March Mid-Month Portfolio Update

Powell: “Not Far” From Rate Cuts

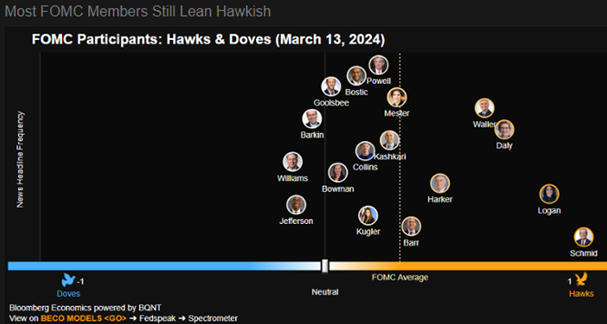

In Fed Chair Powell’s semiannual testimony before Congress, he suggested the FOMC is getting closer to cutting rates by saying “We’re waiting to become more confident that inflation is moving sustainably at 2%,”…..“When we do get that confidence — and we’re not far from it — it’ll be appropriate to begin to dial back the level of restriction.” On both days of testimony, he repeated that it would likely be appropriate to cut interest rates “at some point this year,” but made it clear officials are not ready yet. He did add that the Fed is aware of the risks of moving too quickly or cutting too late. Many Fed members have been leaning more hawkish in their recent speeches and commentary and have conveyed a common theme of being “patient” about rate cuts. They’ve indicated that the economy is strong enough to wait a few months and that the job is not done on getting inflation back to target. On March 20th, the FOMC is expected to keep the Fed Funds Rate unchanged at 5.25%-5.50% and they will also be updating their Summary of Economic Projections, which includes the “dot plot” forecast of future policy rates. Consensus is for the Fed to keep their existing dot-plot target of 75 basis points of rate cuts in 2024.

Source: Bloomberg

Unemployment Rate Rose – But It’s Not That Bad

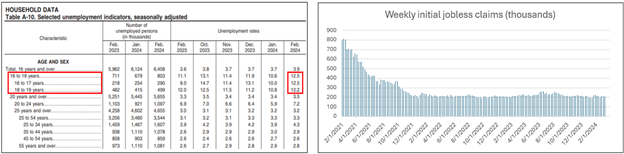

Although the February employment report showed the unemployment rate rising from 3.7% to 3.9%, it has been at or below 4% for more than two consecutive years. The increase in February was a combination of people entering the labor force (which causes the unemployment rate to rise for good reasons) along with reported layoffs of 184,000. However, looking at the underlying data, part of the increase in the unemployment rate was driven by the 16-19 year old cohort, who are not yet prime-age workers and tend to experience more volatility in employment status. Also, layoffs do not look bad; initial weekly jobless claims (number of people who have filed jobless claims for the first time) don’t show any spikes in layoffs this year. In 2024, initial claims have been averaging approximately 209,000, well below the 20-year average of 381,000.

Source: Bureau of Labor Statistics

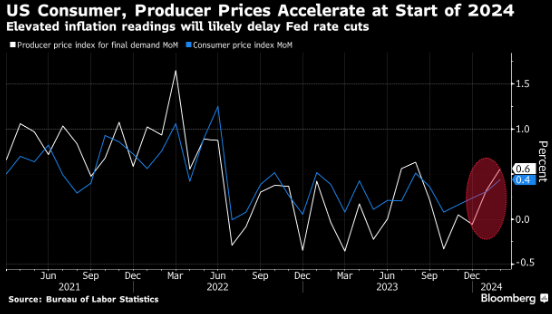

Inflation Data Supports a Delay in Cuts

February inflation readings from both the CPI (Consumer Price Index) and PPI (Producers Price Index) came in higher than expectations, which may make it more difficult for Fed members to begin to lower the Fed Funds Rate. Core CPI, which excludes food and energy prices, came in higher than expectations for a 2nd consecutive month, rising +0.4%. Both headline and Core PPI also exceeded expectations, with headline PPI up +0.6%, the largest increase in six months. Although year-over-year readings continue to improve, the monthly readings indicate that inflation remains stubborn.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.