May PCE: A Positive Report Following Several Disappointments

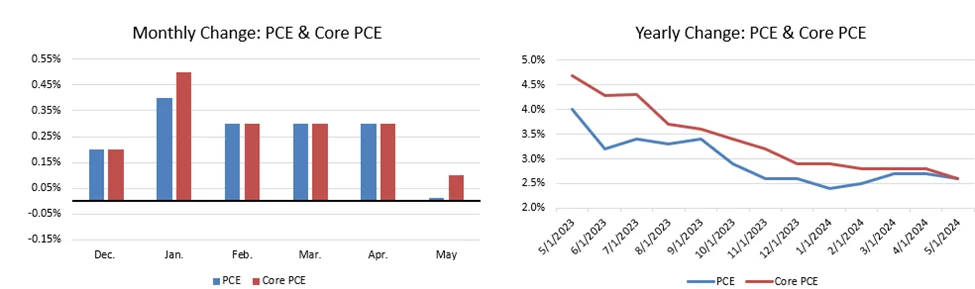

The PCE Price Index decelerated from the previous month as expected. Headline PCE came in at 2.6% year-over-year, and was unchanged month-over-month, down from the 2.7% annual rise and 0.3% monthly rise in April . Additionally, Core PCE came in at 2.6% year-over-year and 0.1% month-over-month, 0.2% below April PCE for both measurements. On a monthly basis, a decline in goods and energy prices offset an increase in services and food prices, leaving headline PCE unchanged. However, on an annual basis, services and energy prices mainly drove the 2.6% increase. Of note, Headline PCE and Core PCE have converged, with major year-over-year changes in energy prices largely in the rearview mirror.

The May PCE Price Index figures are positive for the Fed’s fight against inflation, but this month’s report is unlikely to change the Fed’s near-term perspective. At the June FOMC press conference, Powell noted that the May CPI report was encouraging, but followed several not-so-encouraging inflation reports. Moreover, while the trend in core inflation has been promising, Headline PCE has been fairly stagnant for the last 6 months. While the May PCE report is a welcome sign, the Fed will require more data indicating a strong disinflationary trend before they signal a pivot.

Takeaways for Cash Investors

Federal Reserve – The market has generally maintained its expectations for changes in the Fed Funds rate this year. The market is pricing in a roughly 75% of a cut at the September meeting, with one cut fully priced in by November. The market is pricing in an approximate 90% chance of a second rate cut by year-end, roughly the same as after the May CPI report and June FOMC meeting.

Rates – Rates were largely unchanged following the release of the report. The 2-year Treasury yield fell 0.03% to 4.69%, while the 10-year Treasury yield was unchanged at 4.30%. Recent PCE reports have generally come in as expected, driving minimal change in yields.

Credit – Lower inflation is generally a credit positive, as easing inflation may take pressure off consumers and result in looser financial conditions should the Fed cut rates. However, lower inflation may also be indicative of a slowing economy, leading to an increased chance that a policy misstep could tip the economy into recession.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.