March 2025 Mid-Month Market Update

Tariffs & Government Spending Cuts Stoke Stagflation Fears

Concern is increasing that global trade tensions along with government spending cuts could lead to slower growth and higher prices if tariffs remain in place. Many economists have recently lowered US growth outlooks. Even commentary from President Trump and Treasury Secretary Bessent signal some pain ahead: Trump said “there is a period of transition” while Bessent suggested the economy might need a reset following years of growth supported by federal spending and rising asset prices. The comments dampened hopes that the administration would reverse policies if they had severely negative economic impacts. However, a recent speech by Fed Chair Powell signaled less concern on the economy with Powell saying “The economy is fine. It doesn’t need us to do anything, really. And so, we can wait.”

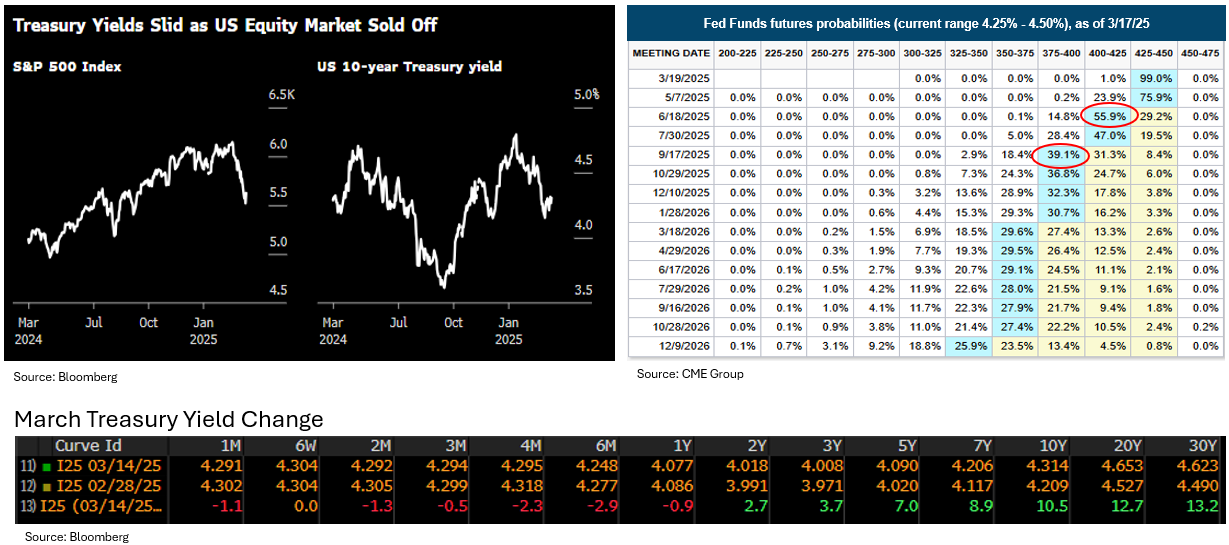

Equity markets continued their decline, with all three major indexes now in negative territory for the year (as of 3/14/25). The S&P 500 fell into correction territory, declining 10% from its peak in mid-February. Despite the risk-off tone in equity markets, we have only seen minor spread widening for investment grade credits, with front-end spreads little changed in March. Treasury yields have been mixed in March, with front-end yields declining while longer end yields rose.

Fed Funds Futures markets are now pricing in two 25 basis point rate cuts in 2025, at the June and September FOMC meetings, with coin-flip odds of a third cut in December. A new Summary of Economic Projections will be released at this Wednesday’s FOMC meeting, which will include FOMC participants’ anticipated year-end target for the federal funds rate. The market consensus is for the FOMC to continue to forecast 50 basis points of rate cuts in 2025.

Source: Bloomberg

Focus on “Hard” vs. “Soft” Economic Data

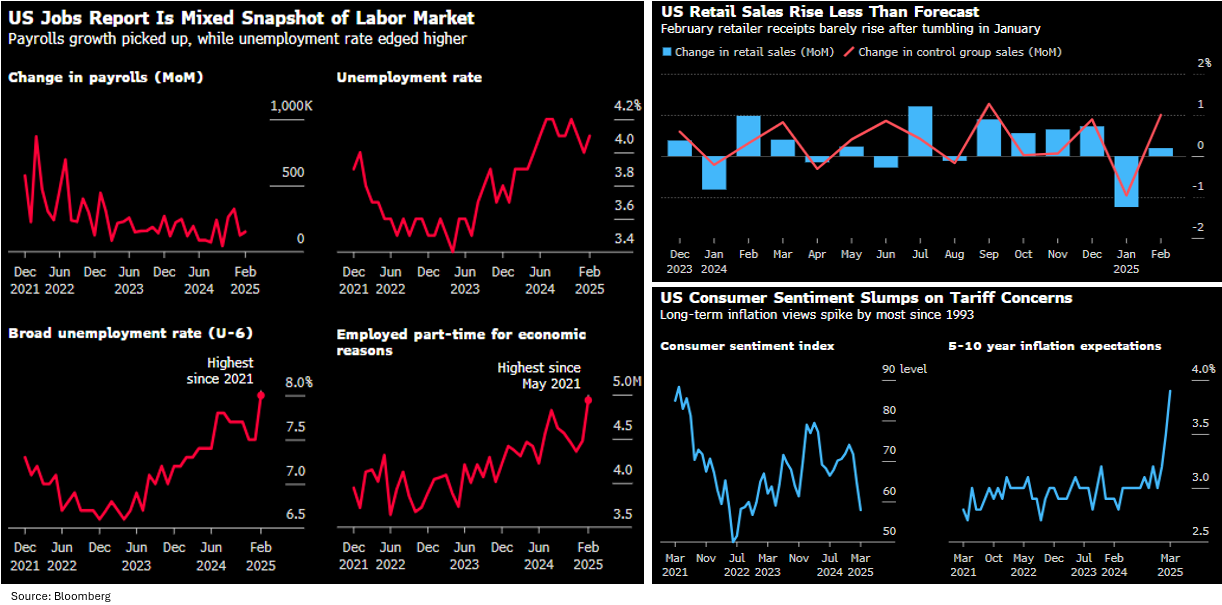

Weak consumer survey reports (soft data) that were released towards the end of February caused concern that this data could foreshadow a pullback on consumer spending and labor market hiring (hard data). The data released in March thus far has been mixed and is unlikely to prompt the Fed to alter monetary policy in the short term.

- Labor Market: Headline nonfarm payrolls for February came in slightly lower than expected at 151,000 but still represented an overall solid monthly gain. However, the unemployment rate ticked higher to 4.1% and would have risen to 4.4% if it wasn’t for the drop in the labor force participation rate. Also notable was the spike in the underemployment rate (U6), which jumped to 8%, the highest level since 2021. Federal government jobs showed a loss of 10,000, which is expected to rise as cuts to federal jobs under DOGE came in too late to be captured in the February report.

- University of Michigan Sentiment: The preliminary March reading plummeted 11% to 57.9, continuing a downward trend seen over the past 3-months and marking the lowest reading since 2022. The report reflected increasing concerns over Trump’s trade policies and the potential for higher prices as the year-ahead inflation expectations surged to 4.9%, which is also the highest since 2022.

- Retail Sales: Headline retail sales came in lower than forecasts at +0.2% while the Control Group, which is a direct feed into GDP, came in higher than forecasts at +1%, a 5-month high. However, looking at the underlying components, eating & drinking establishments (which is typically the first thing consumers pull back on) fell -1.5% which is the most in a year.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.