entry) was released in 2013

2Financial Stability Oversight Council

3According to the FDIC, its nearly 6,000 insured institutions produced a record profit level of $171 billion in 2016

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.