Monetary Policy in Transition

Perhaps no word better describes the start of 2017 than “transition.” The year began with the White House’s transition from the Obama to the Trump administration, continued with the rise of European populism, and recently culminated in the official beginning of Britain’s transition out of the European Union. Somewhat less noticeably, change is also taking place within the Fed. As Fed Governor Lael Brainard stated recently, “monetary policy too is approaching a transition.” After eight years, during which it cut short-term interest rates to zero and expanded its balance sheet by nearly $4 trillion, the Fed is now in the process of removing monetary policy accommodation.

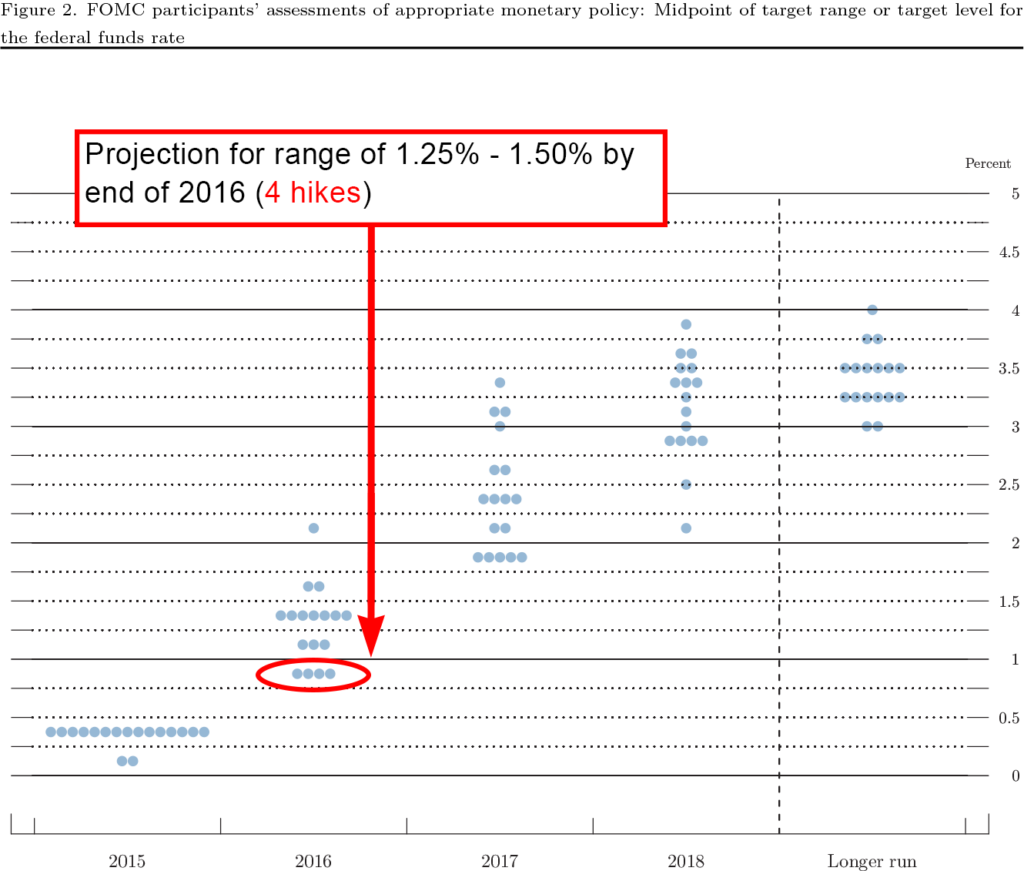

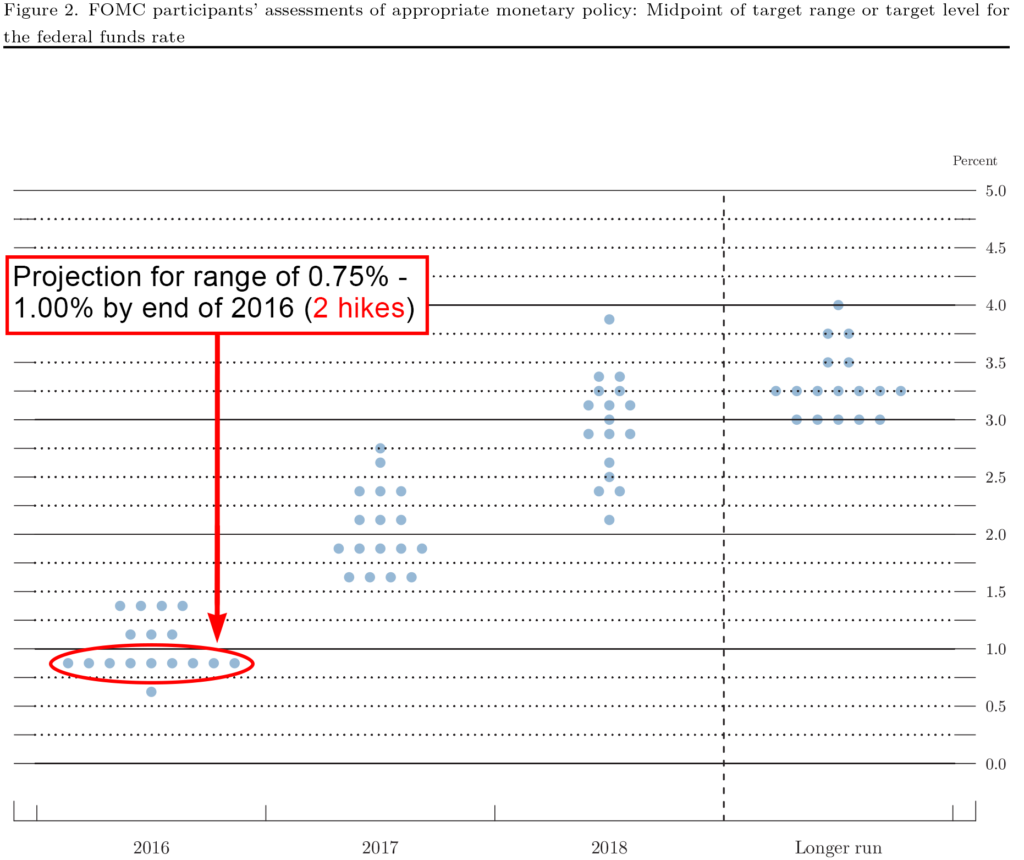

Now it may seem like the period of tightening actually began in December 2015, when the Fed raised interest rates for the first time since 2006. But as Fed watcher Tim Duy pointed out, it is more reasonable to think of that hike as an aborted attempt to “lift-off” of the zero-lower bound. The reasoning behind this theory is that around the time of the 2015 hike, indications of future economic activity turned dour; consumer spending softened, financial volatility spiked, and manufacturing activity came grinding to a halt.* Faced with those realities, the Fed quickly did an about turn, pushing off their forecasts for further rate hikes and emphasizing that monetary policy would remain accommodative for the foreseeable future. The change in tone had the desired effect, with Janet Yellen stating in March 2016 that despite headwinds from abroad, “the baseline outlook for real activity and inflation is little changed because investors responded to those developments by marking down their expectations for the future path of the federal funds rate.” She went on to elaborate that this put downward pressure on longer-term interest rates and eased the turbulence in financial markets. For much of the rest of 2016 it went like this, with the Fed continually scaling back its projections to move in line with what the markets viewed as acceptable.

Summary of Economic Projections: December 2015

Source: Board of Governors of the Federal Reserve, 2015 FOMC Meetings – Summary of Economic Projections (December)

Summary of Economic Projections: March 2016

Source: Board of Governors of the Federal Reserve, 2016 FOMC Meetings – Summary of Economic Projections (March)

Source: Board of Governors of the Federal Reserve, 2016 FOMC Meetings – Summary of Economic Projections (March)

Fast forward to 2017, and the exact opposite has happened. After raising interest rates for the second time in December 2016, it was widely expected that the Fed would wait until at least June to act again. However, over a period of two weeks in late February, Fed officials went on an all-out campaign to signal that the next rate hike was coming sooner rather than later. This culminated in a speech by Yellen, where she affirmed that barring a significant change to the outlook, “a further adjustment of the federal funds rate would likely be appropriate” at the upcoming meeting. Markets took the news in stride, and the Fed was able to raise rates in March without any negative repercussions. It now seems almost certain that the Fed will raise rates at least one more time this year, and the possibility of two (the FOMC’s current median projection) or more hikes is certainly on the table.

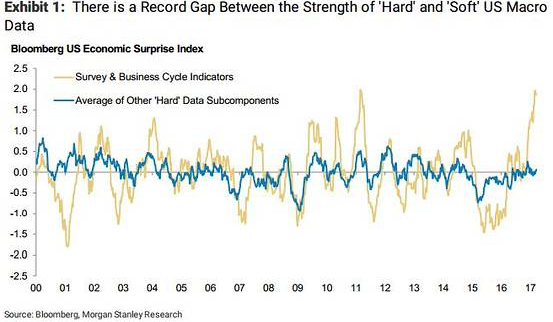

This naturally raises the question of what changed from the beginning of 2016 to 2017 that allowed the Fed to change course. To be frank, “hard” economic data has improved, but not substantially. GDP growth is still hovering around 2% annually, productivity growth is subdued, and core inflation is about the same (though headline inflation has improved). Labor market slack has dissipated further, but there were already discussions within the Fed about the tightness of the labor market in late-2015. More significant changes can be seen in “soft” data, expectations of businesses and consumer activity collected in surveys and market data. Over the past few months, consumer confidence has surged, inflation expectations have recovered, and businesses expectations of future activity have picked up (which has already led to improving fixed investment data). In addition, financial conditions are more favorable, as equity markets continue to rally, credit spreads have tightened, and the dollar has eased back a bit from its post-election highs. Finally, despite the political unknowns, risks from abroad seem to have diminished for the time being. Considered all together, these factors gave FOMC officials greater confidence in their outlook on the economy and shifted the balance of risks from the downside to the upside.

Source: The Wall Street Journal, “The Gap Between Sentiment and Certainty Is Stunning“

Source: Bloomberg, “The Market Is Acting Like the Fed Cut Rates“

There are certainly still threats to this outlook. Part of the rally in equity markets can be linked to the “Trump-effect”, namely the assumption that the current administration will embark on some combination of tax reform and infrastructure spending. In fact, both Janet Yellen and Vice-Chair Stanley Fischer admitted that the assumption of fiscal easing was already built into some FOMC officials’ projections. The failure of the health-care bill portends a possibility that these policies will not come to fruition, at which point the Fed may need to adjust their current projections. Furthermore, there’s a risk that higher interest rates could curtail housing activity, especially since the rate of household formation and home ownership amongst younger generations is declining. Finally, there is still the potential for headwinds from abroad. Any re-strengthening of the dollar poses risks to emerging market economies, especially ones that have currencies pegged to the dollar or carry substantial dollar-denominated debts. Still, the outlook remains positive for now, and as such monetary policy continues its transition towards “normalcy.”

*The ISM Manufacturing index posted back to back contractionary readings in November/December 2015 and year-over-year manufacturing production was negative.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.