Navigating Downgrades During COVID-19

The coronavirus pandemic has forced firms across industry groups to shore up liquidity in order to weather depressed revenue streams. These conditions, coupled with accommodative economic policies, led to a spur of borrowing during the first half of 2020. Due to this current climate, many companies are having trouble finding solid financial footing, leading to a rash of downgrades and defaults. Even with the Federal Reserve bolstering credit markets via the Secondary Market Corporate Credit Facility (SMCCF), both high yield (HY) defaults and fallen angels remain high on the year. Hence, quality of research has become paramount to institutional investment grade (IG) investors to avoid downgrade related value destruction.

The COVID-19 Issuance Boom

As stay at home orders swept the nation in March, many companies saw revenue streams nearly dry up. Needing adequate liquidity to continue skeleton operations during the pandemic, and encouraged by the Fed’s SMCCF program, IG firms issued more debt than ever in Q1, raising a total of $245 billion. HY issuances also set records in June, as $47.4 billion of speculative grade debt was brought to market from June 1st – 19th, shattering the old total month issuance record of $29.3 billion in 2014.

The issuance spree seen in Q1 was not reflective of a boost in debt of a single category. S&P Global reported that the largest increases during the four-quarter period ending in Q1 2020 occurred in the A/A2, BB/Ba2, and CCC/Caa2 and below categories, which grew 17%, 17%, and 19%, respectively. BBB/Baa2 rated debt grew by only 5% this past year, however growth in this category was significantly affected by the high volume of fallen angels. Only the amount of AAA/Aaa and AA/Aa2 debt has decreased from Q1 2019 levels.

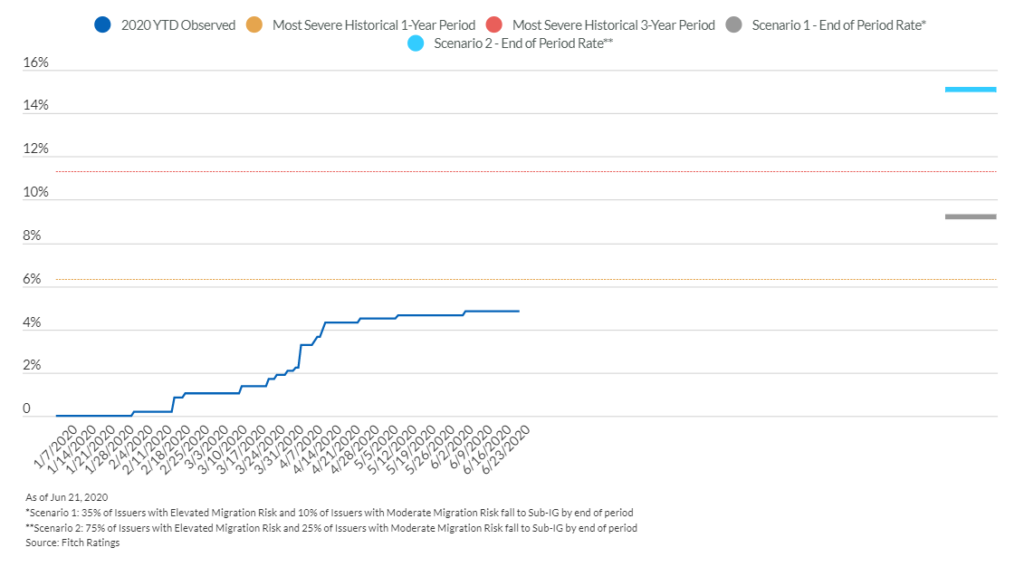

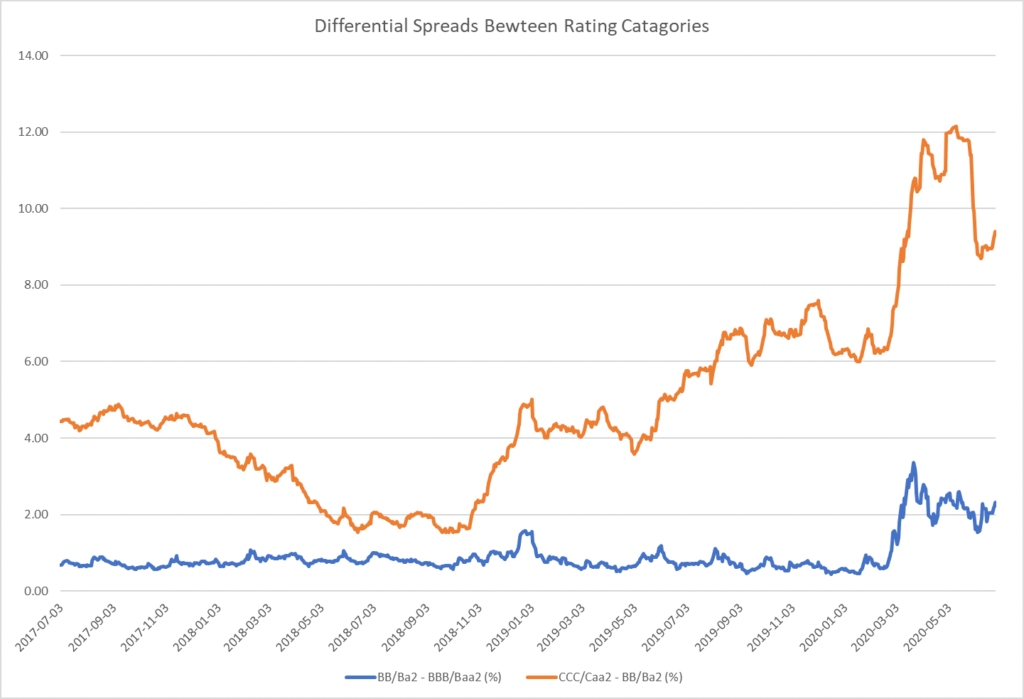

The surge of debt issuance and plummet of corporate cashflows have placed significant strain on credit metrics, forcing rating agencies to implement widespread downgrades. Even as consumer spending picks up, concerns remain about companies’ abilities to generate revenues; particularly as generous unemployment benefits are set to expire at the end of July. Notable names whose ratings have been lowered due to current conditions include Ford, Kraft Heinz, and Occidental Petroleum, all of which have been downgraded into speculative grade. For IG investors fallen angel risk has become of significant concern, as the number of credits demoted to speculative grade approach record levels (Figure 1). The increased uncertainty surrounding the duration and severity of coronavirus related economic impacts made differential spreads between ratings jump, with larger disparities occurring farther down the ratings scale as investors asked for more yield given the increased risk (Figure 2).

Figure 1: Fitch Ratings North America and EMEA 2020 Non-Financial Corporates Fallen Angel Rate

Source: Fitch Ratings

Figure 2: Differential Spreads Between Rating Categories

Source: FRED, ICE BofA BBB, BB, and CCC & Below Index

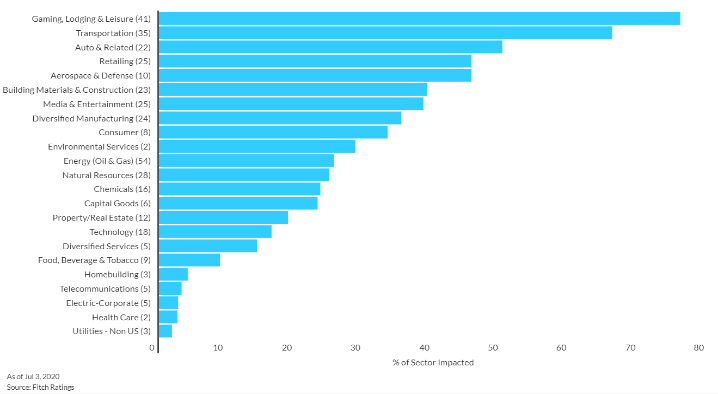

Beyond fallen angels, rating agencies continue to hold a negative outlook towards future credit conditions. As of July 10th, Fitch Ratings estimates that over 40% of credits in the construction, retail, defense, auto, transportation, and lodging & leisure industries have been subject to coronavirus related downgrades or other negative actions since markets crashed in March (Figure 3). Rating agencies have also indicated that they expect defaults to remain elevated throughout the second half of 2020. Fitch Ratings expects the monthly default rate on HY corporate debt to exceed 5.5% in July, the highest since 2010. S&P Global Ratings predicts the trailing twelve-month (TTM) default rate could reach 12.5% by March 2020. This reflects the constrained revenues and increased debt burdens of companies across industries during the pandemic. Current corporate debt market conditions should cause investors to tread carefully in order to mitigate the risk of a downgrade in their portfolios.

Figure 3: Fitch Ratings Percentage of Covered Sector Subjected to Coronavirus Related Negative Action

Source: Fitch Ratings

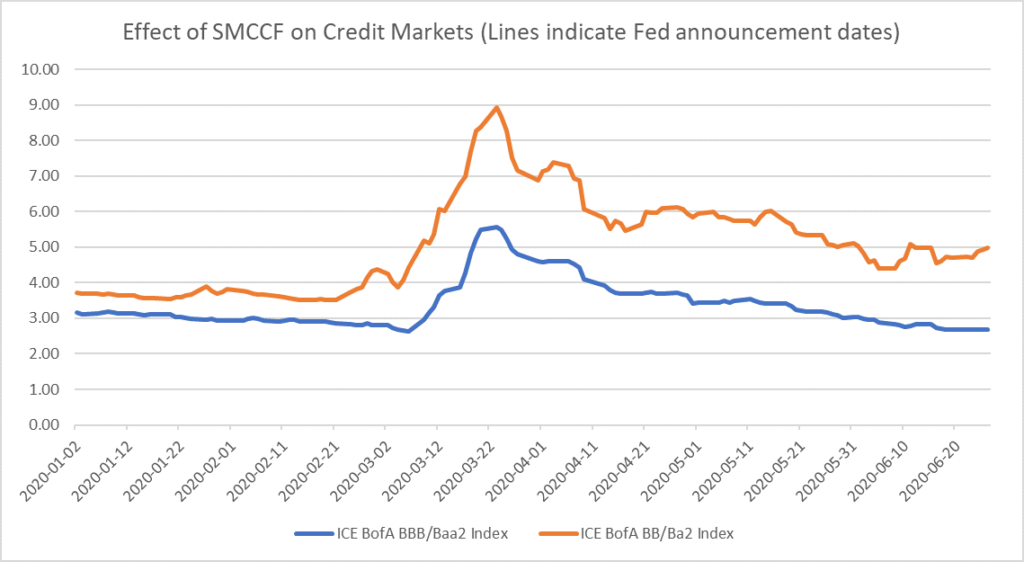

The Fed Lends a Hand

The Federal Reserve has made it clear from the beginning that they are willing to throw the proverbial kitchen sink at the economic effects stemming from the coronavirus pandemic. Since the onset of March stay-at-home orders, the Fed has placed rates near the effective zero-lower-bound and held repeated press conferences conveying that accommodative economic policy is here to stay. Simultaneously, the economic impact of the coronavirus, coupled with widespread rating downgrades following say-at-home orders, caused spreads to dramatically increase across all levels of rated debt, reflecting concerns about potential liquidity issues within debt capital markets. In an unprecedented move, the Fed announced the Secondary Market Corporate Credit Facility program, aimed at promoting liquidity in credit markets via the purchase of corporate bonds. After the initial announcement on March 23rd, investors believed that the liquidity it would provide to the market greatly reduced the risk of sudden credit crunches. Credit markets reacted positively as investors drove down spreads of BBB/Baa2 bonds by 97 basis points over the next week. On April 9th, the Fed announced an expansion of the SMCCF to include fallen angels which had been rated BBB-/Baa3 as of March 22nd. Spreads of BB/Ba2 rated debt proceeded to tighten by 61 basis points over the next five days (Figure 4). The Chicago Fed reported that the price of ETFs primarily composed of SMCCF eligible bonds jumped as well, as the program decreased the perceived default risk of the underlying bonds. (If you would like to read more about how debt capital markets reacted to the SMCCF read our May blog “Powell’s Got the Power.”)

Figure 4: Effect of SMCCF on Credit Markets

Source: FRED, ICE BofA BBB Index

Moving Forward

The perceived reduction of risk, which the SMCCF gave investors, is contrary to the stance rating agencies have taken throughout the pandemic. For investors with laxer rating requirements, the SMCCF provides adequate safety. However, institutional investors with strict rating mandates remain vulnerable to downgrades and subsequent value destruction resulting from a forced selloff. The threat of IG downgrades remains pertinent as rating agencies continue to monitor increasingly levered companies across multiple industries as the pandemic continues.

Downgrades and defaults will continue throughout the coronavirus pandemic even as the Fed remains committed to supporting an accommodative economic environment. The importance of independent fundamental analysis outside of the SMCCF’s shadow remains paramount to avoid value destruction via downgrades. Uncertainty over the length of coronavirus related economic effects forces investors to remain cautious in their decisions, and vigilant in their credit monitoring. While the extreme volatility of March may be behind us, large amounts of uncertainty and belt-tightening remain ahead.

Co-authored by: Pate Campbell

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.