Moving from LIBOR to SOFR

Abstract

The era of LIBOR (the London Inter-Bank Offered Rate) is coming to an end. The rate, which underpins some $200 trillion in floating-rate bonds, loans, securitizations, and derivatives contracts, is broken—at least according to the international regulatory community. In the U.S., this has led to the introduction of SOFR (the Secured Overnight Financing Rate) as a replacement benchmark interest rate for short-term debt. In this paper we take a high-level view of SOFR, overviewing its structure, the timeline for its application, and potential challenges it could pose for cash investors.

Introduction

The introduction of SOFR comes against the backdrop of various regulatory agencies souring on LIBOR. This is in part due to LIBOR’s recent scandal-plagued history, with large banks paying numerous fines for outright manipulation of the rate over the past fifteen years. But even more so, it reflects the impact of post-crisis regulations designed to bolster banks’ balance sheets and improve their liquidity levels. This new regulatory regime has made banks less reliant on short-term borrowing, and as the volume of transactions underpinning LIBOR has dwindled, so has its utility and representativeness.

Banks will only be compelled to make the daily submissions used to determine LIBOR up until 2021. Beyond that date, there is no guarantee that LIBOR will continue to be published. Andrew Baily, chief executive of the Financial Conduct Authority (FCA), the group responsible for LIBOR, stated that post-2021, there is a “high probability” that it will be discontinued.

In preparation for this event, a subcommittee formed by the Federal Reserve Board and the New York Fed called the Alternative Reference Rates Committee (ARRC) recommended that SOFR be introduced as a replacement for LIBOR.

Overview of SOFR

SOFR is a broad measure of the cost of overnight borrowing, using Treasuries as collateral. It is essentially an all-encompassing repo rate, an average of transactions in the tri-party, bilateral, and GCF (General Collateral Financing) Treasury repo markets. Daily transaction volume underpinning the rate is roughly $700-$800 billion, according to the ARRC, compared to just $500 million underpinning LIBOR. The rates and volumes are published daily by the New York Fed and can be found here.

Unlike LIBOR, SOFR is an actual market rate, meaning it faces no threat of discontinuation or manipulation. Once markets are fully transitioned to SOFR, it should provide greater transparency than is currently the case with LIBOR. Additionally, the higher volume of related transactions makes SOFR a more reliable indicator of the level of short-term interest rates.

Difference from LIBOR

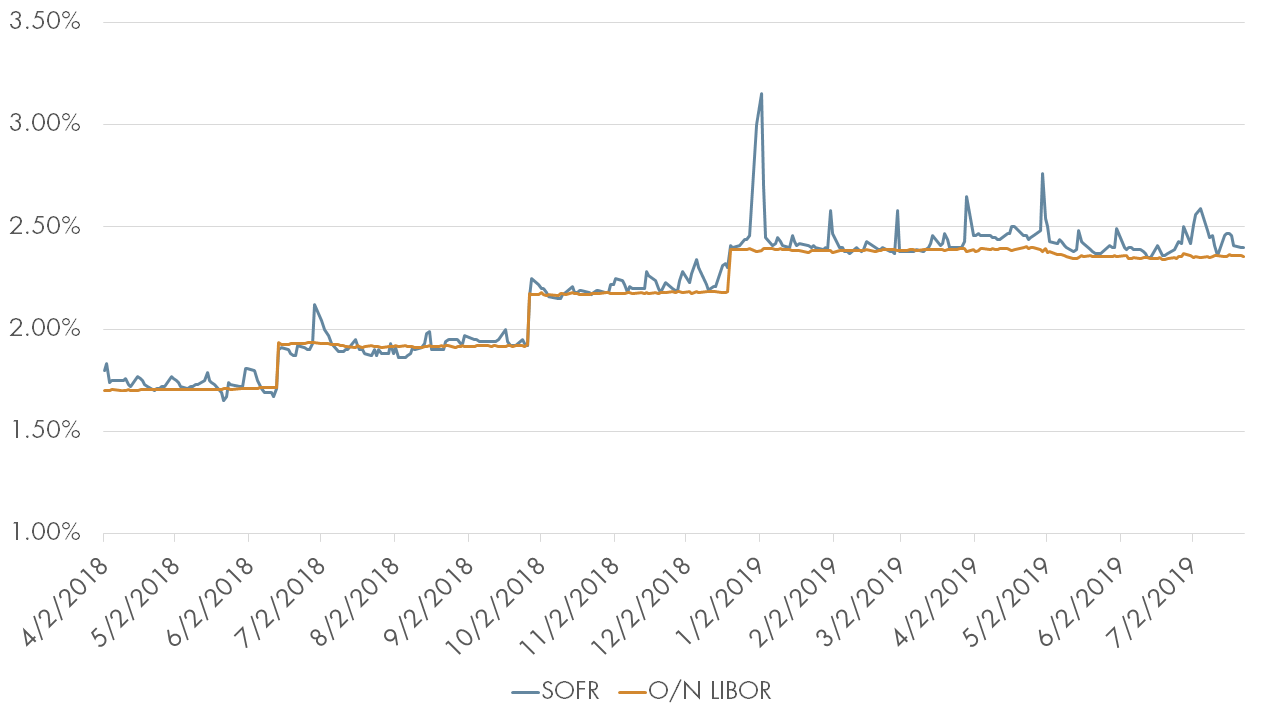

SOFR is a structurally different rate from LIBOR. It is a secured repo rate, rather than an unsecured wholesale funding rate. As such, economic logic would suggest that it be systematically lower than LIBOR. So far however, this has not been the case. Since its inception, SOFR has roughly tracked the overnight LIBOR rate, with an average spread of just 4 basis points.

Figure 1: SOFR and Overnight LIBOR Rates

Source: Bloomberg, Federal Reserve Bank of New York

This relationship will be tested during periods of heightened financial market volatility. During a negative credit event, LIBOR tends to rise because it has a credit component built into it. Banks become risk averse and therefore less willing to lend to each other on an unsecured basis, causing the rate to rise. On the other hand, demand for Treasuries typically rises during times of instability, which in turn drives down secured lending rates such as SOFR.

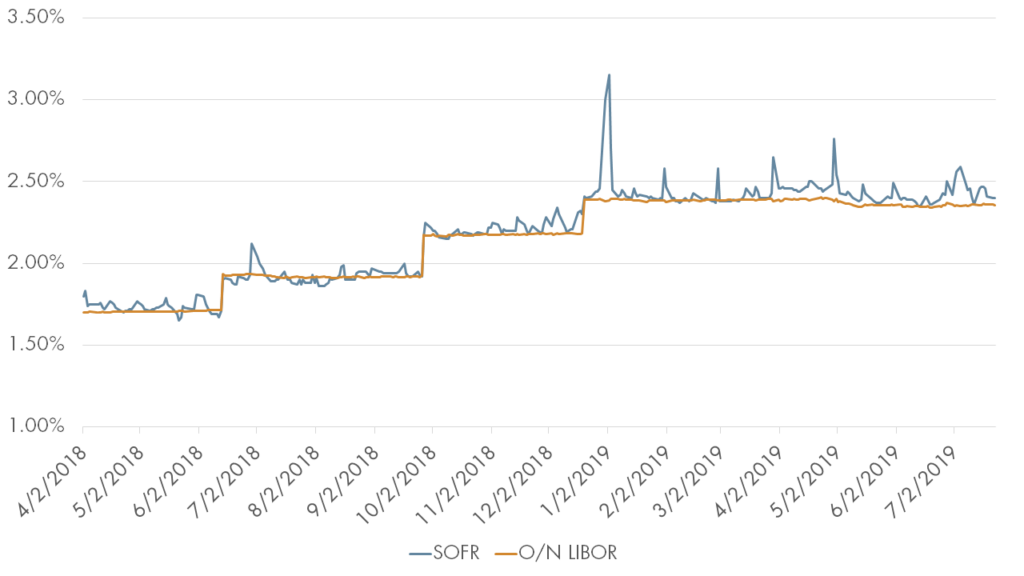

Another difference between LIBOR and SOFR is that SOFR is only published on an overnight basis. LIBOR, on the other hand, includes securities benchmarked to term (3M, 6M, etc.). To address the discrepancy, the New York Fed has stated its intention to publish forward-looking term SOFR rates that could be used in commercial contracts. However, their utility will be contingent on the development of a robust futures market. Both ICE (the Intercontinental Exchange) and the CME (Chicago Mercantile Exchange) have launched trading on one- and three-month SOFR futures contracts. However, as of now, trading in these contracts is too light to establish a reliable forward-looking rate. Consensus expectations are that trading volume will continue to rise as LIBOR’s end date draws closer, with the goal that a term reference rate will be available by the end of 2021.

Figure 2: SOFR Futures Daily Trading Volume (CME only)

Source: Federal Reserve Bank of New York

In the meantime, the NY Fed has also stated its intention to publish backwards-looking SOFR term rates. The ARRC recommends using these rates (either in advance or in arrears) rather than overnight ones because they are subject to less volatility.

Issuance

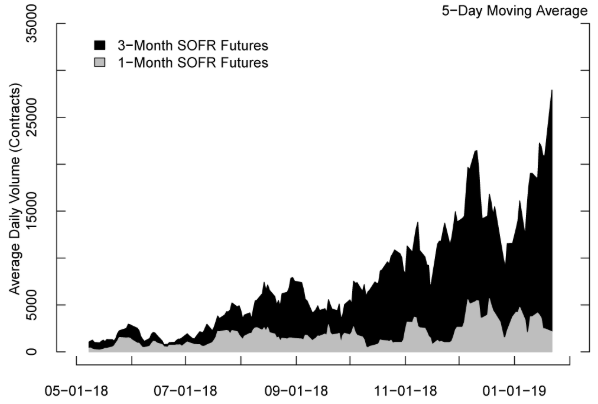

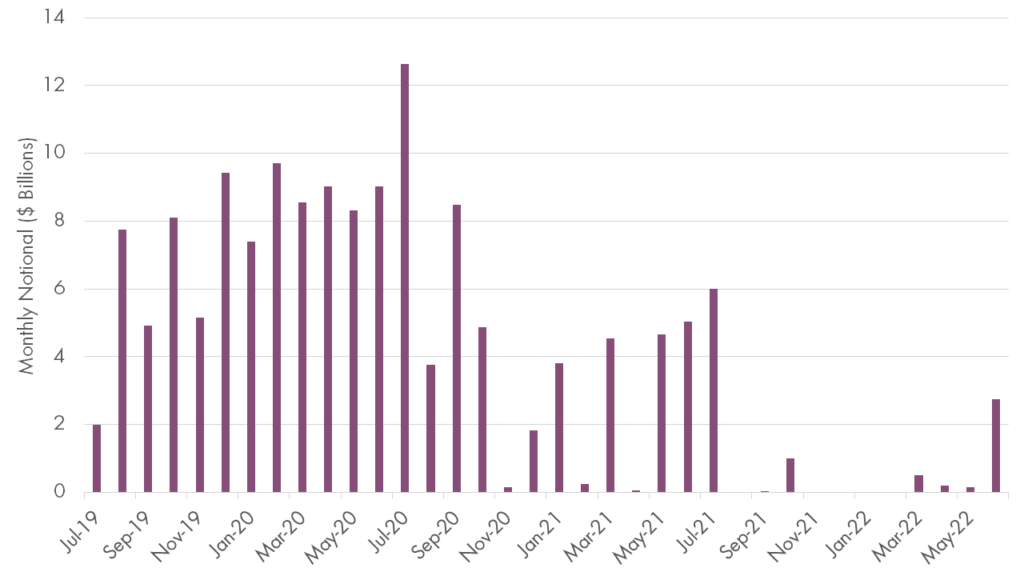

Issuance of SOFR-linked debt has been slower than hoped for by regulators, as most firms still prefer to use LIBOR. The first SOFR-linked note was issued in September of last year, and as of July issuance has reached just over $150 billion. Around two-thirds of the outstanding notes are due within a year, likely due to SOFR’s current limitations.

Figure 3: Maturity Distribution of SOFR-Linked Notes

Source: Bloomberg

Government-sponsored enterprises (GSE’s) comprise 80% of the outstanding notes, with the remaining 20% issued by banks and non-governmental organizations. Spreads on GSE issuances have often been less than 5 basis points over SOFR, and bank notes have been in the 30 to 60 basis point range. Top buyers of SOFR-linked debt are largely money fund operators such as BlackRock, JP Morgan, and Federated.

Challenges

The transition away from LIBOR poses a couple challenges for investors with legacy floating-rate notes. The primary one is that there is no universal protocol for transitioning legacy floaters to an alternative rate. The procedures that follow in the case that LIBOR is discontinued vary based on the “fallback” language contained in individual contacts.

As PIMCO noted, the contract language is all over the place. For some issuances, the contract specifies that the security would revert to using the last LIBOR rate in perpetuity. This would essentially transform a floating-rate security into a fixed-rate one, since the rate would remain stagnant. Others provide some discretion in allowing an “agent” to either estimate LIBOR using comparable rates, or to use an alternative rate (such as SOFR) altogether. Both cases carry execution risk as well as questions regarding the level of discretion the “agent” could have in picking a new benchmark. Finally, some contracts contain no fallback language whatsoever.

The second concern is that of basis risk. Since SOFR is a fundamentally different rate than LIBOR, transitioning a floater’s benchmark to SOFR could potentially cause some fluctuation in market value. As the ARRC and NY Fed note, there will need to be a spread adjustment, especially if a security’s benchmark is being transitioned from 3-Month LIBOR to daily SOFR. This transition would be eased by the introduction of forward-looking term rates, which would remove the maturity risk component.

There is also a related question of how SOFR-linked notes will perform during a credit event. Should SOFR rally, we’d presume that the spread over SOFR would widen out to compensate for the additional credit and liquidity risk. However, if spreads remained constant, then SOFR-linked floaters could see a positive bump in their market valuations relative to other bonds.

Recommendations

To help mitigate these potential challenges, institutional cash investors would do well to:

- Understand their Exposure: Investors should have an idea as to what their exposure to floating-rate debt is. Additionally, as the timeline for LIBOR’s potential end draws closer, adding SOFR-linked debt may reduce uncertainty while allowing cash investors to maintain upside exposure to higher rates.

- Know the Differences: Investors should understand the differences between SOFR and LIBOR, and that the two rates may diverge in certain market conditions. Investors should understand that SOFR is subject to some idiosyncratic volatility, though this should tend to average out over time.

- Examine the “Fallback” Language: Investors should understand how their floating-rate notes will be affected by the discontinuation of LIBOR. Investors should advocate for themselves and work with issuers to avoid pitfalls. The “ARRC’s Recommendations Regarding More Robust Fallback Language for New Issuances” provides instructions on how contracts can be designed to minimize risk. As the end date of LIBOR draws closer, regulators should also provide guidance as to how cash investments will shift benchmarks.

- Follow the Developments: Stay up to date on developments with LIBOR and SOFR. The situation remains very fluid on both ends, with talks of LIBOR potentially being published elsewhere should it be discontinued by the FCA and regulatory bodies pushing firms to start issuing more SOFR-linked debt. In addition, the possible development of forward term rates by the end of 2021 is key.

Conclusion – SOFR is Coming

In light of the recent developments with LIBOR, it is only a matter of time until SOFR is deployed on a wider basis. Once fully adopted, it should prove to be easier to understand and more robust than LIBOR, but the transition will likely pose some challenges for investors. The ARRC is ahead of their own schedule in development of key infrastructural pieces to support the transition to SOFR: the rate is now publicly available, futures trading is available on two separate exchanges, and recommended contract fallback language has been issued.

Nevertheless, there remains much to be done. Private-sector adoption of SOFR has been slow as firms have been reluctant to issue SOFR-linked debt. Futures trading has picked up but remains well below the levels needed for representativeness. And regulatory guidelines for dealing with legacy LIBOR-based cash investments are minimal at this point. These problems will likely be ironed out over the next eighteen months, but it makes sense for investors to start preparing now.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.