March Month-End Portfolio Update

Q1 2024 Performance: Risk Assets Outperform

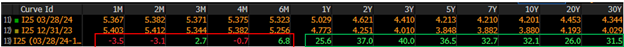

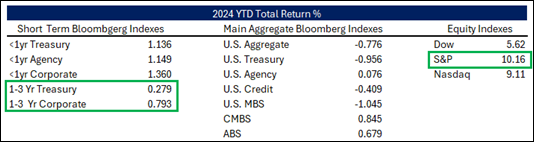

The first quarter of 2024 saw everything from stocks, gold and even Bitcoin rise to record highs as it becomes increasingly likely that the Fed will be able to achieve a soft landing for the U.S. economy. Treasury yields were mixed during the first quarter with 1-month to 6-month T-bills little changed while maturities from 1 year to 30 years rose 25 to 40 basis points. 2-year and 3-year Treasuries led the rise in yields as the FOMC pushed back against the market’s aggressive rate cut projections at the beginning of the year. On the risk asset side, corporate bonds along with ABS and CMBS outperformed government bond market indexes. For example, the Bloomberg 1-3 year Corporate Bond index returned +0.793% during the first quarter while the comparable Treasury index returned +0.279%. In equity markets, the S&P 500 index rose over 10% to close the quarter with its 22nd record high, and more than half of all stocks in the index notched 52-week highs. This is the second quarter in a row where the S&P 500 returned double-digit gains, only the fifth such back-to-back performance since 1950.

Source: Bloomberg

Source: Bloomberg

Global Central Banks – Several Notable Changes

The FOMC was not the only central bank of focus in March as several foreign central banks made notable changes to their monetary policy while others signaled the possibility of rate cuts this year:

- The Swiss National Bank became the first G10 economy to cut rates, reducing their key rate by 25 basis points to 1.5%.

- The Bank of Japan became the last central bank to end its negative interest rate policy, lifting their policy for the first time in 17 years by 10 basis points to the range between 0.0% and 0.1%.

- The Bank of England kept rates unchanged at 5.25% but the meeting marked the first time since 2021 that none of the members voted for a hike.

- The ECB kept rates unchanged with President Lagarde saying, “good progress” is being made on the disinflationary process, but they are “not there yet”. She also said, “we need more evidence, more data…will know a little bit more in April and will know a lot more in June.”

- The FOMC kept rates unchanged at 5.25%-5.50% for the 5th consecutive meeting in March and Fed Chair Powell said rate cuts will begin “at some point this year.” On the recent higher inflation prints, he said it hasn’t really changed the overall story which is that prices are moving gradually on a sometimes “bumpy” road down to 2%. The Committee stuck with its median projection of 3 rate cuts for 2024 but reduced its cuts for 2025 from 100 basis points to 75 basis points.

Last Friday, Fed Chair Powell spoke for the first time since the March 20th FOMC meeting and reiterated that the Fed is not in any rush to cut interest rates. He said, “The fact that the US economy is growing at such a solid pace, the fact that the labor market is still very, very strong, gives us the chance to just be a little more confident about inflation coming down before we take the important step of cutting rates.”

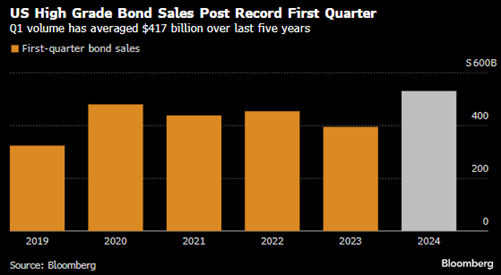

Corporate Bond Issuance: Largest First Quarter Ever

The investment grade corporate bond market had the busiest first quarter ever with a record $529.5 billion in issuance, outpacing the previous record of $479 billion in the first quarter of 2020. Attractive borrowing costs along with merger and acquisition funding were the primary drivers behind the increased issuance. In addition, some companies are looking to raise cash ahead of the US presidential election in November. Looking ahead, expectations are for the record pace of issuance to slow, but expectations for April’s issuance are estimated at around $100 billion, which would outpace last April’s issuance of $65 billion.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.