Navigating Tariffs in the Auto Sector

The U.S. auto industry is entering a period of uncertainty due to the looming threat of tariffs on Canada and Mexico, which could have a deleterious effect on vehicles and parts imported from both countries. As of March 11, President Trump has initiated tariffs of 25% on Mexico and Canada, with a temporary reprieve until April 2, so long as the companies are in compliance with the USMCA trade agreement. In addition, steel and aluminum tariffs of 25% are in place, while tariffs on the European Union could be forthcoming. These tariffs have the potential to disrupt the industry’s deeply integrated supply chains that have been in place for decades. While the President cited fentanyl trafficking and illegal immigration as justification to institute tariffs, the industry is holding out hope that these are merely negotiation tactics to improve the prospects of U.S. manufacturing. In the meantime, consumers and manufacturers may need to weather poor conditions before a clear outcome is presented to the public.

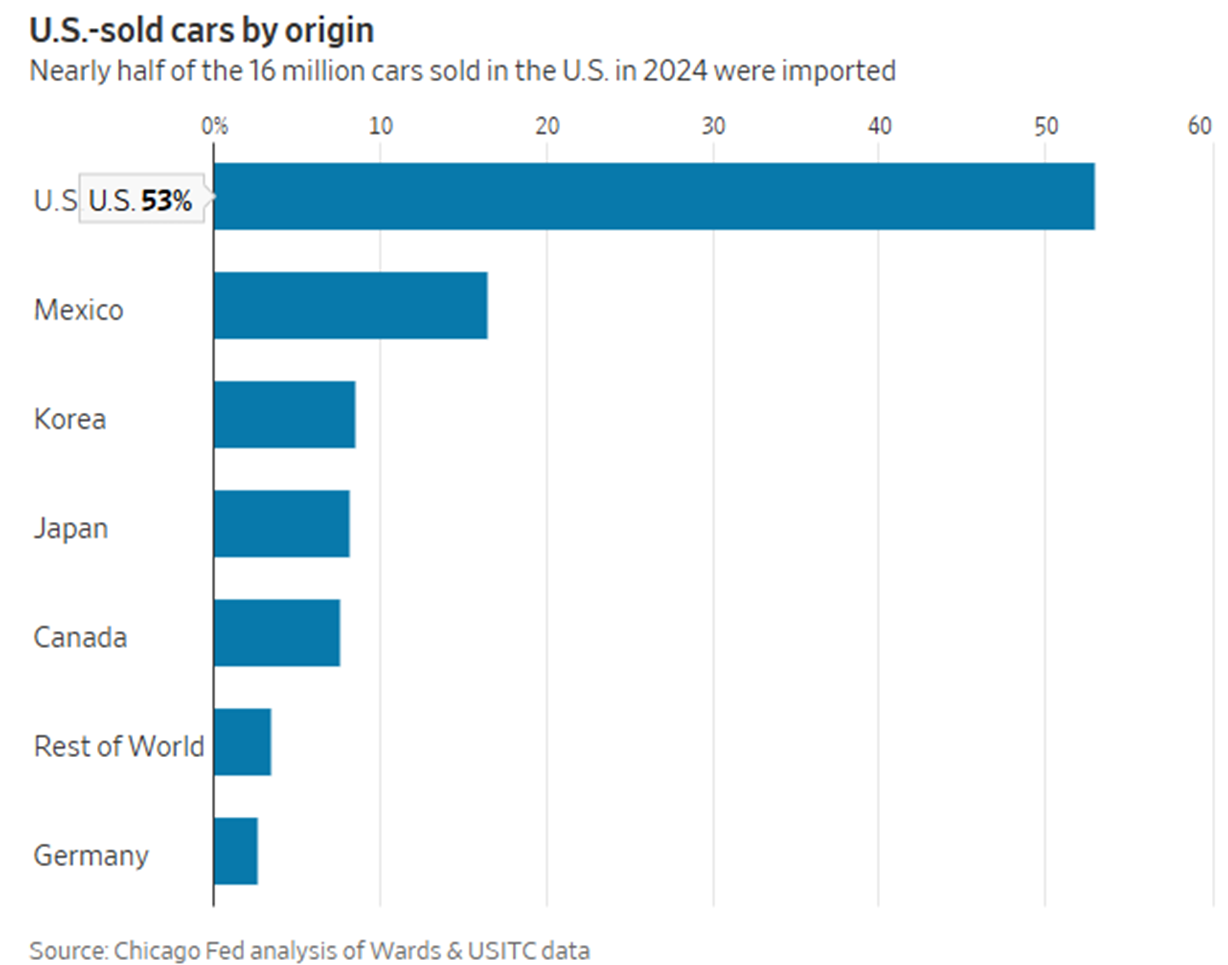

Auto manufacturing in the U.S. is a testament to the power of cross-border collaboration, with parts frequently traversing the Canadian and Mexican borders multiple times throughout the manufacturing process. Roughly half of the 16 million cars sold in the U.S. were imported, with much of the steel, auto equipment and parts coming from all three countries. Tariffs could hit each auto part several times during the manufacturing process as it crosses between borders, and charged again when the finished vehicle is imported to the U.S.

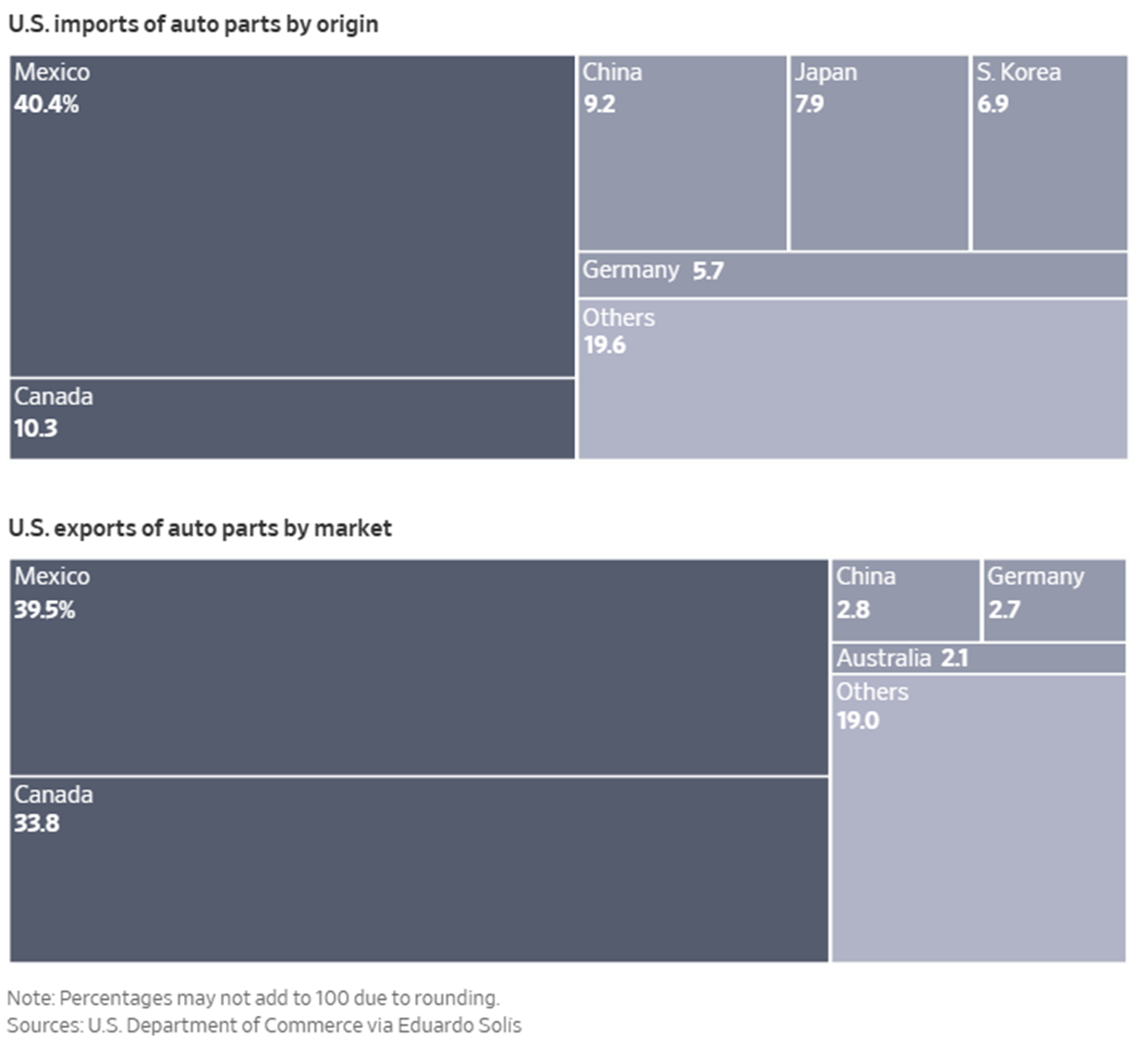

In President Trump’s first term, the USMCA agreement negotiated to bring manufacturing closer to the U.S. and allow duty free trading for products with higher U.S. manufacturing origin. Today, the auto sector makes up 22% of total trading under the agreement and is the largest trade sector between the three countries.[i] Additionally, most U.S. auto part imports pass through Mexico (40%) and Canada (10%), while the majority of U.S. auto part exports are sent to Mexico (40%) and Canada (34%). Given the deep integration of the sector, auto manufacturers have limited options to mitigate prolonged tariffs on the industry.

Automakers are exploring various avenues to mitigate the impact of tariffs and maintain their competitive edge in this unpredictable landscape. According to CreditSights, they expect the largest group of automakers to see average operating profit margins compress by 230 bps, with average margins currently running around 7%. Margin compression could vary based on supply chain maneuvering and level of vehicle production in each country, without accounting for potential sales declines across the sector. To stave off the deterioration, they will likely implement price increases across most vehicle models and reduce consumer options as they determine the full effects of the tariffs. Kelly Blue Book has reported that tariffs could raise prices of a car by an average of $3,000, with average vehicle prices standing at $49,000. The average price of a pick-up truck could increase by $10,000. Indefinite tariffs could also lead to less vehicle production, with S&P Mobility expecting a 30% decrease in daily production volume or about 20,000 less vehicles being produced each day.

The complex and evolving nature of the U.S. tariff negotiations creates a challenging environment for manufacturers and consumers. The potential for economic disruption is high given the integrated nature of the auto industry and the expected price increases for consumers. There is already evidence of businesses delaying capital spending due to high uncertainty, while consumers are reducing spending due to expectations of price hikes. Cash investors should exercise caution and review cash allocations decisions during such uncertain times.

To read more on our tariffs view, please see our post on steel and aluminum.

[i] https://www.wsj.com/business/autos/track-one-car-parts-journey-through-the-u-s-canada-and-mexicobefore-tariffs-7c0d5dcb?mod=hp_lead_pos11

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.